Onboard commercial banking clients faster

Remove the friction of manual, paper-based tasks and minimize the time to value for your commercial and small business clients.

Lose the back-office burden

With Q2, you can automate time-consuming, labor-intensive onboarding and account opening processes for your business clients. You’ll get businesses of all sizes up and running on Day 1 and relieve the back-office burden on your staff.

More automation, less intervention

Automating tasks throughout your commercial and small business account opening and onboarding reduces human error and helps ensure the accuracy of all the data needed in the process.

Automated onboarding tasks like KYC prompts, signer capture, verification, and required form completion help streamline the experience—from beginning to completion. It quickly builds trust and loyalty for long-term relationships.

Faster onboarding processes

Transparent, intuitive workflows help both clients and your institution’s employees know where they are in the process. Dynamic, easy-to-use forms adapt and improve responsiveness while alleviating friction.

Quicker time to value

Reduce the time it takes to get your business clients up and running while still maintaining clear visibility into workflow status. The result is a better overall onboarding experience. It’s how you build better relationships, early.

.png?width=571&height=642&name=Group%201597878922%20(1).png)

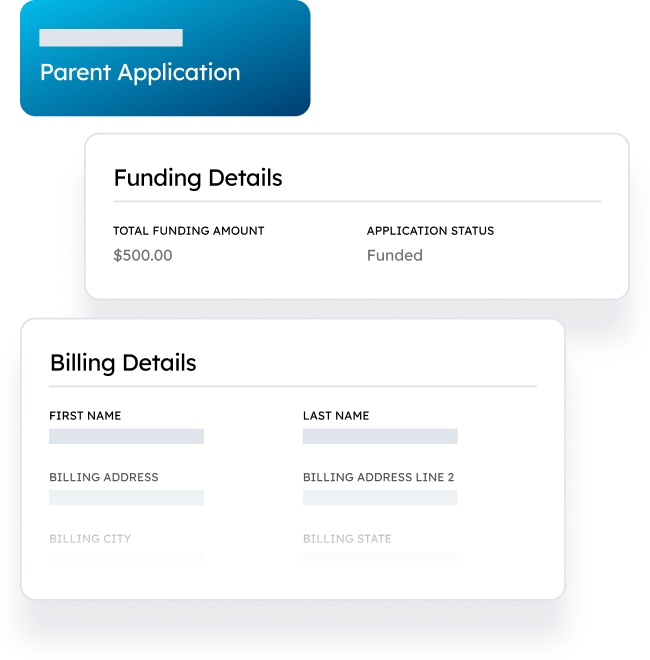

Provide faster, more streamlined account opening

Give account holders an excellent experience from the get-go with enterprise account opening powered by Prelim.

From digital application to core

Provide an intuitive account holder journey, including auto-enrolling in the digital banking platform and smartly kickstarting logical next steps.

Onboard in any channel

Prelim solves the complex challenges of the deposit account opening process, including handling the experiences for every business officer individually and separate.

Keep security front and center

Through pre-integrated connections to proven fintech providers, Prelim addresses the critical issues of fraud screening, ID verification, risk mitigation, data prefill, funding, and core account creation.

Satisfy clients and improve your bottom line

Keep the momentum going after every commercial win while improving the time to revenue and back-office efficiency. With Q2, you have a centralized starting point for commercial bankers, with simplified user setup and permissions, as well as self-service capabilities.

Clear progress indicators and transparent onboarding steps improve the overall experience and reduce support call volume, which saves your financial institution valuable time and resources.

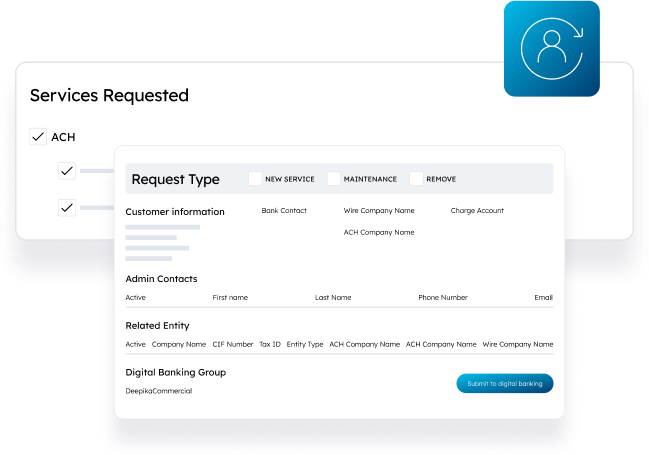

Fewer treasury touchpoints

Q2 Treasury Fulfillment manages the entire onboarding process. More automation means less friction and errors.

Thorough data validation

Built-in validation throughout the fulfillment process helps ensure data is accurate and matches the needs of downstream systems.

Intuitive process

Q2 Console enables you to create an intuitive starting point for front-office and back-office users. Visual markers on the form show additions, deletions, or changes to products, services, and users.

Make it easy to add accounts

With Q2 Add Account, your existing business clients can quickly open new accounts on their own through robust self-service features.

Transparent onboarding

Give business clients autonomy with simple, easy-to-understand steps for opening new accounts. Automated routing and approvals cut down on the amount of manual treasury involvement required, with fewer hand-offs across teams and improved consistency.

Quick, easy processes

Create automated, data-driven opportunities to offer products and services tailored to your clients’ unique needs. Automated workflows suggest relevant products during the onboarding journey, helping you shift from reactive to proactive relationship growth and more retention.

Reducing paper and accelerating processing gives clients and employees time to focus on their most important priorities. Fewer forms and faster processing also drive greater value and a better overall onboarding experience for your business clients.

It’s the fast track to lasting loyalty.

Better upsell and cross-sell

Create automated, data-driven opportunities to offer new products and services tailored to the unique needs of your business clients.

Best-in-class cash management

“Clients often comment that the vendor is a true partner and that its focus on a limited product set enables greater investment and innovation.”

2023 Aite Matrix: U.S. Cash Management Technology Providers Vendor Assessment

best in class

Commercial

“Best-in-class leader” in the 2023 Aite Matrix: U.S. Cash Management Technology Providers Vendor Assessment

Resources

Solutions for your biggest challenges

-

Win more deals

Provide your sales team the tools to tap into trends and data to make the right deals at the right time.

-

Serve clients better

Give commercial customers the digital solutions they need to navigate the opportunities and challenges of running a business today.

-

Grow deeper relationships

Go beyond traditional banking to become a business hub for your customers.

-

Give small businesses banking that fits

Provide a digital banking experience tailor-made for the unique needs of small businesses.