Win SMB loans without sacrificing profitability

With the Q2 Small Business Package you can:

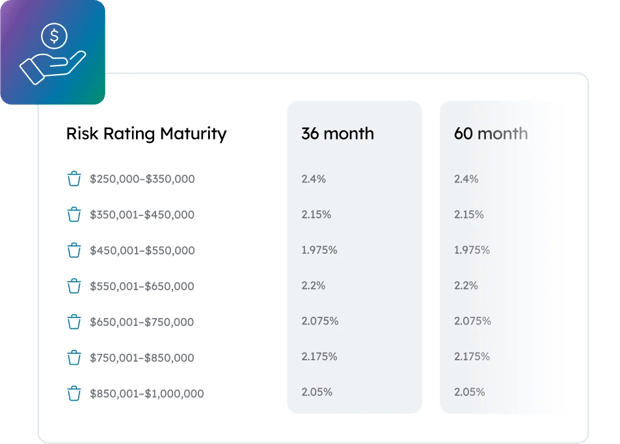

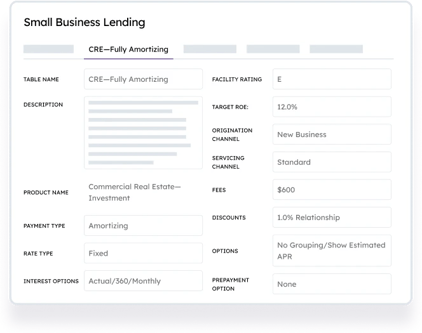

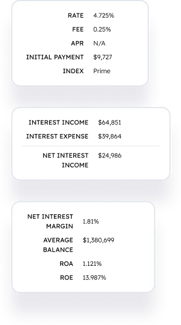

Ensure profitable pricing

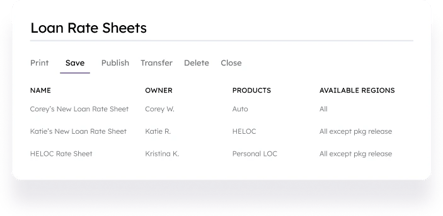

Create and configure rate sheets that enable your relationship managers to quickly get to a price that ensures profitability. Use a wide range of input options – regions, cost structures, fees, origination channels, capital, etc. – to create different targets for each rate sheet.

A community bank in the Midwest has used the Small Business Package to create 25 rate sheets in the past year.

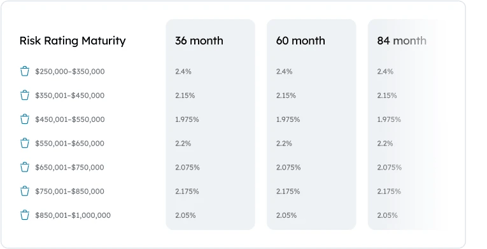

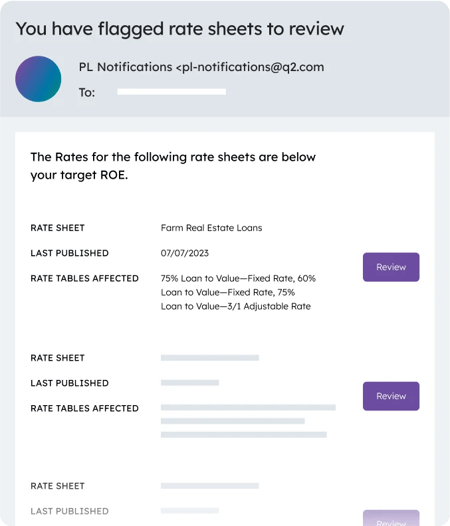

Easily update and maintain your rate sheets

With our centralized pricing platform, you can quickly and easily update your profitability targets and pricing assumptions on your existing sheets across markets and track their publishing history to ensure version control. You can also set up automated notifications that trigger when deals are priced too far below your ROE targets.

A regional bank in the mid-Atlantic has used the Small Business Package to make 777 updates to 13 rate sheets in the past year.

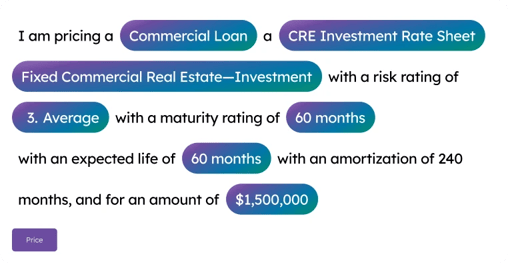

Price loans directly within your Salesforce platform

With our Small Business Package Connector, your relationship managers fill in just a few fields and immediately receive the right rate for their deal – all from within your Salesforce Platform.

Power your own SMB pricing experience

If you already have an existing SMB pricing experience, you can use APIs to connect it to our centralized pricing platform to get updated, accurate rate quotes that align to your profitability targets.

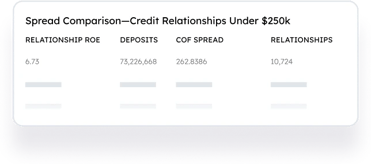

100 bps more in spreads

*SMB defined as credit relationship under $250K

Additional Products

-

Commercial Credit Pricing

Give your RMs the tools they need to price and structure a deal that meets your clients' needs and your institution's profitability goals.

-

Market Insights

Use market data from 150+ financial institutions to get the pricing edge on the competition.

-

Premium Treasury Pricing

Move away from spreadsheets to an integrated digital approach to pricing treasury products and services.