Deliver dynamic personal experiences

Beginning in the first days of onboarding—and throughout account holder journeys—turn data into knowledge to deliver personal experiences that evolve with people.

One-size-fits-all is not an option

To differentiate and thrive today, financial institutions must know their account holders’ evolving needs and start building lasting loyalty from Day 1.

Relationships begin at onboarding

Most accounts don’t last beyond 90 days. Use data and AI to understand people’s needs quickly, so you can deliver the right services from the start.

More than targeted marketing

Targeted marketing is only part of delivering personal experiences. Tailor every digital interaction based on what you know about your account holders.

Go beyond traditional banking

Differentiating your brand takes innovation and partnerships beyond traditional banking. Offer relevant solutions that make people’s lives better.

Whitepaper

Q2 Engage: Building Lifetime Consumer Relationships With Dynamic Personal Experiences

Ready to dig deeper into how dynamic personal experiences can help you differentiate and build lasting account holder loyalty? Download our new white paper to learn more about the powerful framework to know, serve, and grow your consumer banking relationships. Plus, read how one financial institution is putting it into practice.

Q2 can help

Dynamic Personalization

Q2’s composable dashboards deliver targeted education and offers through personal homepages—for experiences that change with people.

An innovation ecosystem

With Q2 Innovation Studio’s fintech partner ecosystem, access pre-integrated, trailblazing apps tailored to account holders’ evolving life stages and pivotal life moments.

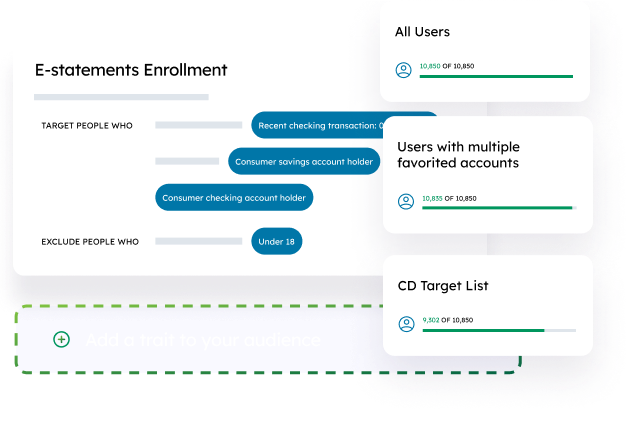

Right offer, right time

Powerful, yet easy to use, Q2 SMART's behavior-based insights mean you can serve up highly targeted marketing and offers that resonate—at exactly the right time.

Contextual outreach

Q2 Discover tracks behavior to understand account holders and reveal where they need information. It helps create guides, in-app messages, and custom interfaces that drive adoption.

The power of personal

-

>3X

more consumers adopt digital banking products or services when they’re personal.

Q2 and customer metrics, 2023 -

>440%

growth at a bank using the Q2 digital banking platform with contextual personal financial management and Q2 SMART.

Customer metrics provided to Q2, 2023 -

390%

increase in NPS survey response after deploying Q2 Discover.

Citizen and Northern Bank, 2023

Proven success

“Q2 SMART and Q2 Discover are differentiators for our bank. Because they help us identify what’s important to our clients, and we can see how they’re engaging, we can send targeted messages to targeted audiences quickly. When I interact with my consumers, I want to send a message that’s meaningful to them.”

Senior Vice President and Chief Operations Officer

Lake City Bank

Resources

Solutions for your biggest challenges

-

Increase value of new accounts

Turn new accounts into lifetime relationships.

-

Improve financial wellness

Make lives better with integrated financial tools and education

-

Accelerate digital innovation

Quickly innovate to solve real problems for people—at every important life moment.