Get more from your SMB portfolio

Small and medium-sized businesses (SMBs) are not only plentiful, they’re underserved. With data-driven segmenting and an individualized approach to marketing to them, they can be a lucrative part of your financial institution’s deposit-growth strategy.

Put the data to work for you

Each SMB vertical has unique needs. Whether you serve dentist offices or hair salons, understanding your SMB customers’ behaviors is key to providing the right banking solutions.

Actionable information

Your financial institution has a plethora of customer data available to you, but you need to know how to track it, understand it, and make it meaningful.

Right product, right time

Your SMB customers need your help cutting through the clutter so they can get to the right solution for their immediate banking needs.

Targeted strategy

Truly getting the most from your SMB portfolio requires a thoughtful, data-driven approach and market insight.

Better understand your customers

Track online behavior, product usage, and more to get a deeper understanding of account holder activity. Q2 Discover helps you target customers with more effective communications and more relevant products.

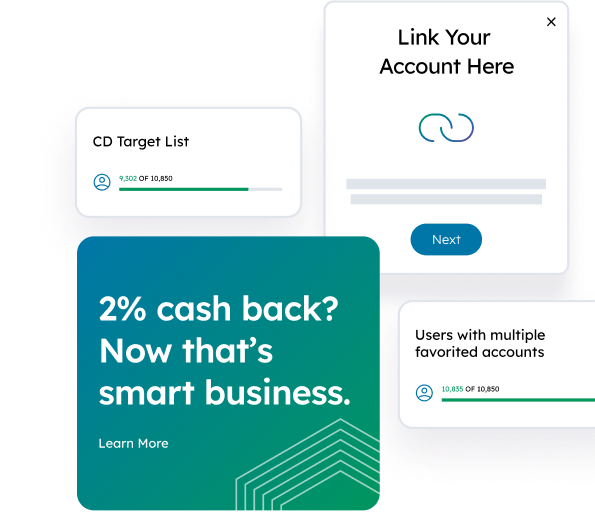

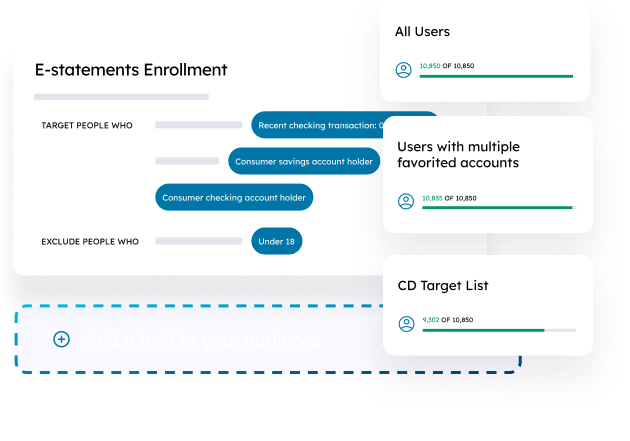

Better segment and target SMBs

With Q2 Audience Builder, you can organize your SMB customers into audience segments based on specific traits driven by behaviors and transactional characteristics, so you can provide them with a tailored experience composed of the tools and services they need the most.

Anticipate SMB needs

Deliver the right content and offers at the right time to the right customer. The recommendation engine in Q2 SMART™ distills account data to help you deliver what your customers need as soon as they need it.

Expand beyond traditional services

Be more than a bank for your SMB customers. Be the hub of their business by offering the fintech solutions they need through their digital banking platform.

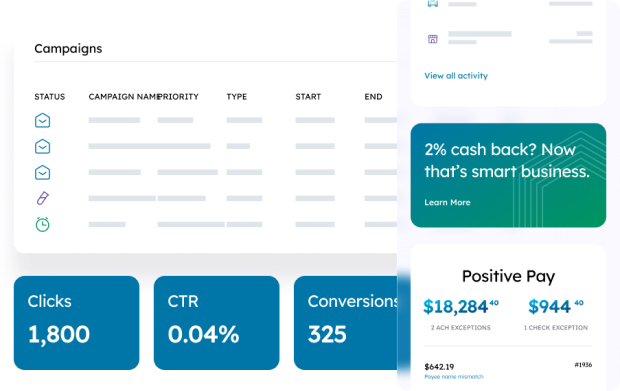

Elevate your engagement strategy

Q2 Advisory Services can help you make the most of your data to create greater engagement, improved adoption of services, and better experiences for SMBs. What’s more, they can help you assess your market, specific SMBs, or SMB verticals to discover opportunities.

Don't take our word for it

2X

in small business and commercial deposits

3X

increase in small business and commercial membership

"Since going live, we have increased our small business and commercial membership count nearly three times and more than doubled our small business and commercial deposits.”

EVP and Chief Experience Officer

Solutions for your biggest challenges

-

Differentiate with technology

Give small and medium-sized businesses the customized digital banking experience they crave.

-

Accelerate innovation

Innovation is never a one-and-done deal. Rely on Q2 and our partners to never stop building solutions that enable your FI to meet the changing needs of the businesses you serve.

-

Fight fraud and drive income

Be a fraud-fighting ally for your SMB customers by providing the tools they need to stop cyber thieves in their tracks.