Automated fraud detection

Q2 Sentinel, our fraud detection and analytics solution, applies machine learning, endpoint interrogation, and other security technology to monitor user behavior on our digital banking platform and prevent fraudulent activity from negatively affecting our banks and credit unions.

Proven fraud defense

Real-time anomaly detection and alerts

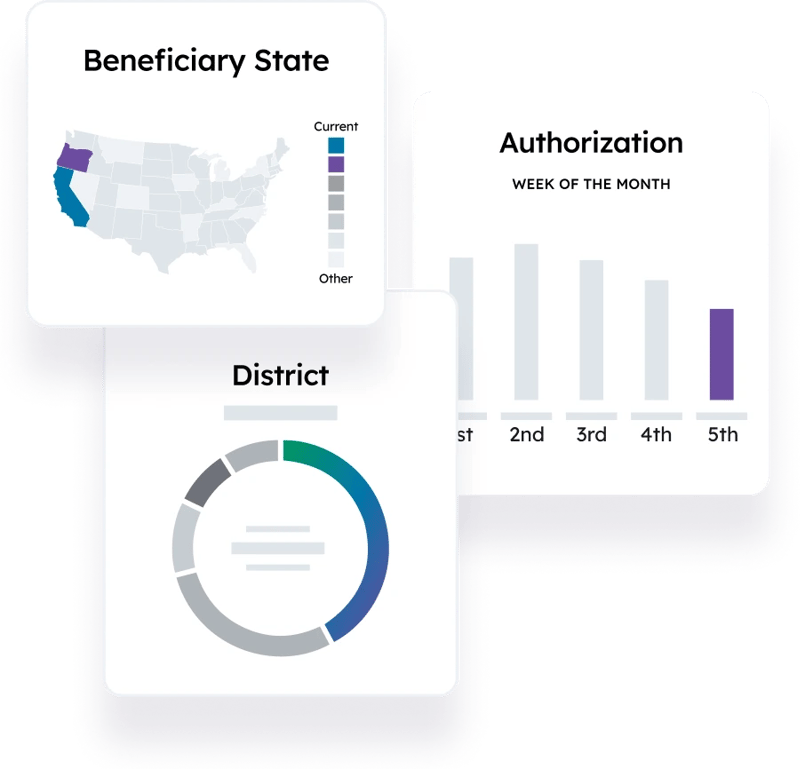

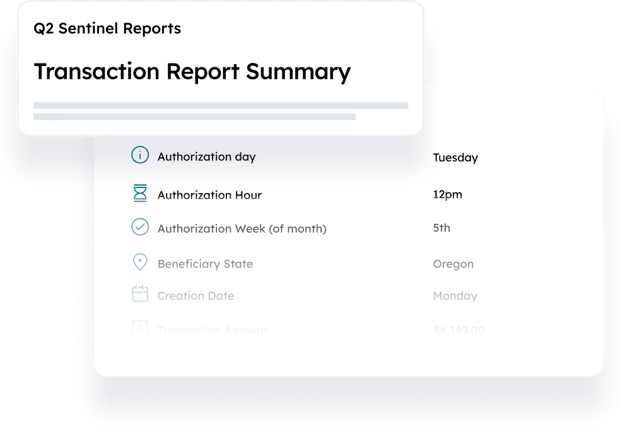

With Q2 Sentinel™, account holders’ typical patterns of logins, transactions, and other behaviors are monitored and any behavior outside of those patterns is immediately flagged as potential fraud. Our fraud analytics software uses machine learning to detect and flag login events and transactions determined to be anomalies based on a range of characteristics analyzed against historical account holder information.

This real-time, deep integration allows an FI to be actionable, safeguarding itself in the moment with AI-driven fraud detection based on behavioral analytics, rather than relying on after-the-fact reporting.

For both online and mobile banking

There’s geo-location detection, and Sentinel’s check fraud detection for mobile RDC (mRDC) will reduce fraud penetration.

Policy decisioning

Your FI has control in the process and can tailor monitoring to the account holder.

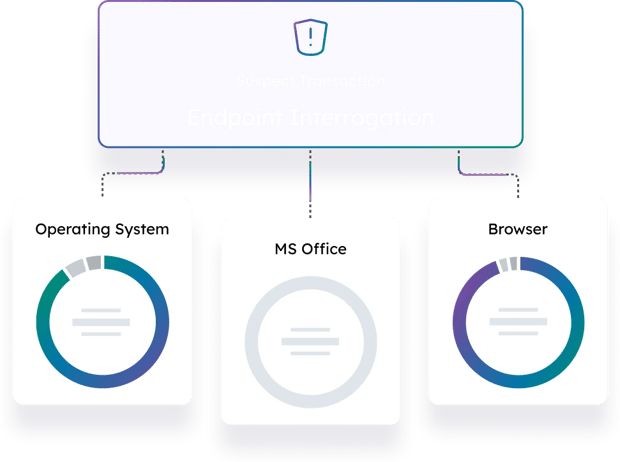

Comprehensive endpoint interrogation

Endpoint interrogation is part of the Q2 Sentinel™ solution, providing another layer of security for your account holders. Your FI will be able to measure account holder behavior outside of transactions in your digital banking platform.

Constant analysis of browsers and other integrated software offers an important fraud prevention advantage.

Establish deeper, more complete digital fingerprinting for the wellbeing of your account holders and protect your institution’s positive reputation.

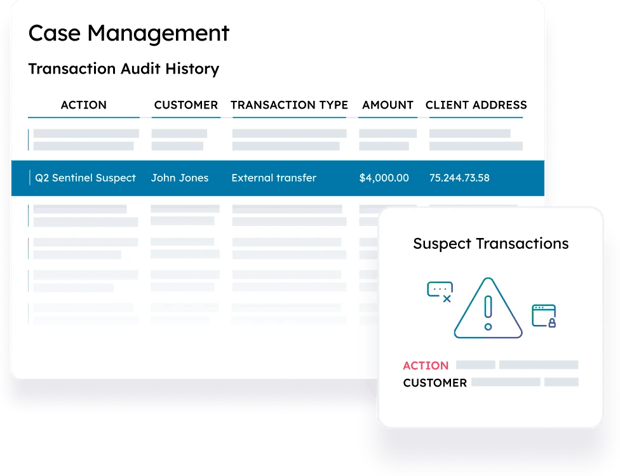

Transaction scoring to safeguard payments

With transaction scoring, an FI has the opportunity to process a transaction or not, creating significant protection with minimal friction. Quickly determine money movement that falls outside of what is normal for an account holder and prevent a possible fraudulent act.

Apply transaction scoring to ACH, External Transfers, Domestic Wires, and International Wires.

Proven success

- >$3B in suspicious transactions identified in 2023

- ~$10K of "Suspect" transactions stopped each month

The Q2 Sentinel™ solution continues to prove its value to many of our financial institutions (FIs) over the years.

We’ve had the Sentinel program for a number of years, and it has helped protect our customers. We’ve had one $600,000 loss we were able to avoid because of Sentinel.

Senior VP and COO

Resources

How is behavioral analytics used for fraud prevention?

Behavioral analytics tools are used to constantly monitor user activity – everything from locations, transaction amounts to login attempts – to detect suspicious and potentially fraudulent activities that deviate from established user behavior patterns. It uses historical user data to create a profile of legitimate user behavior and then flags any significant deviations in activity – triggering alerts that start investigations and raise protection levels.

How does machine learning improve fraud detection?

Machine learning is the engine that powers behavioral analytics. Machine learning models handle the analysis of vast datasets to identify and flag patterns and anomalies indicative of fraudulent behavior, when analyzed against historical account holder information. This enables a level of real-time detection and prevention that surpasses traditional rule-based systems.

Additional products

-

Access Control

Stop digital intruders before they strike.

-

ACH Processing & Reporting

Automating your transaction management efforts brings efficiency.

-

Positive Pay

Features-rich check and ACH positive pay for fraud prevention.