Critical market intelligence & coaching

Compete smarter with Q2 Market Insights

Give your RMs an edge

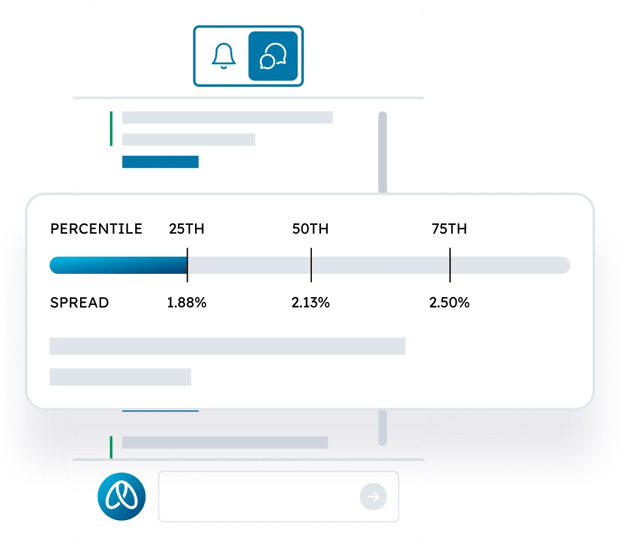

Now your relationship managers can price and negotiate with confidence, thanks to market-based guidance on their deal structures.

Deliver timely coaching

Andi®, our virtual digital assistant, provides in-the-moment advice and market information to your RMs on spreads, fees, deposits, and cross-sell.

Leverage internal best practices

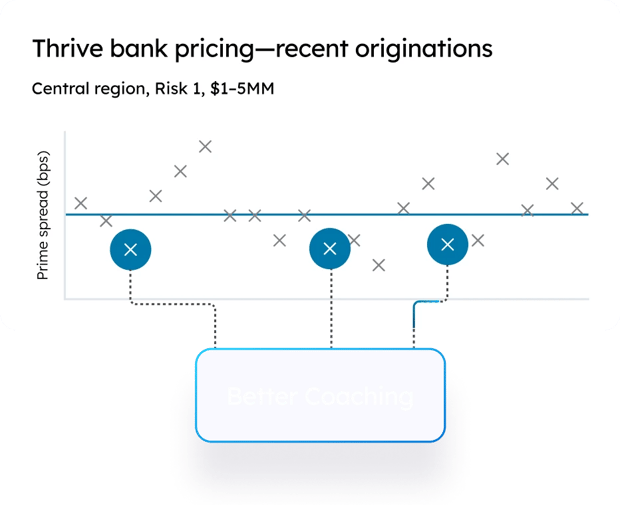

Supplement the market intelligence with data on your institution’s recent wins, which reflect your unique value proposition. Show RMs what their colleagues have achieved to build confidence.

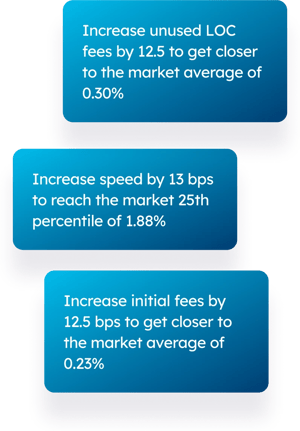

Tailor your recommendations

Easily configure Andi’s advice to align with your specific goals. Nudge RMs with modest pricing increments or set more ambitious targets. Tailor recommendations based on how far below-market your RM’s proposal stands.

A powerful combination

Market Insights is powered by Q2 PrecisionLender’s immense and continuously growing commercial database.

- $1T+ in loans

- 1.3T+ in deposits

- 1% (1600+) of NAICS codes represented

- 1M+ commercial relationships

- 1K Activity from more than 29K bankers

Deep Expertise

When that data is combined with our experience and expertise in commercial banking, it becomes a powerful solution that more and more top banks are using to move ahead of the competition. It’s a wide-ranging list, from community institutions and regional banks all the way up to several of the 10 largest banks in the United States.