Create loyalty at account opening

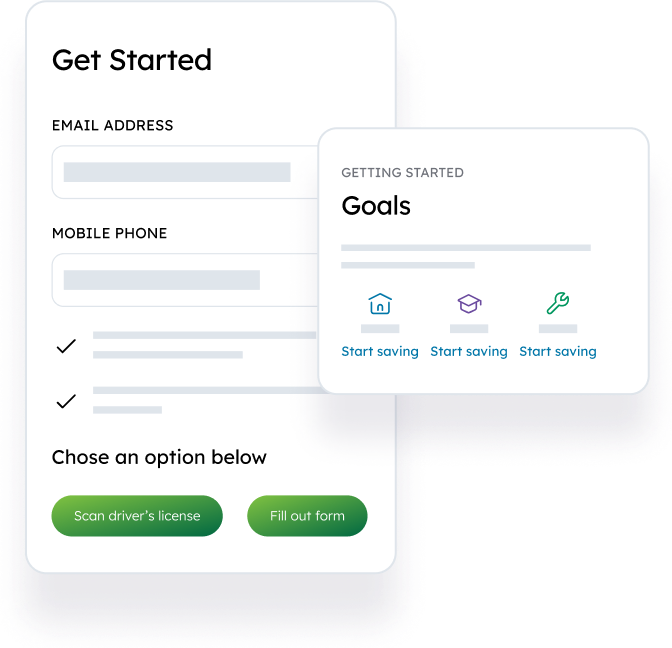

Account holders' first experiences are the most critical for creating lifetime relationships. With smarter digital account opening and onboarding, you’ll start increasing the value of new accounts on Day 1.

Half of new accounts don’t survive

Most new accounts don’t last beyond 90 days. That’s because legacy digital account opening and onboarding processes don’t engage, build relationships, or drive account value quickly enough.

Automation changes everything

Fast, efficient account opening and onboarding win relationships. But when processes are manual and inefficient, they overburden staff and can cost you new account holders.

Relationships start at account opening

Build loyalty immediately by quickly giving people what they need—from setup of recurring payments to e-statement signup to simplified direct deposit switching.

Adding accounts should be frictionless

As life changes, consumers expect it to be quick and simple to open additional accounts with their existing FIs. So, remove the hassle of adding accounts.

Open accounts, expand possibilities

Our account opening products increase conversion of new accounts, then deliver personal experiences for ongoing engagement, primacy, and relationships for life.

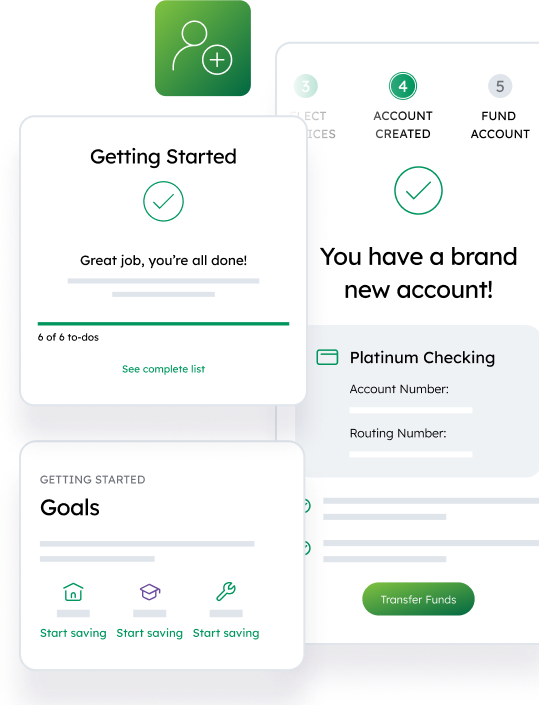

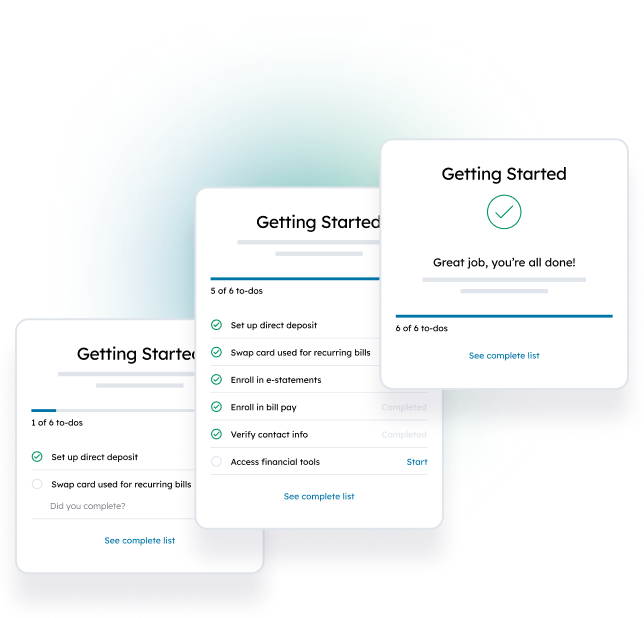

A guided onboarding experience

Q2 Getting Started delivers a fully guided onboarding experience. Walk account holders though the most critical—and valuable —account setup steps. You’ll build trust and loyalty that lasts.

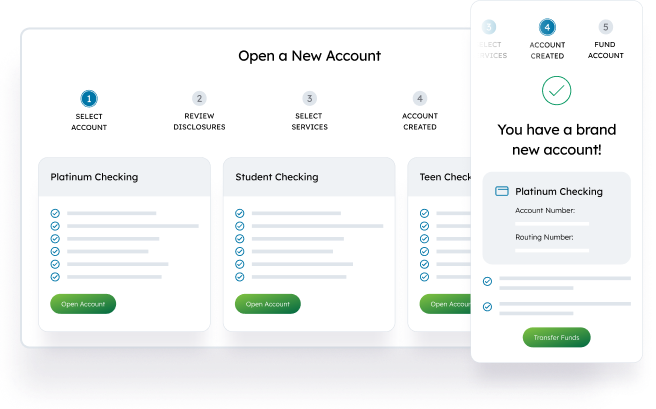

More accounts, less hassle

With Q2 Add Account, pre-authenticated account holders—consumer or small business—can conveniently add checking and savings accounts in just a few clicks, within the digital banking experience.

Remove obstacles to growth

Quickly turn new accounts into primary banking relationships with Q2 ClickSWITCH. We automate the process for switching direct deposit, clearing the path to revenue growth.

Proven success

“We’ve seen about a 75% increase in account opening with Q2. It’s been a great step forward for us. The biggest piece of positive feedback we’ve received has been the power of being able to go through the entire account opening process in just minutes, including account funding. It’s been a very positive impact for us.”

VP and Director of Product Management

Resources

Solutions for your biggest challenges

-

Deliver personal experiences

Create meaningful experiences for the moments that matter on account holders’ financial journeys.

-

Improve financial wellness

Make lives better with financial tools and education integrated with digital banking.

-

Accelerate digital innovation

Quickly innovate to solve real problems for people—at every important life moment.