Reduce risk, build trust

When your digital banking security gives consumers peace of mind, you build trust. Keep them secure with minimal friction, and you deepen loyalty.

Managing elevated threats takes next-level security

You need comprehensive, automated protection that matches the sophistication of today’s bad actors—without compromising account holder experience. That means detecting problems early and handling them swiftly.

Early detection is a must

Mitigate risk by investing in technology that leverages advanced analytics and machine learning to track patterns, identify anomalies, and stop suspicious activity.

Tighten controls

Choose security solutions that allow you to define business rules at the account level, for transaction monitoring.

Stay vigilant

Automation matters, but to stay ahead of fraudsters, you need an all-encompassing, multi-layer approach that’s backed by continuous innovation.

How Q2 can help

Track behavior to stop fraud

Using behavioral analytics and machine learning, Q2 Sentinel™ aims to stop fraud before it happens. Typical log-in, device, and transaction patterns are tracked, and anomalies flagged and suspended. Resolution is quick and easy.

An extra layer of protection

Q2 Patrol delivers an extra security layer by monitoring behavior, devices, and browsers to identify anomalous sessions, requiring additional authentication for high-risk, non-transactional activities. It keeps funds safe with minimal friction for account holders.

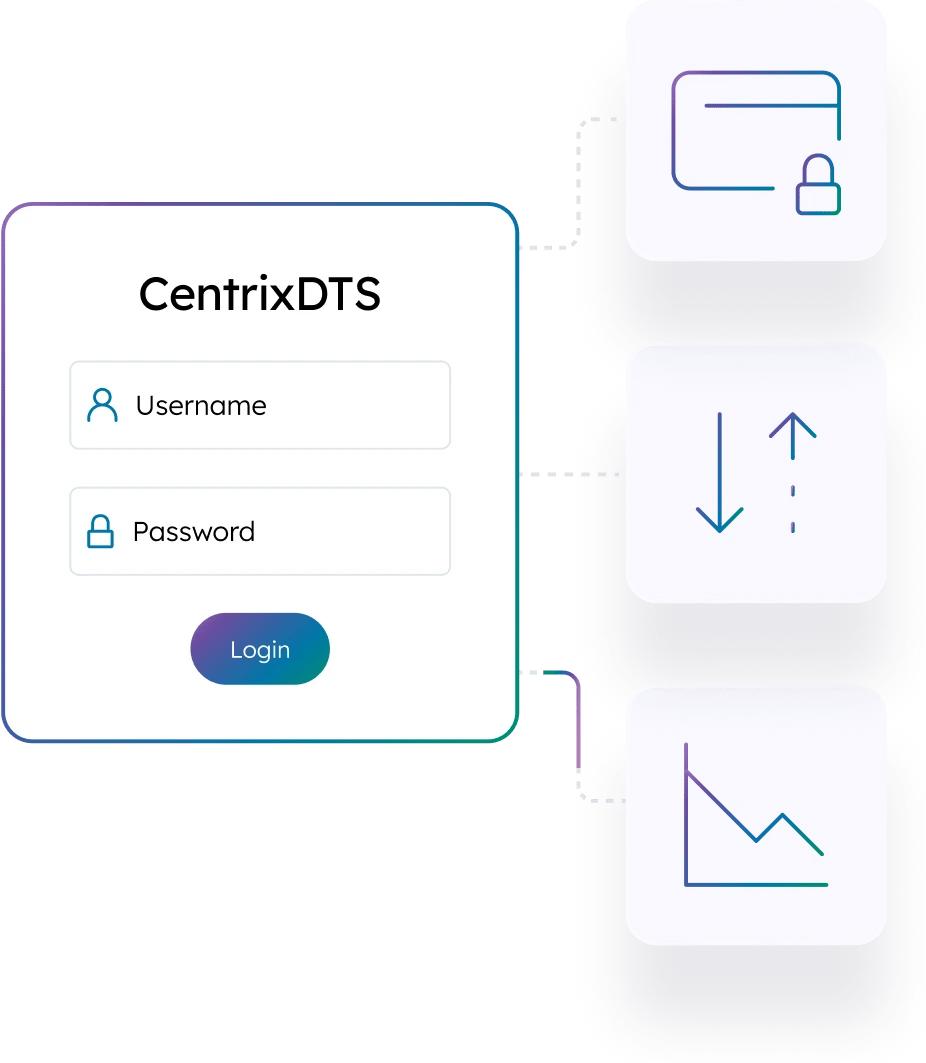

Automated dispute tracking

In the event of fraud, Q2’S CentrixDTS™ simplifies disputes—for you and your account holders. It speeds fraud response, ensures Reg E compliance, and quickly uncovers the impact of card breaches.

An end-to-end approach to security

From a secure perimeter to zero-trust framework to hardened endpoints, our network, application, and data are protected by constant, vigilant monitoring. Security is interwoven at every level.

Rising to meet increased threats

- $1B in suspicious transactions were stopped by Q2 Sentinel in 2023 and, after confirmation by human review, were not processed by Q2 customers.

- >$1M The largest single transaction stopped by Sentinel in 2023.

Proven success

“Offering a secure online experience for our customers was the No. 1 reason Q2 was attractive.”

President, First National Bank of Hutchinson

Solutions for your biggest challenges

-

Deliver personal experiences

Create meaningful experiences for the moments that matter on account holders’ financial journeys.

-

Improve financial wellness

Make lives better with financial tools and education integrated with digital banking.

-

Accelerate digital innovation

Quickly innovate to solve real problems for people—at every important life moment.

-

Increase value of new accounts

Turn new accounts into lifetime relationships.