Simple, fast, cloud-based lending.

Close loans faster and reduce operational inefficiencies with an integrated, cloud-based lending platform.

Nobody wants to borrow money—they want what their loan makes possible. Help your account holders move forward on their financial journeys with a faster, easier borrowing process that fits their needs and matches their expectations of the digital age. You’ll close more loans and build stronger account holder relationships.

An intuitive, cloud-based solution makes it all possible.

Here’s how.

SET A NEW STANDARD

Easy online borrowing experiences are the new standard.

Replace manual in-branch-only processes to meet current consumer expectations for speed and simplicity.

OMNICHANNEL EXCELLENCE

Offer online applications, provide instant decisions, and quickly generate suitable offers. An omnichannel experience ensures borrowers get the same level of service regardless of channel or location.

COMPREHENSIVE CONFIDENCE

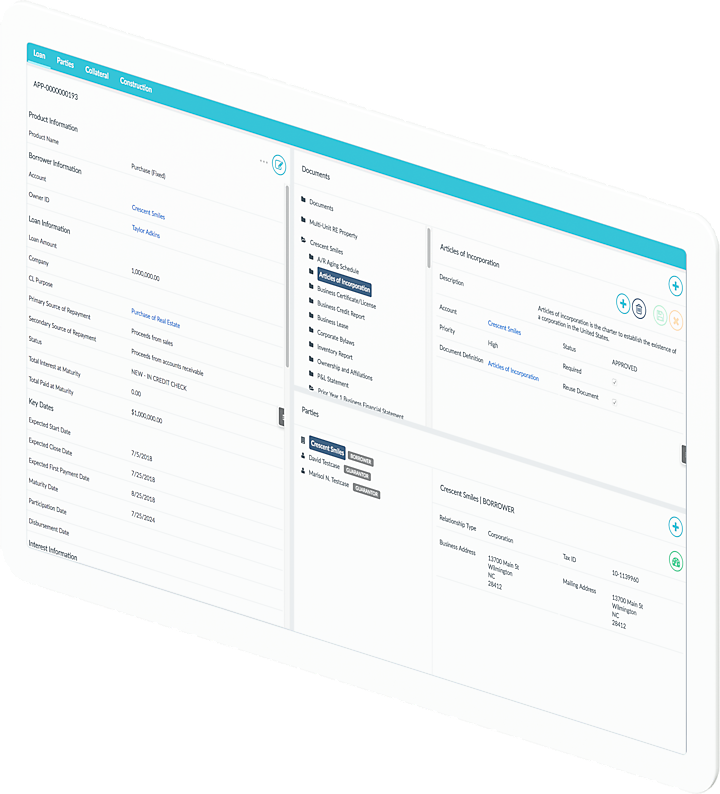

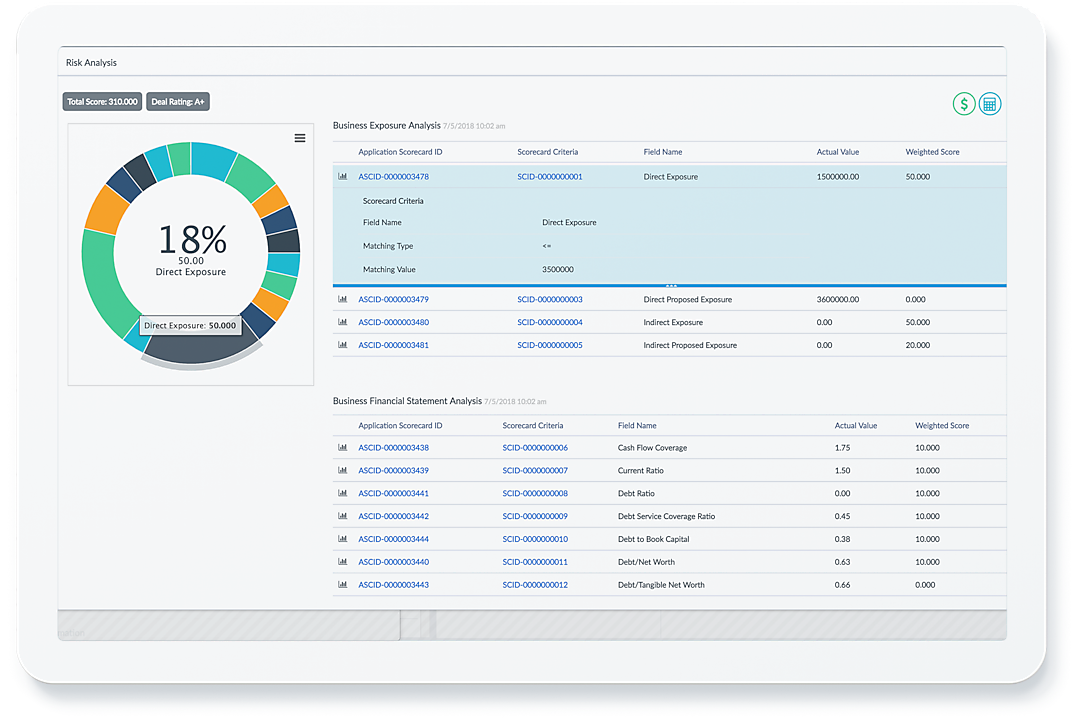

Manage the entire loan lifecycle—billing, payments, collections, accounting, and more—from a single robust, flexible, and secure platform. Having consistent, accurate, and up-to-date customer data from a single authoritative source will help enforce underwriting, servicing, and collection rules, as well as procedures and document requirements.

Automated loan-cycle management Automated and streamlined collections Personalized loan experiences Loan and line-of-credit management Agile loan origination and underwriting

Your account holders have a lot of apps that do a lot of things. Simplify their lives and build richer relationships with a single platform that does it all.

-

CL Loan

Improve borrower experiences at scale with automated, cloud-based lending.

-

Product Overview

CL Collections

Maximize revenue with automated, agile, cloud-based collection processes.

-

CL Originate

Increase productivity and lower origination costs with auto-decisioning and compliance checklists.

-

CL Portal

Create great borrowing experiences with quickly configurable workflows and automated processes.

-

PRODUCT OVERVIEW

CL Marketplace

Expand your presence in online marketplace lending with an automated, comprehensive loan management tools.

We’ve gained complete, end-to-end lending with Cloud Lending. It’s made starting up so much smoother. We’re efficiently managing our lending while adding more customers without any issues.

A UNIFIED USER EXPERIENCE

Tailor loan products to meet market demand while maintaining flexibility at the individual loan level.

CONFIGURABLE WITH A CLICK

Design and tailor borrowers’ journeys with a “point-and-click” portal builder that allows you to rapidly deploy and easily iterate over time. Using our portal builder, simple application workflow, and document management and automation capabilities, you’ll shorten time-to-market and reduce maintenance expenses.

FLEXIBILITY

Create and maintain positive borrower experiences with repayment schedules that are easy to generate and alter. Combine monthly and weekly payments, define unique payment dates, manage delinquency with grace periods or payment holidays, and more.

BUT THIS IS JUST THE BEGINNING

Consumer Lending is just one piece of a comprehensive consumer solution set. Effectively serve account holders and transform their lives with our other consumer solution set.

Begin with the basics.

Give them all of the experiences and features that they want, while building loyalty, engagement, and revenue for your institution.

Offer what they want, when they want it.

They’re used to one-stop ecosystems that understand their needs and deliver everything with the push of a button. Live up to their expectations.

Keep them safe without adding hurdles.

Consumers don’t want to think about security, and they expect you to have it handled. Keep them safe without complicating their experiences.

Launch a digital bank brand.

Capture deposits from digital-first account holders by launching a challenger bank in parallel with your existing core.

Be everything they need.

Competing in the disrupted financial services landscape means being more than a bank. It means replacing a disjointed, frustrating, impersonal user experience with something better.

It means becoming irreplaceable.

You can’t do it alone—but you won’t be.

Let’s do this.

Or call 1-833-444-3469