Features

Everything you need to re-imagine banking

-

Accounts & Onboarding

Create the hub for your customers to manage their money

-

Cards

Offer unique virtual & physical cards to extend your product or streamline disbursements

-

Payments

Fund accounts, send money, and simplify backend payment workflows

-

Data & Controls

Access customers’ financial data and help them enact change with granular controls

-

Admin

One shared source of truth makes it intuitive to partner with banks and customers

-

Monetization Solutions

Eliminate friction, increase usage, and solve more customer problems to drive revenue

Why Helix

A modern, cloud-native core for embedded finance

Our flexible platform allows you to build unique banking products that delight your users.

-

Made for humans, by humans

We agonized over every bit of our API architecture so your teams don’t need to stitch together disparate systems to embed banking functionality.

-

Created to differentiate

By giving you granular control over every aspect of your product, we’ve made it easy to differentiate your offering and personalize it to each user.

-

Built for scale

Our technology, operations, and business model have been designed for scale and chosen by flagship companies.

Case Studies

Grow your ecosystem

-

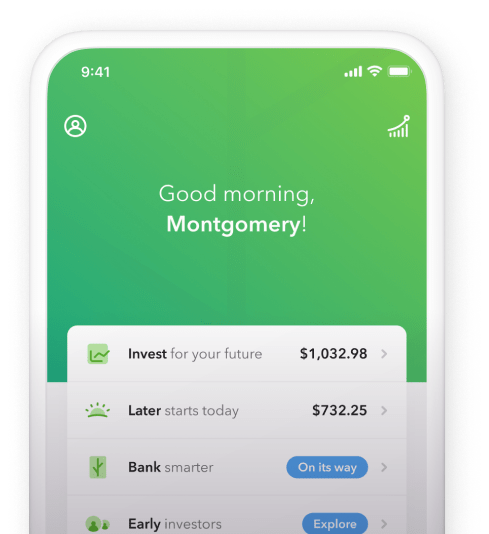

Acorns

-

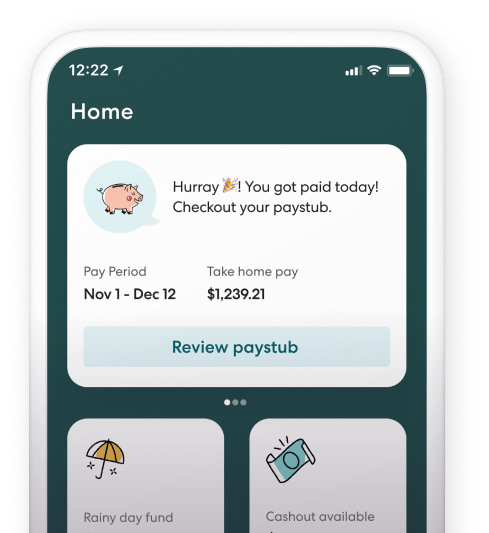

Gusto

Gusto

-

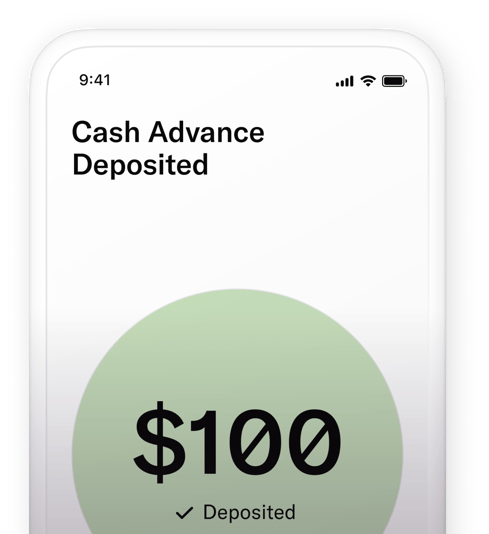

Empower

Empower

Investing, meet banking

Acorns used Helix to integrate banking into its ecosystem so users could autonomously manage their entire financial life, not just part of it.

Put your paycheck to work

Helix powers Gusto Wallet – a smart new way for employees to track, save, and access their hard-earned money.

Cash flow, managed

Empower used Helix to build the Empower Card: the only card users need that puts more cash into their pockets.

Building Blocks

Scale for every aspect of your business

You have a vision for your products, your company, and your customers. It’s our job to help you realize it.

-

Technology

A platform that is proven to handle 10M+ users—without middleware so you can scale on demand.

-

Operations

Admin, program management support, and bank flexibility make it easy to operate your banking product, even if this is your team’s first time doing it.

-

Fraud

Managing fraud well is the secret to a profitable program. Our tools and expertise help you mitigate risk, automate disputes, and understand trends to stay a step ahead of fraudsters.

-

Business Model

With low upfront costs and a pricing model that’s aligned with your growth, we give you an economic edge over your competition so your business can thrive in the long run.

Testimonials

Take their

word for it

-

“Helix gave us the foundation to build something unique. We didn’t want to just take something off the shelf and launch it, we wanted to think 5-10 years ahead and build with a long term partner that would help us get there over time.”

Mark Wes GM Consumer Products · Gusto -

“Helix made it easy to integrate banking and allowed us to focus our efforts entirely on building a truly differentiated product.”

John Mileham CTO · Betterment .png?width=538&height=291&name=MicrosoftTeams-image%20(2).png)

Start something new

Banking as a Service is helping innovative companies create a more empathetic economy through unique, highly targeted products.