Simple, effective digital account opening

Opening a new account should be quick, easy, and convenient. That’s why we offer flexible options through trusted partners.

With Q2, you can choose the digital account opening solution that best fits your needs and delivers the seamless, self-service experience consumers expect.

What’s possible for your financial institution?

Consumer account opening

Start the lifetime relationship journey

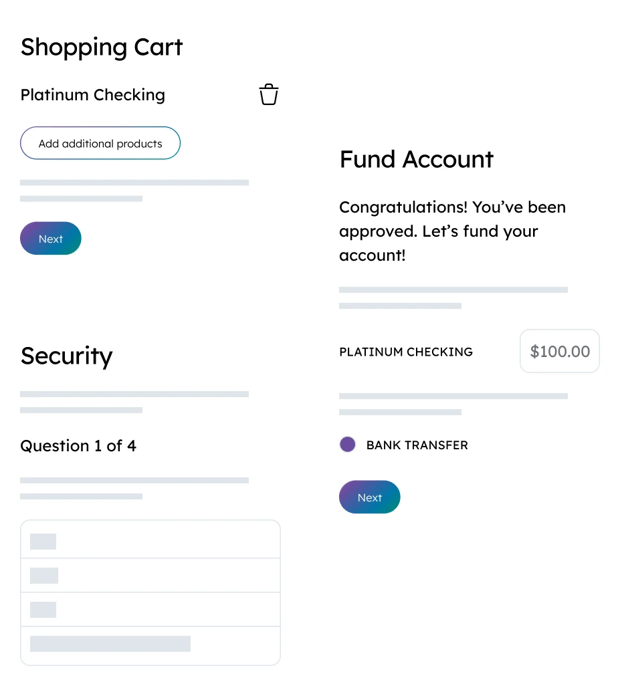

With smart digital-first onboarding, you can build strong first impressions with new account holders.

Delivering a seamless account opening experience helps quickly create the kind of engagement that leads to greater product adoption, less abandonment, and enduring loyalty.

Personalized, data-driven engagement from Day 1 drives cross-sell opportunities for new, high-value products and adoption of loyalty-building services like digital wallets and direct deposit switching, which deepen relationships and stem attrition.

Drive growth

Through trusted partnerships, we offer solutions that streamline account opening and onboarding and build the kind of loyalty that creates lifetime relationships. You'll reduce the costs associated with manual processes across multiple channels and realize improvements in operational performance and financial results.

Features like identity verification, risk assessment, and funding workflows speed up and streamline account opening and onboarding, reducing operational cost and friction.

Stay secure and compliant

Our fully vetted partners handle Know your Customer (KYC) data collection, making the account opening process hassle-free for consumers who expect speed and convenience. Their risk engines work behind the scenes to manage KYC and deposit risk, helping to keep bad actors out while ensuring a secure, seamless digital experience for legitimate new account holders.

Encrypted data handling, audit trails, and regulatory compliance provide a strong security posture that strengthens consumer trust in your institution by ensuring they stay protected.

Flexible integrations through Q2’s trusted partners

With integration through the Q2 Innovation Studio fintech partner ecosystem, as well as APIs and our SDK, financial institutions choose the onboarding solution and partnership that best fits their strategies and goals.

Our partners provide identity verification, funding, fraud detection, document capture, and other critical services, making the entire onboarding process simple. We offer solutions that are scalable enough to handle high-volume onboarding during spikes caused by promotions or special rate offers.

Benefits to financial institutions and the consumers you serve

Q2 and its ecosystem of partners deliver value to financial institutions and your account holders.

-

Financial institution benefits

- Reduced operational burden

- Faster revenue capture

- Managed risk

- Stronger brands

-

Account holder benefits

- Quicker access to digital banking features

- More convenience and protection

- Faster time to value

Resources

Additional consumer products

-

Financial WellnessOffer financial wellness tools to deepen consumer relationships.

-

Card ManagementAutomated, feature-rich card management and provisioning.

-

Getting StartedEase account holders into your institution with an onboarding process they can complete on their schedule.

-

Direct Deposit Switching

Enable customers to transfer all data from their previous accounts to start banking with you immediately.