Win better commercial business

Succeeding in commercial banking requires a deep understanding of relationship profitability—across business units. Digital solutions provide the valuable insights needed to make better-informed pricing and structuring decisions to build high-performing relationships.

Equip your deal makers for success

It’s a competitive world out there, and your financial institution needs the tools to help your sales team tap into trends and data to make the right deals at the right time.

Relationship pricing

Get a comprehensive, data-driven, real-time understanding of your commercial relationships’ value as you structure and price deals.

Insights and coaching

Evaluate profitability, understand relative trade-offs, and easily price products across business units within a single, seamless experience.

Tailored test drives

Let your prospects take your commercial offerings for a test drive to see how much better your experience is.

Move beyond offering a lower rate

Give your bankers the right information at the right time to effectively price and win profitable commercial loans. Use data-driven insights and guidance to structure deals that meet both your customers’ needs and your FI’s portfolio goals.

Give treasury a seat at the table

Give your treasury officers the product and pricing information they need, quickly and efficiently, improving the deal experience for the customer as well as the bottom line for your FI.

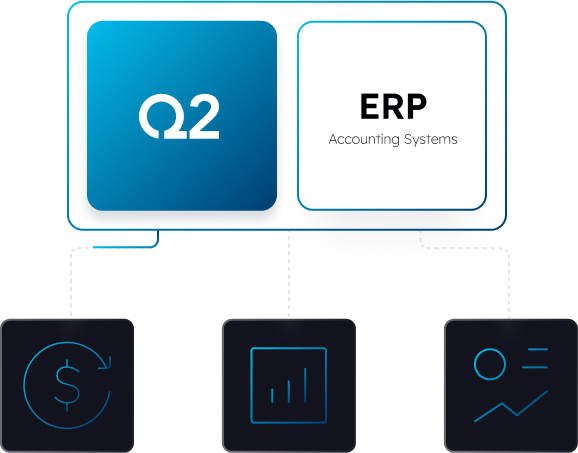

Compete for larger commercial accounts

With Q2 Direct Data Services, you can integrate your digital banking platform with your commercial customers' accounting systems, saving them time and streamlining accounts receivable/accounts payable processes.

Don’t tell them, show them

Let your commercial prospects take your offerings for a spin with a customizable test drive that lets them experience what it’s like to bank with you.

Don’t take our word for it

Q2 is a big partner in our digital strategy, which I would say is one of our biggest strategies today—to remain top-of-market when it comes to digital offerings

Executive Vice President and Founder

Who we work with

- 75+ Banks and credit unions

- 5K+ Bankers

- 35% Top 20 N.A. commercial banks

Resources

Solutions for your biggest challenges

-

Serve clients better

Give commercial customers the digital solutions they need to navigate the opportunities and challenges of running a business today.

-

Onboard clients faster

Remove the friction of manual onboarding processes and minimize the time to value for your commercial and small business customers.

-

Grow deeper relationships

Go beyond traditional banking to become a business hub for your customers.

-

Give small businesses banking that fits

Provide a digital banking experience tailor-made for the unique needs of small businesses.