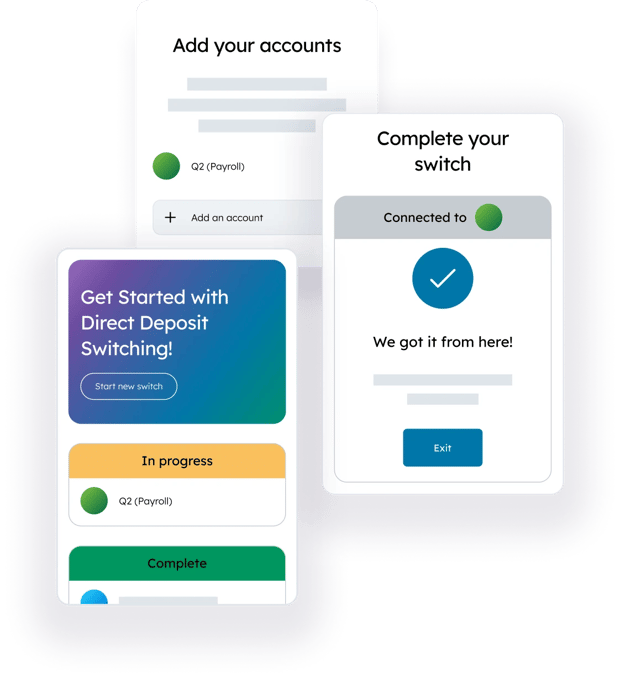

Quick, simple, and secure direct deposit switching

Drive deeper engagement by enabling account holders to switch direct deposits with Q2 ClickSWITCH.

Make it easy to join your financial institution

Streamlined and trackable direct deposit switching

Automate the process for switching direct deposits, recurring payments, and automatic payments while leveraging a user-friendly admin portal to track activity and monitor conversions.

Comprehensive employer database and integration capabilities

Offer an expansive database of hundreds of thousands of employers and the ability to integrate with new employers not already available.

Lifelong loyalty and cross-sell ROI

Direct deposit is a strong foundation for lasting loyalty. By making the direct deposit switch simple and secure, financial institutions strengthen long-term account holder relationships. It’s a fast track to profitable growth.

In fact, recent research from the American Bankers Association shows that the marketing ROI of cross-selling to existing account holders can be up to 10 times higher than new-account acquisition. This highlights the value of strengthening existing relationships through seamless onboarding experiences like direct deposit switching.

Key Benefits

Q2 ClickSWITCH delivers measurable advantages for both financial institutions and account holders, making direct deposit switching a powerful driver of growth and engagement.

-

Streamline the switch

In 90 seconds or less, account holders can move their direct deposit information, recurring payments, and automated payments to your institution.

-

Establish primary banking relationships

Direct deposit is a strong foundation for lasting loyalty. By making the direct deposit switch simple and secure, you strengthen long-term account holder relationships and accelerate profitable growth.

-

Revive inactive accounts

Simplified direct deposit switching makes it easier to reengage dormant accounts, encouraging account holders to deposit funds and restart digital or mobile banking activity.

Quantifiable Results

By reducing friction in the onboarding process, including quick and simple direct deposit switching, financial institutions see improved retention and stronger opportunities for cross-sell growth.

- <120 seconds for automated direct deposit switching

- $150+ annual account profitability gain with onboarding best practices like easy account switching

- 200+ financial institutions already rely on Q2’s direct deposit switching solution

-

Why direct deposit switching matters

Account holders often hesitate to move to a new financial institution. This is true even when they’re dissatisfied.

That’s because transferring direct deposit information and automating payments can be a hassle. This inertia is often the single biggest barrier to changing financial institutions.

- Direct deposit is a critical step in establishing a primary bank account relationship

- Without automated direct deposit switching, many account holders abandon the onboarding process before completing it

- By simplifying this essential part of onboarding, financial institutions remove friction and accelerate adoption

When account holders can complete a direct deposit switch in just a few clicks, financial institutions see higher conversion rates and stronger retention. There are also increased opportunities for cross-sell across mobile banking, online banking, and other digital banking services.

Making deposit switching easy translates directly to profitable growth.

-

Why Q2 ClickSWITCH?

Q2 ClickSWITCH is a secure, proven solution to simplify direct deposit account switching and improve account holder engagement.

Proven adoption: Trusted by more than 450 financial institutions.

Extensive integrations: Connects with hundreds of thousands of employers and payroll providers, with the ability to add new ones quickly for seamless direct deposit switching.

Trackable outcomes: Admin dashboards give financial institutions clear insights into onboarding performance, conversion rates, and deposit activity.

Part of the Q2 ecosystem: Integrated into the broader Q2 Digital Banking Platform, ensuring account holders have a consistent, reliable experience across online banking, mobile banking, and deposit-related services.

With Q2 ClickSWITCH, your financial institution can remove barriers to establishing primacy and build stronger long-term relationships.

Resources

Additional digital onboarding topics

-

Consumer Account OpeningOffer simple, effective, self-service account opening for consumers.

-

Treasury Onboarding

Provide quick, comprehensive onboarding for commercial account holders