Grow relationships and grow your FI

Businesses want you to understand and meet their needs. Put your data to work, build deeper understanding, and deliver products and experiences based on real needs.

Understand what businesses need

Success means more than just attracting the right commercial customers. It means creating strong, long-lasting, lucrative relationships with them.

Be there when they need you

Use what you already know about your account holders to provide them with the right financial products at the right time.

Strengthen your portfolio

Use up-to-date, relevant market data to see where your FI stands against the competition.

Create new revenue streams

Be a conduit of efficiency for commercial customers and drive non-interest income for your FI through fintech partnerships.

Anticipate customers' needs

Deliver the right content and offers at the right time to the right customer. The recommendation engine in Q2 SMART™ distills account data to help you deliver what your customers need as soon as they need it.

Create deeper engagement

Track online behavior, product usage, and more to get a deeper understanding of account holder activity. Q2 Discover helps you target customers with more effective communications and more relevant products.

See where you stack up

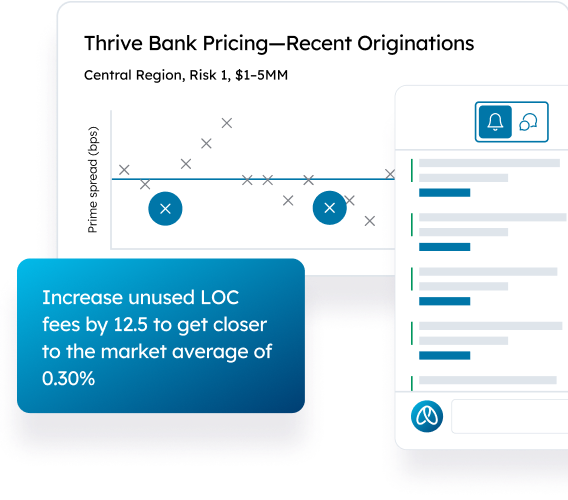

Understand how your business portfolios are performing against the market and identify opportunities to improve overall profitability. Market Insights provides a data-driven view of how your pricing compares to the market.

Go beyond banking

Q2 Innovation Studio helps you be more than a bank for your commercial and small business customers.

-

Accelerate your innovation

Boost engagement and go to market fast with pre-integrated fintech solutions, delivered directly within your digital banking experience.

-

Stand out from the competition

Differentiate your institution’s digital offerings with new capabilities and best-in-class tools for accounting, expense management, payroll, and more.

-

Drive non-interest income

Offer fintech solutions and niche products directly through digital banking, and enjoy a share of your integrated fintechs’ revenue.

What our customers are saying about us

-

“Q2 SMART and Q2 Discover are differentiators for our bank. Because they help us identify what's important to our clients and we can see how they're engaging, we can send targeted messages to targeted audiences quickly. When I interact with my consumers, I want to send a message that's meaningful to them.”

Lisa FultonRead story

SVP and COO -

“I can't tell you how many thousands of people we were able to help get approved for higher credit limits with Discover just by asking for that information in a pop-up window. We've been using Discover for targeted communications like that, and it's really deepened our member relationships.”

Justin OlsonRead story

CIO

Resources

Solutions for your biggest challenges

-

Win more deals

Provide your sales team the tools to tap into trends and data to make the right deals at the right time.

-

Serve clients better

Give commercial customers the digital solutions they need to navigate the opportunities and challenges of running a business today.

-

Give small businesses banking that fits

Provide a digital banking experience tailor-made for the unique needs of small businesses.

-

Safeguard customers and build trust

Arm your back office and your business customers to manage risk, detect fraud, and streamline compliance.