Be more than a bank for SMBs

Grow stronger, stickier relationships with small and mid-size business customers by stepping outside the confines of traditional banking to offer more comprehensive solutions for all their business needs.

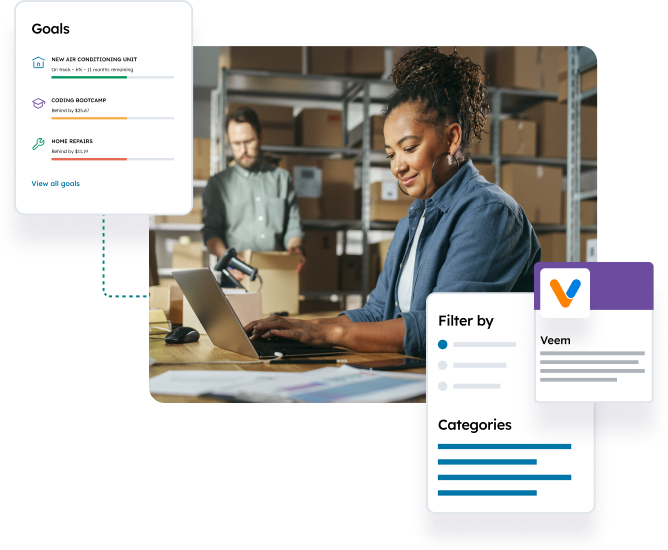

One central business hub

Busy SMB owners have enough to manage without juggling multiple tools and vendor relationships. They need one place where they can manage all the financial aspects of their business.

Integrated fintechs

SMBs need help streamlining their processes, like being able to access important business tools for payroll, expense tracking, and legal forms through the digital banking platform.

Quick, easy payments

Whether it’s paying vendors, collecting from their customers, or paying their quarterly taxes, SMBs need relief from payments complexity and access to all the payment options.

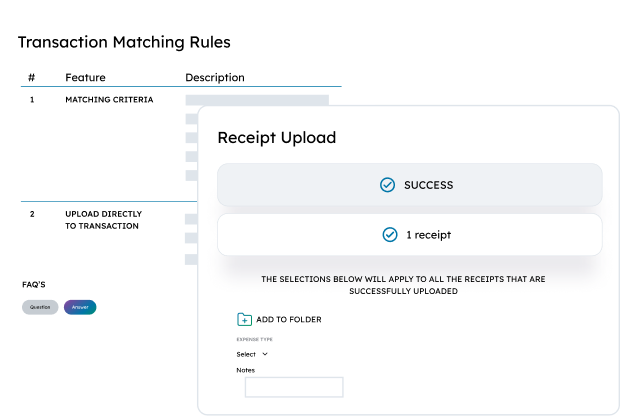

Better spending management

Entrepreneurs need to run a tight ship when it comes to business expenditures, and the right digital tools that make it easy to stay organized.

Built-in business tools

Through the fintech partner ecosystem in Q2 Innovation Studio, financial institutions can choose from among a variety of fintech partners, including those most popular with SMBs, to offer in-demand business tools through the Q2 Digital Banking Platform™.

Every payment for every need

Payments are a critical aspect of any business, but they’re the lifeblood of SMBs. Q2 enables FIs to provide secure, reliable payment options, from ACH to the new instant payments rails.

Track and manage expenditures

Many small and mid-size businesses consider expense reconciliation to be a painful task. You can take the sting out with Q2 Spend Manager’s seamless capture and auto-reconciliation functionality.

Better access control

Protect customer data by ensuring employees have access to only the information they need, as well as control who can originate transactions and move money through basic entitlements in the Q2 Digital Banking Platform.

Don't take our word for it

Technology has changed the game in banking. We looked for a digital partner that was the best of the best with unmatched capabilities and competency. Q2 brings immense value and innovation to the table. Their team immediately aligned with our vision at the executive level, and we look forward to a long-term partnership.”

President and Chief Strategy & Growth Officer

Who we work with

Solutions for your biggest challenges

-

Differentiate with technology

Give small and medium-sized businesses the customized digital banking experience they crave.

-

Fight fraud and drive income

Be a fraud-fighting ally for your SMB customers by providing the tools they need to stop cyber thieves in their tracks.

-

Grow SMB deposits

Make the most of your SMB portfolio by segmenting and targeting your business customers with the products and services most important to them.