Banks: Rethink your RFP model if you want to beat the competition.

As Banking as a Service (BaaS) and Lending as a Service (LaaS) solutions vendor, Q2 participates in many requests for information and proposals (RFIs/RFPs). The process can often be old-fashioned and time-consuming – often taking a year or longer. What’s more, RFPs generally don’t allow both parties to truly get to know each other. These observations demonstrate opportunities to streamline processes and build closer relationships founded on confidence and understanding.

Developing a true partnership is key to successful engagement.

Establishing a true partnership with your technology partner is critical. Because that relationship usually starts with the RFP process—it’s essential to gain a quick understanding of who a vendor is, what their technology looks like, and how they partner with customers. This approach will be increasingly important in navigating the new normal that COVID-19 has initiated.

In today’s connected world, many believe the process of choosing technology partners should evolve in line with the evolution of the technology itself, rather than focus on getting to know each feature and function of a platform (which has been the traditional approach).

If COVID-19 has demonstrated anything, we must be flexible. Operations and tech teams everywhere have had to rally together and come up with new solutions in days (not months or years). This trend will likely continue. To remain competitive, FIs should focus on becoming more nimble and able to move with technology advances, testing and evolving in response.

An FI’s challenge today: Compete effectively, efficiently, and securely.

If you have an outdated legacy platform that no longer fits requirements, you understand the need to modernize and identify a solution that can support business objectives now and in the future. While some assigned project teams review requirements and undertake research—drawing up a shortlist of potential vendors that will hopefully meet all criteria—there may be an easier, more effective approach. Thanks to the open data and API infrastructure available in today’s world of digital ecosystems, FIs can embrace a more extensive array of choices; you no longer need one provider to meet all requirements. Ideally, you need a technology backbone that allows for easy API integration to other technology and services that could be crucial to your value proposition.

You also want security and no-risk exposure. As you look deeper into a new technology solution, it’s important to know there have been very few security breaches in the cloud approach. In contrast, many on-premises data centers have been the victim of high-profile cyber-attacks, data breaches, and systems outages. Robust security is a top priority for cloud providers. After all, without it, they would have no business. According to research by Gartner, through 2025, 99% of cloud security failures will be the customer organization’s fault.

As with any system, the cloud is only as secure as its most vulnerable link. FIs should work to ensure their drive for speed, scale, and innovation doesn’t compromise security and jeopardize a technology choice that could finally relieve their legacy woes.

Experiences matter

An FI’s RFP should inquire about the experiences of borrowers and staff alike. The FI should learn more about what a lending technology can provide to bring effective, less stressful experiences—the experiences that produce loyalty from borrowers and staff.

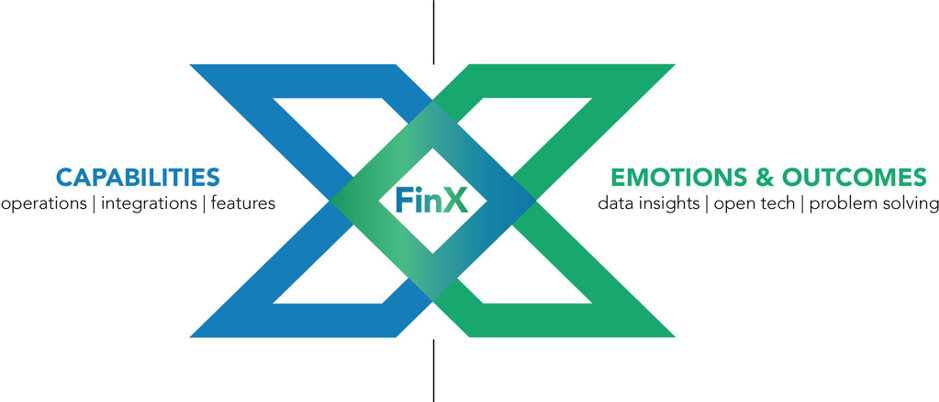

Automation, easy integration, and thoughtful user experience will lead to the right emotions and outcomes. Q2 calls this the FinX experience. We believe a unique problem-solving approach, open technology, and data-driven insights – in addition to our ever-developing integrations, operations, and features – can orchestrate the financial experiences account holders want throughout their lifelong financial journey.

What should you do?

If you’re looking for an alternative to a lengthy RFI/RFP process, here are a few things to consider:

- Conduct a quick scan of vendors instead of a lengthy RFI/RFP process and start building a Minimum Viable Product (MVP) instead. Why? It’s essential to learn and pivot your design once you start building and implementing it. By doing this, you will have the chance to show early results to key stakeholders.

- Decide on the principal design features that are important to you. If you are looking to provide greater scalability, offer stronger security, and bring overall costs down, a cloud platform can deliver those features and more.

- Embrace open banking, leveraging fintech approaches in designing your customer journeys. Solving a particular pain point is what fintechs have in common, so you should consider their methods instead of trying to compete with them.

- If you operate in multiple countries, select the country where you can create the model office using the 80/20 principle, as customization will be needed in every country. By identifying the management team that’s most supportive of change, an organization’s momentum toward digital transformation can increase significantly. Also, it’s important to remember that change is good. Implementing new technology almost always requires staff to work differently. Take this opportunity to work with vendors to customize technology for a new way of working.

Make sure your RFP asks the questions that will help you discover a solution provider’s technology evolution (roadmap), how it can help your FI with more seamless and efficient processes, and if it can meet the demands of today’s borrowers.

For help framing those questions or learning more about the cloud and other newer effective technologies, please contact us.