Deepen relationships with financial wellness

Help account holders make informed decisions about their financial circumstances with sought-after financial wellness tools, and benefit from the deeper relationships they can deliver.

.png?width=655&height=509&name=Hero%20(1).png)

Make financial wellness easy

Choosing innovative, easy-to-integrate digital personal financial management tools can better guide account holders in their money decisions while connecting them to useful digital services and solutions available at your bank or credit union.

See the full picture

Automated tools for aggregation and tracking of financial accounts

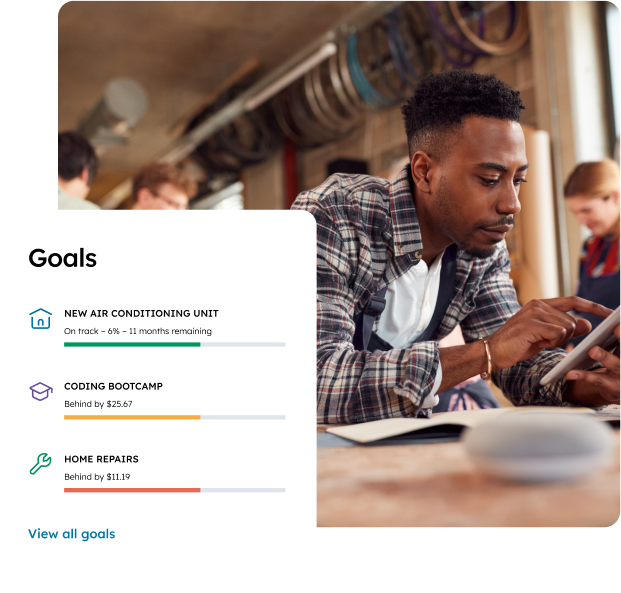

Set meaningful goals

A digital framework to establish and meet savings goals for any need or want

Support every need

Partner with fintechs to support a wide range of financial wellness needs

The proof is in the numbers.

Q2 client’s shared metrics, 2023.- 50% The percentage of credit union members who raised their credit scores in one year using Q2 fintech partner financial wellness technology.

- >500+ The number of new savings goals opened at one FI following Q2 Goals implementation.

The right financial wellness tools

Quick, easy-to-use financial wellness tools within digital banking will help consumers save, meet goals, and improve their money management. With the right tools that are simple to integrate, your bank or credit union will be in a great position to:

- Offer more personalized banking experiences

- Lay the groundwork for a customer's financial journey

- Build loyalty and increase revenue

Money management and more

Personal Financial Management can be part of your account holder’s digital banking experience. It’s automated with simple aggregation, categorization, and visualization tools, allowing them to track spending, understand their cash flow and net worth, and budget more effectively.

To achieve saving goals online

Account holders will appreciate the chance to set up specific savings goals within our digital banking platform and have easy visibility into their progress and activity. Besides making the savings process automatic, just about any goal can be sought.

Financial wellness tools from leading fintechs

Easy-to-integrate fintech solutions are available in our marketplace to help your account holders with expense management, accounting, taxes, insurance, and more. Provide offerings to attract any consumer demographic—Baby Boomers, Gen Xers, millennials, and others.

Resources

Solutions for your biggest challenges

-

Increase the value of new accounts

Capture the interest of new account holders with their desired solutions to set the stage for long-term loyalty.

-

Deliver more personalized banking experiences

Q2 has the innovative technology in place to produce even-more personalized consumer banking.