Be an ally against fraudsters

Payments fraud is a part of life when it comes to running a business. But fraud losses don’t have to be. With Q2 solutions, equip your business customers with the safeguards to stop fraudsters in their tracks—and open up a new source of fee income for your financial institution.

Are your business customers losing sleep?

Businesses need to know their FI is behind them in their efforts to protect their hard-earned dollars. With advanced digital defenses, businesses can take an aggressive stance against fraud.

Behavioral analytics

SMBs benefit from a tool that continuously learns, monitors, and models user behavior in real time to determine whether login events and transactions should be treated as potentially fraudulent.

Constant monitoring

Fraud detection and monitoring shouldn’t be a manual, hands-on practice. Businesses need a tool that runs quietly out of sight and quickly responds when a deviation is detected.

Streamlined and integrated

Businesses need to be able to fight fraud from one central location—their digital banking platform.

Digital banking with built-in defenses

Our Centrix positive pay solution integrates with the Q2 Digital Banking Platform™ for seamless, robust positive pay and transaction management—a service so valuable that surveyed SMBs say they’ll gladly pay for it.

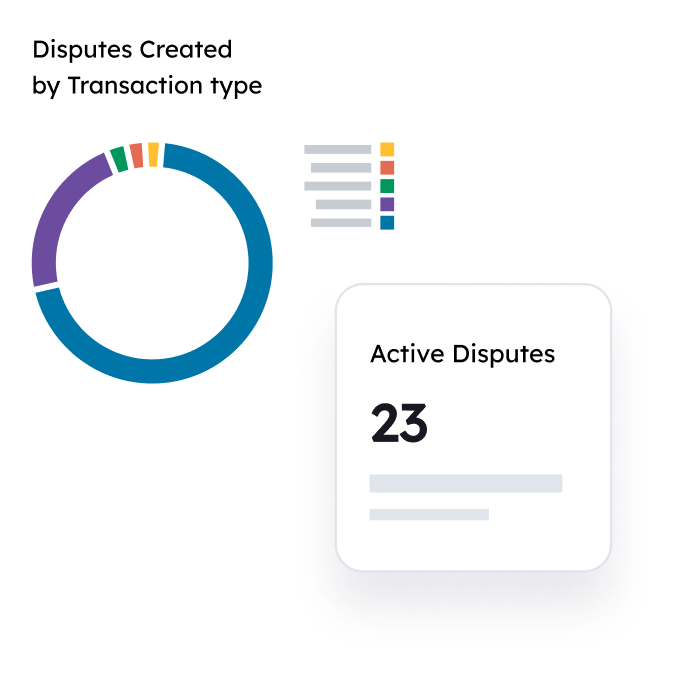

Simplified dispute tracking

We'll help your FI simplify the administration of disputed electronic transactions (debit card, ATM, ACH, and remittance transfers) for the purpose of Reg E compliance.

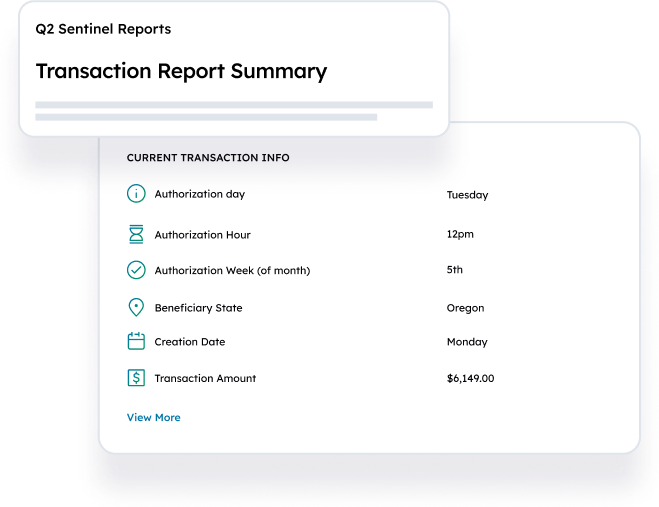

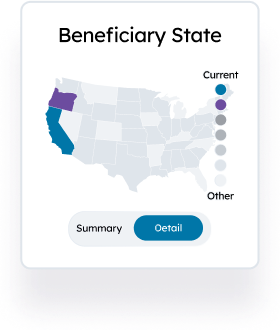

Real-time, all-the-time monitoring

Q2 is ready to determine in real time whether login events and transactions should be treated as suspect based upon a wide range of characteristics, which are analyzed against historical behavioral activity specific to the individual user.

Behavior-based authentication

Add another additional layer of monitoring by leveraging user behavior and device details to identify suspicious sessions and require further authentication around certain high-risk activities.

Data-based due diligence

In partnership with Alloy, Q2 delivers further protection with connections to 170+ data sources, providing critical information for automating and managing KYC, AML, credit, and compliance.

Don’t take our word for it

-

“It creates trust between us and our customers because they’re not just getting an impersonal text message about a transaction that needs to be validated. They’re talking to a real person at our bank. They appreciate that they’re talking to someone who is taking the time to call and make sure their money is not going out the door fraudulently—because, unfortunately, fraud is a daily occurrence in our country.”

Jennifer MaggioRead story

VP and Business Solutions Manager -

“We’ve had the Sentinel program for a number of years, and it has helped protect our customers. We’ve had one $600,000 loss we were able to avoid because of Sentinel.”

Scott Jennings

SVP and COO

Who we work with

Resources

Solutions for your biggest challenges

-

Differentiate with technology

Give small and medium-sized businesses the customized digital banking experience they crave.

-

Expand beyond traditional services

Be more than a bank for your SMB customers. Be the hub of their business.

-

Grow SMB deposits

Make the most of your SMB portfolio by segmenting and targeting your business customers with the products and services most important to them.

-4.png?width=224&height=101&name=Partner%20logos%20(1)-4.png)

-3.png?width=224&height=101&name=Partner%20logos%20(2)-3.png)

-1.png?width=224&height=101&name=Partner%20logos%20(3)-1.png)

.png?width=224&height=101&name=Partner%20logos%20(4).png)