Know your customers better, serve them better

Deepen relationships at every stage of the financial journey

From unlocking powerful data to enabling an exceptional end user experience, you’ll transform the relationships you strive to nurture.

-

Turn your data into an invaluable tool

Track user behavior, categorize demographics, and identify meaningful trends.

-

Provide personalized, relevant experiences

Deliver the next best experience to account holders with precise targeting and agile personalization.

-

Boost adoption

Keep your account holders active and engaged with the products and services that matter most to them.

-

Drive digital sales success

Run campaigns to likely-to-buy segments and complete the sales process entirely through the digital channel for faster time-to-revenue. -

Grow more profitable relationships

Become more embedded in your account holders’ financial lives, resulting in long-term relationships that drive profitability.

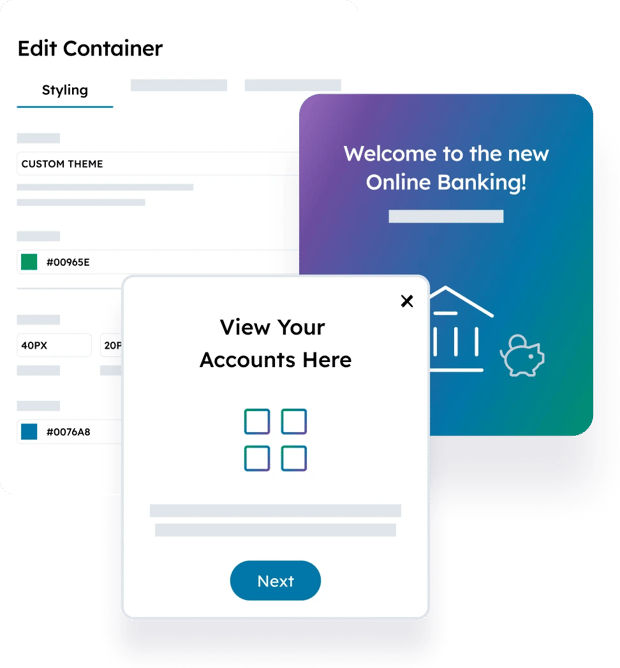

Dynamic Personalization

Give account holders highly tailored experiences—such as personalized homepages—that automatically evolve with them. No extra configuration needed.

Targeted Marketing

Use behavioral characteristics to parse account holders into clearly defined audiences for highly targeted marketing with Q2 SMART.

In-App Guides

Make every interaction more impactful by pushing out personalized guides, in-app messaging, and customized interface components with Q2 Discover.

EVE Data Extract

Incorporate the power of EVE into your data warehouse

Incorporate the power of EVE into your data warehouse. EVE (every valuable event) is a data extract containing end-user activity from various functions within the Q2 digital banking platform. All the user data and context you need to grow your business is delivered on a regular basis with the last 24 hours of activity.

The proof is in the performance

Here are just a few of the results we’re driving with our customers.

-

35% conversion rate to eStatements in first 60 days

-

Generated 1.7K loans at $3.6M per month within 90 days

-

Deployed customized in-app banners in <10 minutes

-

Reduced call center volume to nearly zero

Proven success

-

“Q2 SMART and Q2 Discover are differentiators for our bank. Because they help us identify what’s important to our clients and we can see how they’re engaging, we can send targeted messages to targeted audiences quickly. When I interact with my consumers, I want to send a message that’s meaningful to them.”

Lisa FultonRead story

SVP and Chief Operations Officer -

“For us, our true ROI is the member experience. Now, we can immediately address issues bubbling up from the call center—and deploy guides in advance of the issue to keep members happy.”

Jenny WrobbelRead story

Digital Operations Manager