In the current, volatile lending market, already tight margins have only gotten leaner. Rising interest rates and inflationary pressures have slowed loan applications for consumer spending, as well as commercial, industrial, and small business development — resulting in decreased lending volumes across nearly all sectors.

These market shifts have forced lenders to work harder to attract a steady flow of new loan applicants. At the same time, they’re also tightening their underwriting standards in an attempt to maintain financial stability.

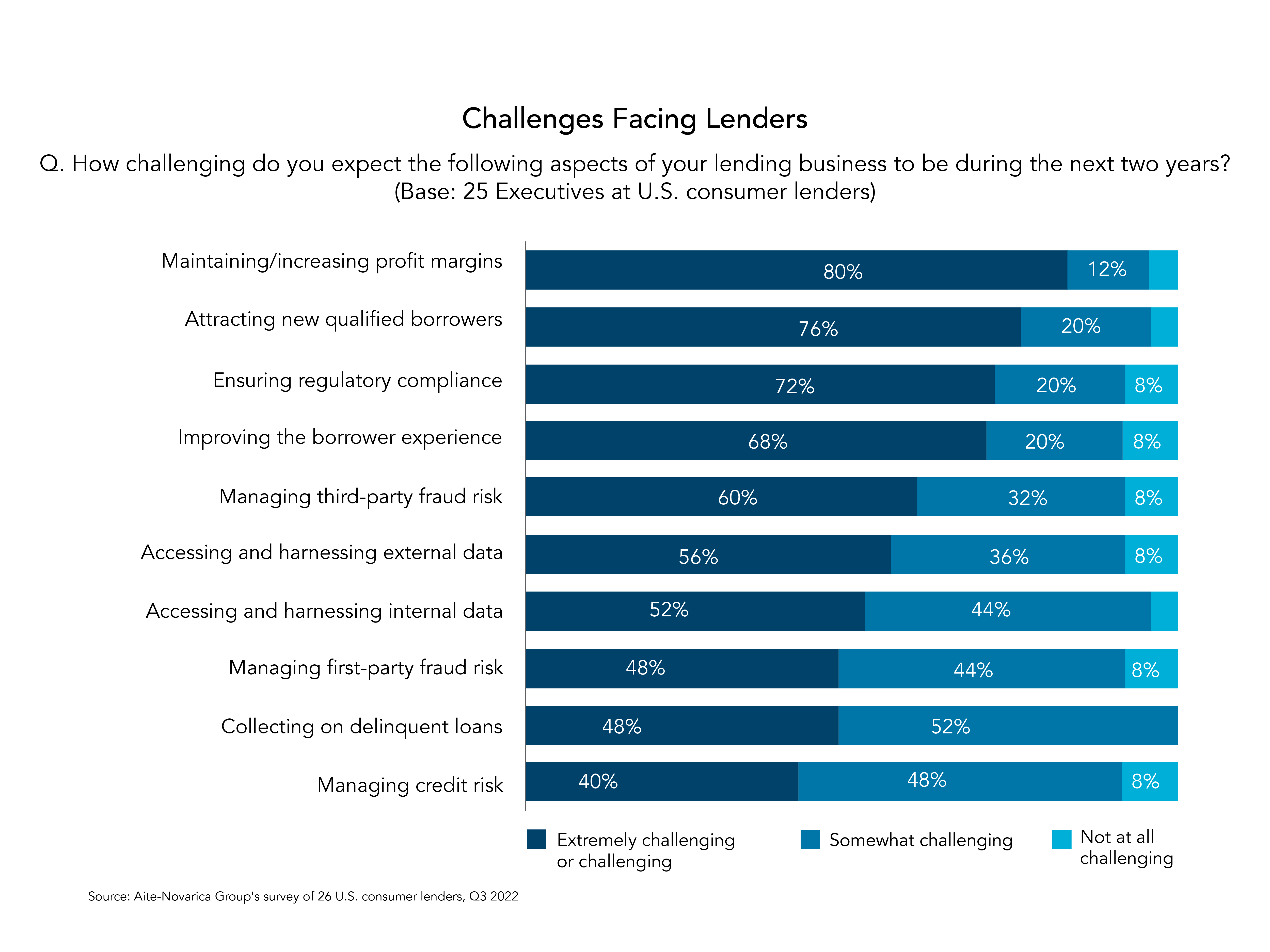

In recent loan cycles, it has become even more challenging for lenders to net a consistent influx of qualified borrowers — so much so that 76% of lending executives view it as one of their business’s top challenges, according to Aite-Novarica Group’s May 2023 survey of U.S. commercial lenders.1

To stay afloat in this landscape and attract business from prospective borrowers, lenders must understand and capitalize on several key trends.

Trend 1: Borrowers want a fast and simple process

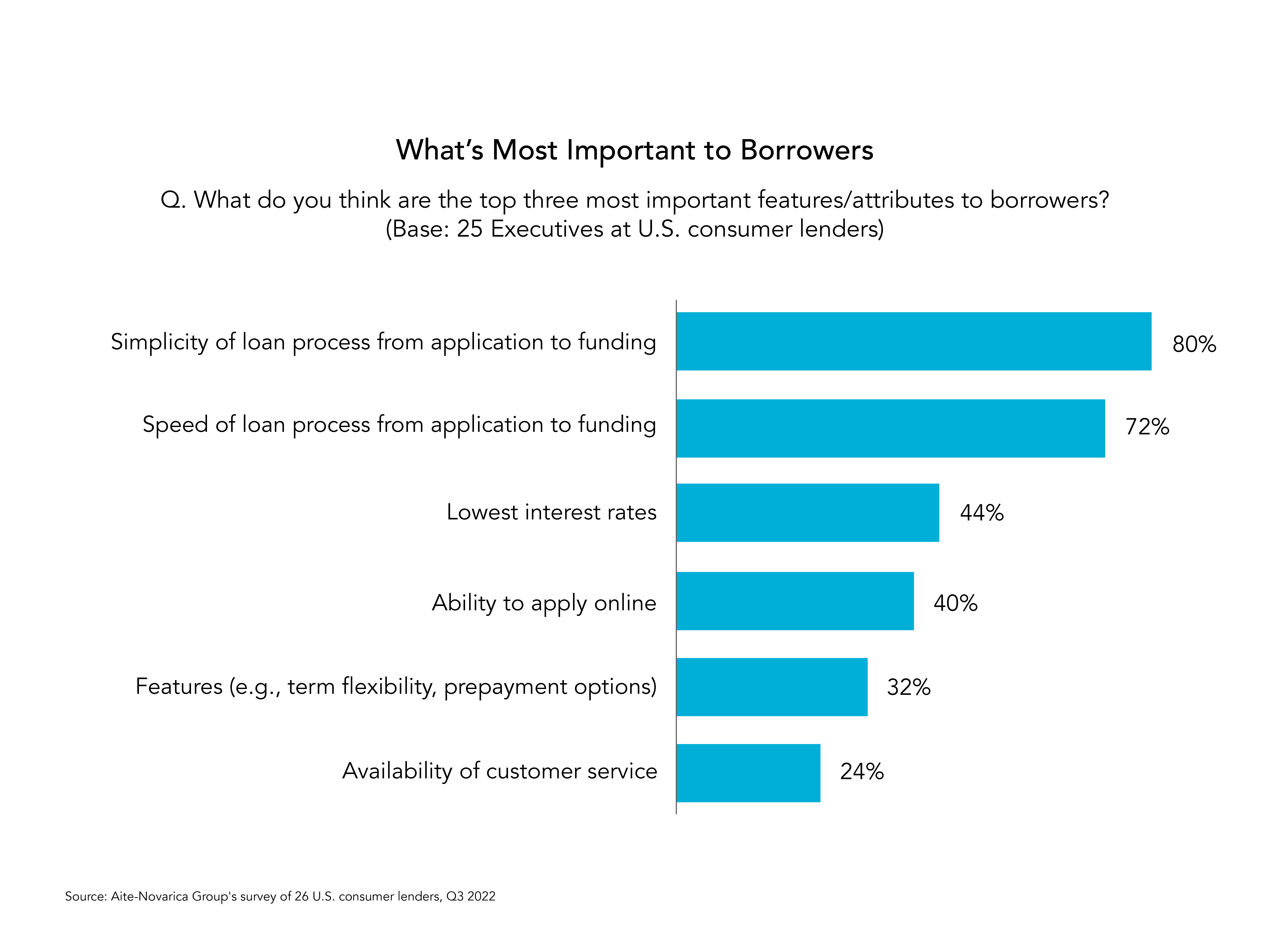

Consumers want a borrowing method that’s quick and easy. The Aite-Novarica Group survey found borrowers care far more about simplicity (80%) and speed (72%) of the loan process than securing the lowest interest rates (44%) or having features like term flexibility (32%).2

Today’s borrowers expect both a convenient, online application process and rapid response times when shopping for a loan provider. Without those, they’re likely to take their business elsewhere.

Trend 2: Customer experience investment is critical

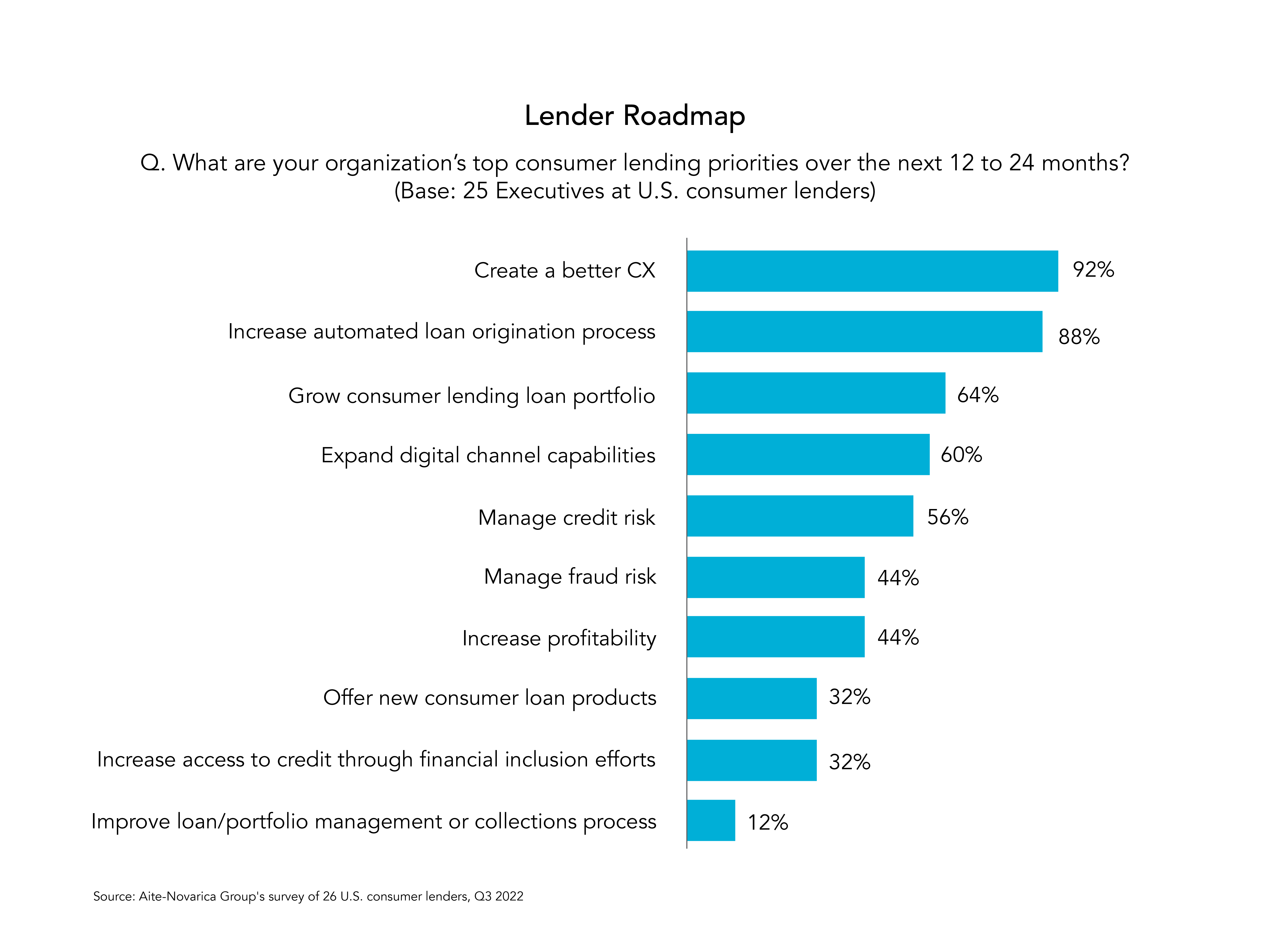

Lenders increasingly understand the need to invest in a positive overall customer experience (CX) to deliver the user-friendly loan processes customers now demand.

Nine out of 10 lending executives said that creating a better CX is their top consumer lending priority over the next 12 to 24 months, according to Aite-Novarica Group’s research. But 68% percent of those executives also admitted they found CX improvement to be challenging or extremely challenging.3

Lenders know CX is essential — as important as perennial goals like regulatory compliance and attracting new customers. But when it comes to CX implementation, many still feel lost.

Trend 3: Margin management is key

Finding ways to reap profitability amid the lending market’s shrinking margins requires skill and careful planning.

Eight out of 10 consumer lending executives view maintaining or increasing profit margins to be an “extreme challenge” to their business. More than half name shrinking margins as an inhibitor of their business growth, according to Aite-Novartica Group’s research.4

To make existing margins workable, lenders need loan processes that run as efficiently and cost-effectively as possible and support their credit policy.

Automated lending platforms = a multipronged solution

Fortunately, non-bank lenders (including fintechs, captive finance, and embedded finance) can tackle all three consumer lending goals using a single solution: Q2 Digital Lending. Q2’s cloud-based platform streamlines the loan process for both the borrower and lender resulting in a smoother, more satisfying origination and service experience for everyone.

Together, Q2 Origination and Q2 Servicing:

- Simplify the application process, making application quick and easy for borrowers.

- Deliver seamless CX improvement, providing loan decisions within minutes and reducing wait time for funding.

- Reduce operational overhead and hands-on work by staff, allowing lenders to work within tight margins to cost-effectively scale their business.

- Enable businesses to get their lending products to market faster.

- Deliver easy configurability, creating loan processes that are flexible and scalable for lenders.

From a borrower’s perspective, automated platforms cut down on the hassle of applying for a loan. Consumers simply enter their data into an accessible, easy-to-use online application portal — no lengthy paper forms or in-office visits required.

Even better, automated approval decisions often arrive online in a matter of minutes, so borrowers know right away whether they’ve been approved for a loan and at what interest rate.

Lenders, meanwhile, benefit from the platforms’ ability to cost-effectively automate and expedite loan processing operations. Q2’s tools allow lenders to integrate precise, pre-determined underwriting and approval parameters within their decision-making systems. As a result, the vast majority of loan decisions process automatically, without requiring staff review.

In this way, automation can help reduce the potential for human-driven data processing errors and free staff to focus on the subset of specific, specialized loan applications that do require hands-on attention.

A lifeline for lenders

Q2’s automated platform provides lenders with a practical way to not only bolster their underwriting but also fortify the overall health of their lending portfolios.

Using advanced credit scoring models and alternative data sources, such as bank account details and credit bureau information, Q2 Origination tools provide lenders with a comprehensive view of borrower creditworthiness.

Q2’s integrated, risk-based pricing strategies enable lenders to tailor interest rates and loan terms to the specific risk profile of each applicant, optimizing profitability while minimizing the potential for default.

Additionally, Q2 gives lenders access to built-in, third-party support tools that facilitate steps along the entire loan application and servicing process, including risk assessment, data accuracy verification, document signing, and loan collections.

By building on the many added efficiencies these automation tools provide, lenders can scale their businesses and expand their lending portfolio — without the need to dramatically scale staff size.

Even better: When lenders’ business growth or changing lending approach requires modifications to Q2’s automated platform, those can be made quickly and easily by any staff member. Unlike custom software modifications — which are expensive and may even require computer programming expertise — changes to Q2 platforms can be made with just a few keystrokes, thanks to their low-code/no-code operational frameworks.

In short, Q2 Digital Lending offers a comprehensive, yet customizable, suite of tools to help lenders successfully navigate even volatile loan markets.

By making the loan process easier, faster, and more efficient, Q2’s automated platform bolsters lenders’ efforts to capture profitability within challenging margins. It also serves as a key tool for delivering better overall customer experience and, in turn, boosts opportunities for repeat customer business among the most sought-after, qualified borrowers.

Ready for a customizable, cloud-based solution that can help scale your business efficiently and effectively? Elevate your lending operations with Q2’s best-in-class tools. Reach out today to get started .

1. Survey of U.S. Consumer Lenders: Next Steps

2. Survey of U.S. Consumer Lenders: Next Steps

3. Survey of U.S. Consumer Lenders: Next Steps

4. Survey of U.S. Consumer Lenders: Next Steps