Financial wellness energizes engagement

Help your consumer account holders master their money while unlocking their financial freedom. Q2 can help your financial institution (FI) improve their financial wellness with useful tools while driving deeper loyalty and engagement.

Financial wellness tools to improve financial wellness

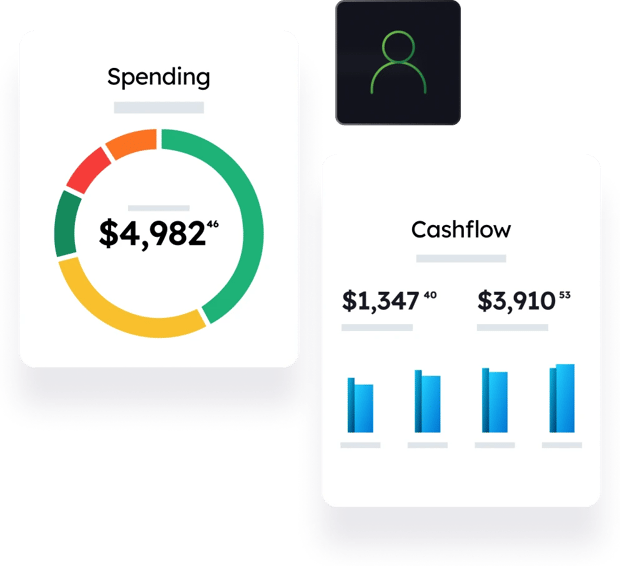

Personal Financial Management

Give account holders a clearer financial picture

Q2 Contextual Personal Financial Management (CPFM) can be part of your account holders’ digital banking experiences, allowing them to track spending, understand their cash flow, and budget more effectively through data visualizations. For your FI, access to this competitive intelligence can be a game changer in understanding account holder’s financial needs to better engage and serve them.

What is CPFM?

A deep integration of key PFM features directly into the users daily banking interactions. External accounts aggregated through CPFM display in parallel to the user accounts at your FI, and the user has a comprehensive view of their finances in one location. Transaction history also is automatically enriched with a cleansed description and categorization.

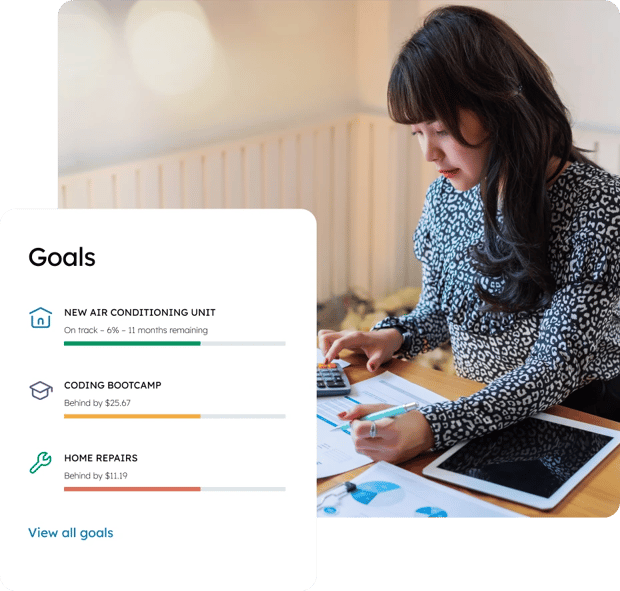

Any-Need Savings

With Q2 Goals, account holders can easily set up a savings goal with visibility into their activity and progress anywhere, anytime. Your account holders can easily set savings goals for dedicated purposes such as education, home improvement, travel, health needs, and special purchase planning.

Expand financial wellness with best-in-class fintech partners

Fintech choices covering automated savings, financial education and personalized insights, expense management, accounting, insurance, older adult support, and more await your FI.

Key Benefits

-

Innovation to enrich financial health

Q2 CPFM and Goals, along with fintech options, offer a complete financial wellness experience via digital.

-

Customers can control their financial health

Q2's tools and solutions meet the self-service preferences of many consumers. Online and mobile.

-

Stickiness ensured

Knowing their FI is invested in their financial well being is a win-win as consumers will be reluctant to leave.

Proven Results

-

>1,000

Saving goals accounts opened in the first 24 hours of offering Q2 Goals.

Utah Community Credit Union,

Provo, Utah -

>1,700

New savings goals created through Q2 Goals in the first two months, representing $500K.

Lake City Bank, Warsaw, Indiana -

>100%

Credit union members who raised their credit scores in one year using Q2 fintech partner financial wellness technology.

*Q2 client’s shared metrics, 2022

Resources

Additional Products

-

Consumer Banking

Digital banking for consumers expecting more from their FI.

-

Card Management

Make card management a breeze for consumers.

-

Digital Onboarding

Seamless account onboarding and more.