Fraud Intelligence for digital banking

Putting multilayer fraud prevention in place is challenging, especially if you’re not staying on top of the latest best-practice methods. Without this edge, expect trouble.

Q2’s combination of experience and innovation makes us the perfect fit for banks and credit unions seeking to improve their fraud and risk management in today’s 24/7 threat environment.

Fraud prevention is a 24x7x365 job

A digital banking platform provider has to maintain a continuous focus on global research, top-tier partnerships, and AI-powered innovation. Q2 does all that and more.

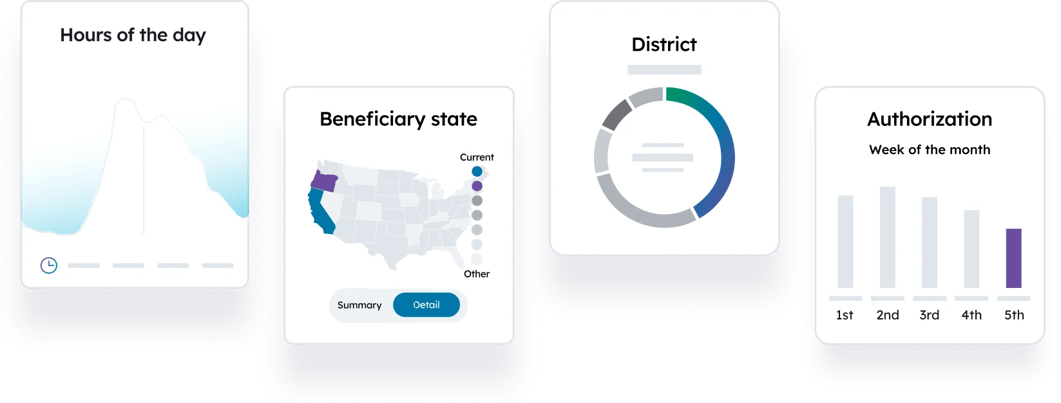

Data-driven security

Q2’s innovative tools combine behavioral data and machine learning to detect potential fraud and trigger real-time alerts. This makes it possible for banks and credit unions to see fraudulent activity sooner, stop it proactively, and then resolve it efficiently.

Automated risk management

Streamline ACH reporting and compliance with Andi®, Q2’s virtual advisor. Andi leverages human expertise and AI-enabled tools to provide coaching and actionable insights that make your staff more effective and your account holders more secure.

Robust access control

Q2 gives institutions the flexibility to manage access in the way that’s best suited for their needs. Pick from a wide range of options, including password policy management, password encryption, out-of-band MFA (multifactor authentication), and entitlement control.

Bank on Q2’s best-of-breed fraud prevention

With the robust fraud and risk assessment measures built into the Q2 digital platform, as well as powerful Centrix solutions, plus access to countless options via Innovation Studio, banks and credit unions can breathe easier knowing their account holders' assets, as well as their trust, will be protected.

Here’s how well our fraud prevention and risk management features perform, by the numbers

- $5.4B of "Suspect" transactions stopped in 2025

- $1.1B Check and ACH fraud prevented in 2025

- 2.2M Step ups authenticated in 2025

Build trust. Not friction

- CentrixDTS

- Centrix ETMS

- CentrixPIQS

Automated dispute management

Allows more effective, more efficient case management by reducing your reliance on manual processing and improving your time-to-resolution. A single screen shows all activity associated with a dispute, including case notes, attachments, letters, and adjustment transactions, with automated alerting.

ACH and check fraud prevention with positive pay

Secure commercial clients with automated, full-featured transaction monitoring and management for ACH and check positive pay. Centrix Positive Pay can coexist with an institution’s legacy technology or easily integrate into the Q2 digital banking platform.

Risk mitigation and compliance made easy

Remove the burden of manual effort from your ACH originators, RDC customers, or other risk reviews and let innovative technology work to simplify audits, ensure compliance, mitigate risk, and manage ACH and other payment activity.

Behavioral analytics and fraud prevention

With Q2 Sentinel, apply machine learning, endpoint interrogation, and other security technology to monitor user behavior on our digital banking platform and to prevent fraudulent activity from negatively affecting our financial institution customers.

With AI-driven fraud protection, you can detect anomalies earlier and prevent fraudsters from impacting your account holders.

Step-up authentication

With Q2 Patrol™, monitor login and behavior patterns and prompt users to complete step-up authentication before accessing high-risk events when anomalous activity is detected.

Access details are continuously tracked, and anomalies found in use patterns trigger further authentication.

Learn the Fraud Intelligence framework

Fraud Intelligence is a real-time approach to fraud prevention that leverages advanced technologies to create customized security measures for each account holder. It’s based on a three-phase action plan:

-

See It

Advanced analytics aggregate data from user behavior, transaction patterns, device characteristics, and historical activities. This allows institutions to identify threats before they have an opportunity to strike.

-

Stop It

Proactive and tailored security measures such as adaptive authentication and real-time interdiction can be deployed to address suspicious activities with minimal disruption for the account holder.

-

Solve It

Automated case management, intelligent workflows, and clear communication channels provide banks and credit unions with rapid response and resolution capabilities. This ensures incidents can be dealt with before they lead to serious financial and reputational damage, building trust and providing stakeholders with the information they need to understand what’s been done and why.

Important fraud factors

The rising cost of fraud

A successful fraud attempt costs a financial institution more than just the amount of money taken from an account holder.

There is also the cost of investigating the fraud and the negative impact on the account holder experience, which often leads to churn. According to the latest True Cost of Fraud study from LexisNexis Risk Solutions, every dollar lost to a fraudster costs U.S. financial institutions $5.75.

Emerging threats in digital banking

Thieves are always looking for weaknesses they can exploit and new tools they can use to bypass security measures. With recent developments in technology, they have more ways than ever to break through protection.

For example, phishing schemes used to rely on fraudsters establishing contact with victims and fooling them into providing their credentials or personal information through email. With the rise of generative AI, however, algorithms can now craft emails and maintain communication with victims automatically and without human intervention.

Criminals also can create sophisticated deepfakes to trick victims into giving up their login information. According to a recent report from Deloitte, it’s estimated that generative AI will lead to banks losing an estimated $40 billion from fraud.

The fight against fraud is a never-ending battle, and Q2 is committed to being on the cutting edge of protection. Our continuous research into fraud schemes and global partnerships with leading authorities in fintech security make us the thought leaders in this space.

Education and end-user awareness

Even the strongest fraud prevention measures can only go so far, and in many cases the weakest link is the end-user. That’s why Q2 is here to support FIs with comprehensive training for staff and account holders.

With training programs, webinars, and best-practice toolkits, Q2 prepares financial institutions and consumers to recognize the warning signs of fraud and avoid making costly mistakes. Preventing fraud is everyone’s responsibility, and Q2 is dedicated to providing all the tools and expertise needed to achieve it.

Proven success

-

“Offering a secure online experience for our customers was the number one reason Q2 was attractive.”

Greg Binns

President -

“We’ve had the Q2 Sentinel program for a number of years, and it has helped protect our customers. We had one $600,000 loss we were able to avoid because of Sentinel.”

Scott Jennings

Senior VP and COO

Resources

Learn more about Q2’s best-practice technology

-

The Q2 Platform

Best-in-breed security plus fast, easy account opening and onboarding; personalized, tailored banking; data-driven marketing; and much more.

-

The Q2 Security Framework

Our quick-read ebook will give you more insight on how we tackle today's security concerns.