Banking that fits small businesses

For too long, small business banking has missed the mark, with either too much complexity or not enough capabilities.

Many solutions make the process more arduous than it needs to be, with fragmented fintech tools, long onboarding windows, and a lack of personalization. But with Q2, your bank or credit union can give small businesses a just-right banking experience by tailoring the functionality for every type of small or mid-size business (SMB).

Help them help themselves

If there’s one word to describe small business owners and entrepreneurs, it’s busy. They want the flexibility to do their banking the way they need to, when they need to. For instance, retail SMBs may require POS integration, while contractors need invoicing tools. With Q2, you can give any type of SMB the flexibility and scalability needed to meet its unique challenges.

Tailored experiences

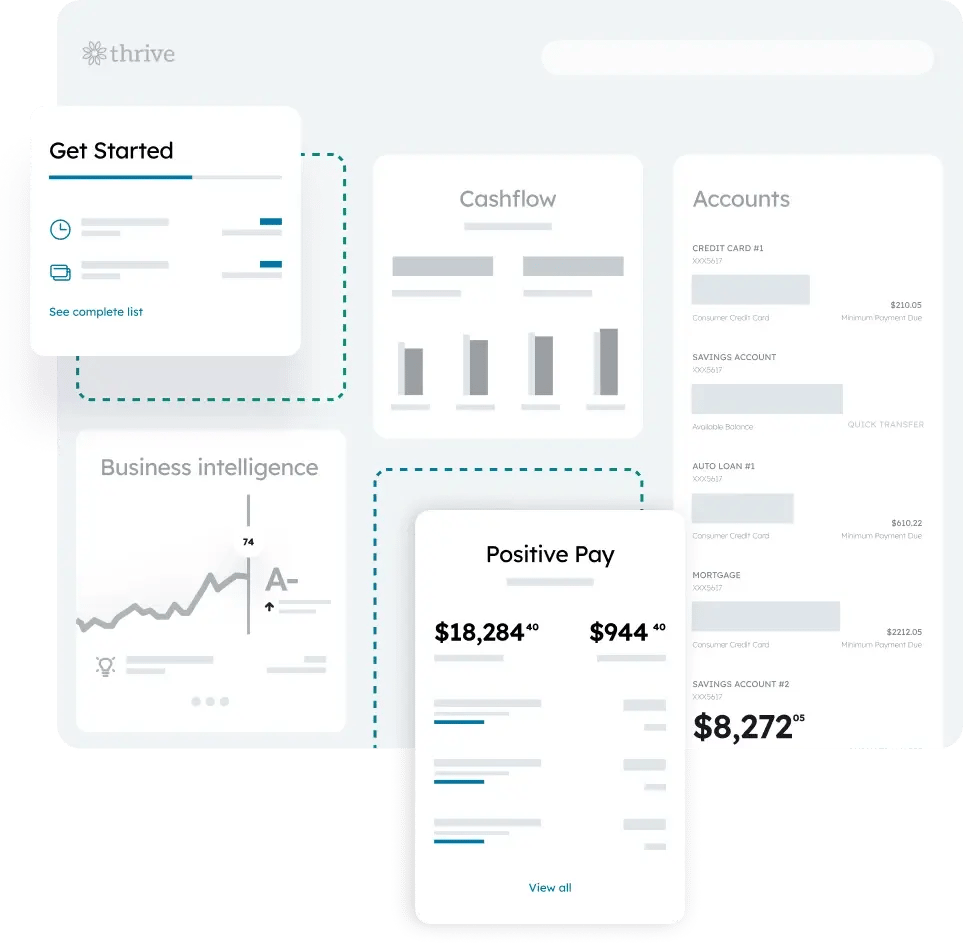

With the Q2 Digital Banking Platform®, SMBs have the capabilities and functionality specific to them, and you can go further to create a custom experience based on their needs. Features such as cash flow management, multiple user roles, and account segmentation give you the ability to meet a wide range of SMB requirements.

Beyond banking

When you provide fintech solutions for services such as expense management and payroll, you strengthen relationships and keep your account holders from sourcing those solutions themselves.

Room to grow

As your SMB account holders grow, so do their banking requirements. With Q2 digital banking, you can add features and functionality on demand to meet needs.

Dynamic Personalization

Make it personal

With Q2 Composable Dashboard, you can leverage the power of data insights with dynamic personalization that’s integrated into every interaction, every decision. Beyond offering the baseline services SMBs require, take it a step further by packaging those services based on specific needs.

Q2 Innovation Studio

Research shows that businesses want their financial institutions to partner with more fintechs. With the Q2 Innovation Studio fintech partner ecosystem, you can turn your digital banking platform into an e-commerce hub where small businesses can choose innovative products for needs such as:

- Payroll

- Expense tracking

- Legal forms

Deploying new fintech integrations also becomes a much faster and smoother process, with timelines shrinking from several months to typically just a few weeks.

Business account opening

Open accounts with ease

With business account opening powered by Prelim, you can automate the process of opening new accounts and adding accounts for small businesses, giving them autonomy with clear, easy-to-understand steps, reducing paper, and increasing processing times.

Treasury fulfillment

Get SMBs up and running on business banking solutions fast with Q2 Treasury Fulfillment, providing a streamlined, automated fulfillment process that eases communication between the front and back office.

Simplify cash flow and

financial insights

Q2 provides SMBs with simplified and intuitive dashboards for real-time cash flow tracking, as well as features like invoice management, expense alerts, and cash forecasting.

With the power of our platform on your side, you can move from “just a bank” to a true financial partner, offering actionable business insights. Embedded fintech integrations such as accounting and expense management also help support client retention.

Positive pay

Stop fraudsters in their tracks

Be an ally against fraud by equipping SMBs with Centrix Exact/TMS™, which gives them the positive pay capability to stop cyber criminals before they begin—and creates a new source of fee income for your financial institution.

Payments from A to Z

Many SMBs struggle with managing cash flow and vendor payments. Whether it’s ACH, checks, or new instant payments rails such as FedNow® and RTP®, Q2 offers choice. All payment workflows can be consolidated into one platform.

Q2 earns top marks for small business banking

“The ability to more efficiently process payroll, ACH and payments; offer remote deposit capture; and deliver overall functionality has put us into a referral environment with the local CPAs. Q2 has been integral in that.”

EVP and Chief Experience Officer

BEST IN CLASS

Small business

"Best in Class" in Javelin Strategy and Research’s 2025 Small Business Digital Banking Vendor Scorecard