How Small Financial Institutions Can Leverage AI to Play on the Same Field as the Big Banks

By Carl Ryden, Q2 Executive Fellow

25 Mar, 2024

As large financial institutions rush to adopt new generative AI (GenAI) tools, many of their smaller competitors are standing on the sidelines. Overall, community banks and credit unions lag behind on their digital offerings because of budget and staff constraints, so it stands to reason that they’re playing catch-up with GenAI — which includes large language models (LLMs) such as ChatGPT.

Even without resource constraints, many smaller institutions are reluctant to integrate GenAI into their ecosystems because of concerns about security and compliance. In a recent survey of community bankers, nearly 49% of respondents viewed existing technology as somewhat of a threat — and that number jumped to almost 55% for future technologies.

Smaller institutions may reason that they can afford to wait on GenAI because their competitive advantage has always rested on their ability to personalize their products and services. By contrast, larger financial institutions couldn’t compete on personalization, so achieved scale by offering generic products to large swaths of people in big markets, creating a wide footprint.

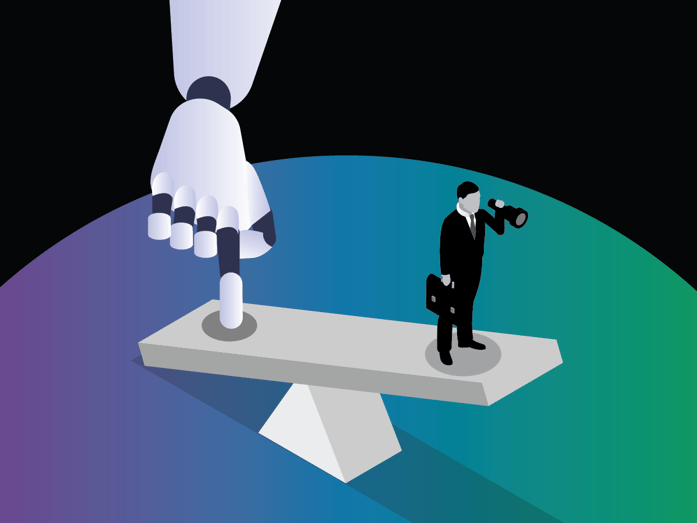

But the paradigm is shifting. Using GenAI, large institutions can now personalize each of their products for a specific customer, in a particular region, in a certain industry, and with a unique deal. In short, GenAI enables larger institutions to reduce the minimum viable market and minimum viable customer size they can target.

In this new environment, community banks and credit unions must ask themselves if they will be able to use technology to neutralize the scale advantages of the big banks before big banks can leverage technology to neutralize the personalization and local knowledge of smaller institutions.

Because in this case, LLMs are the critical neutralizer. Historically, community banks have competed on scope and on narrowing the scope to a particular area, in a particular industry, in a particular region, to a particular set of clients with a particular set of needs. Cloud computing and rudimentary AI tools then enabled them to access scale.

But now, GenAI is giving larger banks the ability to access scope at scale.

Despite their reticence, community banks and credit unions that want to maintain their competitive advantage and defend their turf can no longer afford to stand on the sidelines.

If this all sounds familiar it’s because we’ve been here before. Many times. With every technological advance, the banking industry’s first response has been, “I’m scared of this.” Then it realizes it needs that technology to remain competitive and it starts saying, “I must have this!” And with every phase, the period between the two sentiments has gotten shorter and shorter while the consequences for being late to the game are getting bigger and bigger.

So the way reluctant bankers feel now about GenAI is probably pretty similar to the way they initially felt about mobile banking apps, Al-powered chatbots and cloud computing or the way their predecessors felt about email, ATMs and online banking. I’m sure that even the typewriter and telephone were viewed suspiciously by 19th century bankers.

In each case, reluctance turned to acceptance and eventual ubiquity. Can you imagine running a financial institution without computers? That’s how GenAI will be viewed one day.

That’s not to say there aren’t legitimate reasons for financial institutions to be prudent about adopting new technologies, including GenAI, that generate new content based on data they’re fed.

But banks can use GenAI tools that are connected to knowledge models with proprietary data that is kept internally. This not only mitigates privacy and security concerns, but proprietary knowledge models can “teach” the tools industry-wide regulatory and compliance regulations as well as individual bank policies, procedures and workflows, thus increasing their effectiveness.

Used properly, GenAI tools will revolutionize banking. Now is the time for community banks and credit unions to jump into the game — before their larger competitors leave them permanently benched.