Commercial banking software

Serve businesses of all sizes with market-leading, mobile-enabled commercial banking delivered on one configurable, extensible platform.

Then, choose from among our end-to-end digital capabilities to fit your financial institution’s goals and your commercial clients’ needs.

Banking services

that matter

Whether they’re in manufacturing, healthcare, real estate, or any other industry, businesses today are focused on doing more with less—less labor, less time, and less waste—and they need the same from their banking relationships.

Tailored experiences

Make each commercial client feel like your most important one by targeting market segments with financial services built for its unique needs.

Payments from A to Z

Payments are a critical aspect of any business. Q2 digital banking software enables you to provide secure, reliable payment options, from ACH to instant payments.

Integration that drives efficiency

Streamline accounting processes by seamlessly integrating your digital banking platform with your commercial clients’ accounting systems.

Offer commercial banking that businesses want

Serve commercial customers of all sizes with market-leading, mobile-enabled commercial banking delivered on one configurable, extensible platform.

It’s more than a demo. It’s a real-life experience.

With Q2 Interactive Test Drive, your commercial clients and prospects can try out new banking capabilities in a mock-up of their own environment. Put them in the driver’s seat and let your business banking products and services sell themselves.

Treasury onboarding transformed

Unlock productivity, enhance customer experience, and drive revenue faster with Q2 Treasury Fulfillment.

Positive pay

A powerful tool to battle check fraud

Companies of all sizes continue to battle check fraud, and many are looking to their financial institution to help. With Centrix® Exact/TMS™, your commercial clients have a powerful tool to validate payment-related information, manage exceptions, and create custom reports.

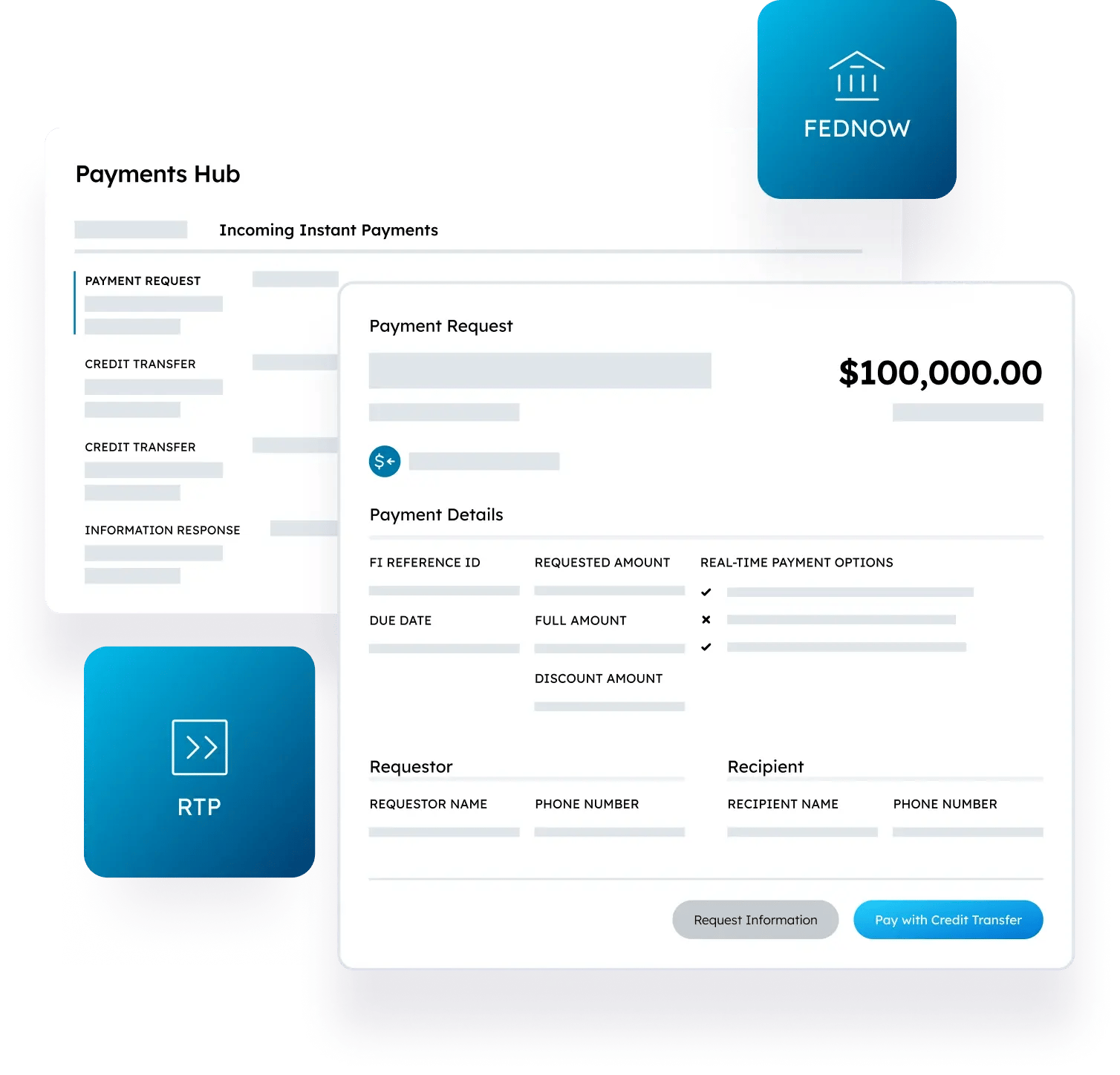

Instant payments

Speed is just the starting point

With Q2 Instant Payments Manager, businesses can take advantage of the robust messaging capabilities provided by RTP and FedNow instant payments networks.

Even more valuable than the ability to send and receive payments in real time, at any time, instant payments enable remittance information to travel with the payment throughout the payment life cycle, streamlining accounts payable/accounts receivable processes.

Every payment type for every need

Meet your commercial clients’ payment needs no matter what they are, whether it’s advanced ACH or wire capabilities for paying suppliers or paying taxes, or it’s cross-border money movement to support international business interests.

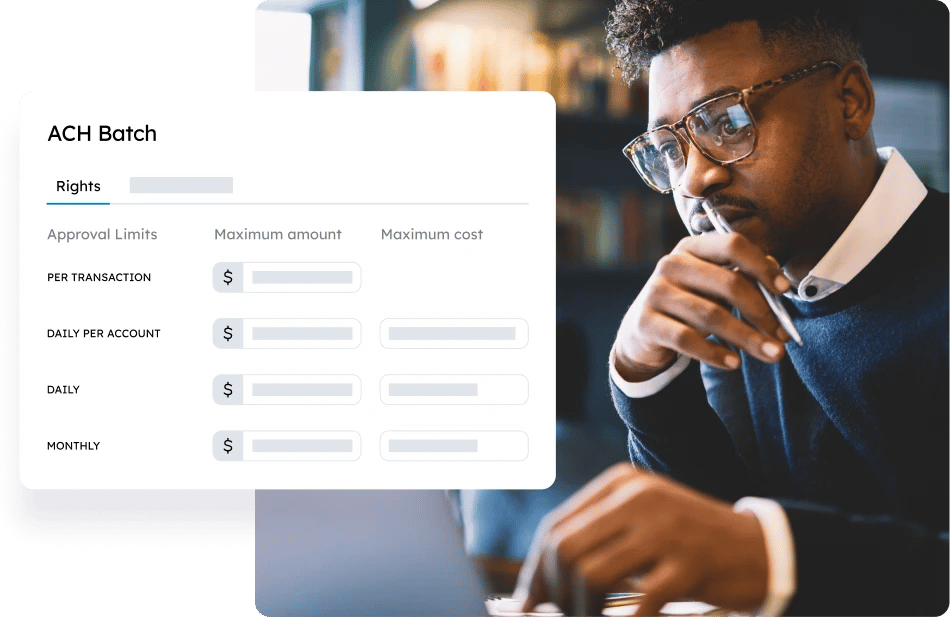

Give the right access to the right people

Information is power, and your financial institution has a lot of it. Our entitlements feature helps you ensure the right people have access to the information they need to make critical decisions.

Information your customers can act on

By understanding the banking data at their fingertips, the businesses you serve have better control of their finances. Q2 Information Reporting provides easy-to-understand reports on all activity within their accounts.

ERP integration and direct payables

Integration creates efficiency

For most mid-size to large companies, the labor-intensive, manual process of reconciling accounting systems within the digital banking platform is inefficient.

You can remove that burden by seamlessly integrating businesses’ digital banking platform with their ERP accounting systems, as well as providing direct payables and reports via API or file exchange. The Q2 Digital Banking Platform is compatible with leading ERP providers, including Oracle NetSuite, SAP, and more.

-

Commercial customer experience

When it comes to helping businesses understand the value your financial institution can bring, there’s no better way than to show them. With Q2 Interactive Test Drive, you have a one-of-a-kind demo experience that shows off what the Q2 Digital Banking Platform can do and how it can benefit the companies you serve.

Unlike other standard demos, Interactive Test Drive offers an efficient, authentic, and compelling view of what your commercial prospects can expect from your institution.

It provides realistic demos of real-world situations in a way that allows companies to see firsthand what you can do for them. It gives you the opportunity to customize each demo to fit the prospect’s unique business.

Best-in-class cash management

“Clients often comment that the vendor is a true partner and that its focus on a limited product set enables greater investment and innovation.”

2023 Aite Matrix: U.S. Cash Management Technology Providers Vendor Assessment

BEST IN CLASS

Commercial

“Best-in-class” leader in the Aite Matrix: Leading U.S. Cash Management Technology Providers vendor assessment, 2023"