Grow your portfolio. Improve profitability. Reduce risk.

See what's possible with

Q2 PrecisionLender

Contextual deal coaching, at scale

Andi®, your virtual insights analyst, delivers timely pricing advice to RMs to help them craft winning, profitable deals.

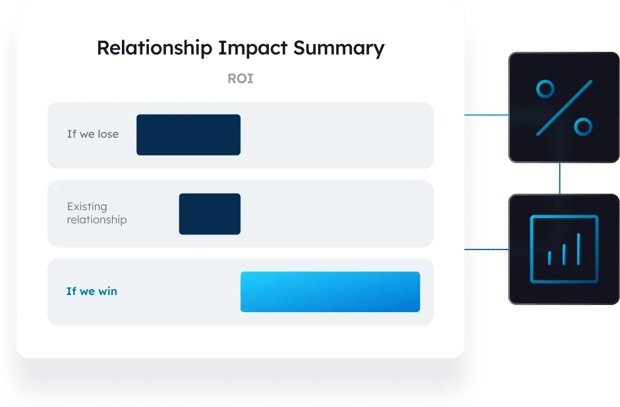

See the full relationship value

Now you can see each relationship's credits, deposits and treasury services, making it easy to understand the impact on the relationship - and the portfolio - if the opportunity is won or lost.

Monitor RM performance

Pricing software only matters if your RMs use it – and use it in the way you intended. Keep track of how they’re performing vs. their peers at our institution.

Turn deal promises into portfolio realities

Keep your clients (and your sales team) accountable. Ensure that non-credit accounts promised when the deal was priced are eventually delivered to your FI.

Proven success

The power of our pricing platform is proven every day. Our clients outpace the industry in these key annual metrics.*

- 10% higher growth rate in non-interest bearing deposits

- 10% higher growth rate of commercial loan portfolio year over year

- 5 basis points higher net interest margin

“We’re no longer talking about just ‘this loan,’ or ‘that loan.’ We’re talking about relationships and customers.”

Managing Director, First National Bank of Omaha

Who we work with

Resources

Additional Products

-

Market Insights

Use market data from 150+ financial institutions to get the pricing edge on the competition.

-

Small Business Pricing

Streamline your pricing on high-volume transactions to give a better experience and meet your profitability targets.

-

Premium Treasury Pricing

Move away from spreadsheets to an integrated digital approach to pricing Treasury products and services.