Build trust. Not friction.

A new approach to fraud management

It's time for the banking industry to shift its thinking on fraud. To stop prioritizing restriction and start developing intelligent, proactive strategies that enable secure, seamless interactions for each customer and continuously adapt to their unique risk profile.

What is Fraud Intelligence?

Fraud Intelligence is an identity-centric, real-time, data-driven approach that harnesses AI-powered technologies to customize security measures dynamically for each customer. Instead of applying uniform friction across the customer base, institutions deliver security precisely where and when it’s needed. It’s all in support of the policies and procedures of each bank and credit union—giving them control of their fraud prevention posture so they can match it to their risk profile.

See it

See it

By leveraging advanced, real-time analytics to automatically aggregate signals from user behavior, transaction patterns, device characteristics, and historical activities, your institution can proactively identify threats. This is the critical first step in preventing fraud before it impacts customers, which significantly reduces potential losses and preserves essential customer trust.

Stop it

Stop it

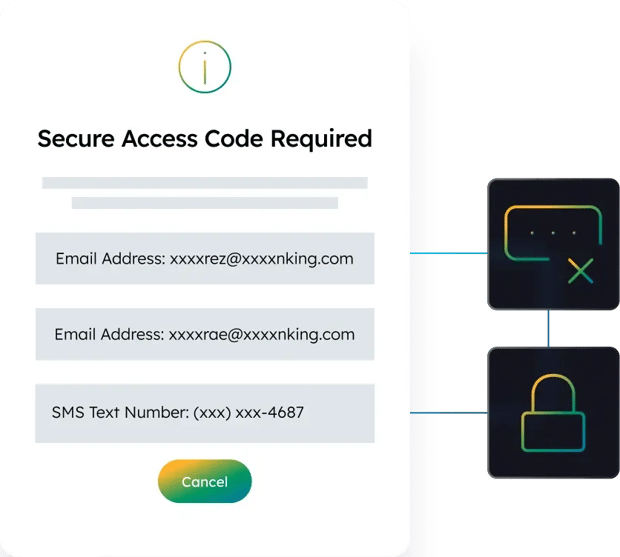

Proactive, tailored security measures powered by AI minimize disruption for trusted customers, while promptly addressing suspicious activities. Timely deployment of advanced security interventions, such as adaptive authentication and real-time interdiction, help cultivate stronger, more secure customer relationships.

Solve it

Solve it

When fraud incidents do occur, response and resolution capabilities are delivered swiftly and efficiently via automated case management, intelligent workflows, and clear communication channels. Rapid resolution of these incidents mitigates financial and reputational damage, ensuring stakeholders clearly understand actions taken and outcomes achieved.

Our Vision

Enabling Fraud Intelligence in the banking industry

At Q2, our goal is to become the first fraud intelligence platform specifically designed for regional and community banks. We can do this because Q2 occupies a unique strategic position—one that combines community and regional financial institution access, comprehensive customer data, and specialized fraud intelligence, to deliver a distinct, "unfair" advantage in the market.

- 5+ Years of experience in fraud management

- 400+ Customers using Q2 fraud management products

“We’re more proactive on the front side in order to mitigate fraud loss by identifying it before it happens. With Q2, everything is streamlined and very user-friendly for our customers.”

Vice President and Business Solutions Manager

How Q2 enables Fraud Intelligence

Our customers take the “See it, Stop it, Solve it” actions via our suite of fraud management products, enabling them to achieve the following outcomes.

Real-time prevention

Stop fraud before it happens with continuous monitoring and advanced detection models. Q2 solutions provide instant risk signals and orchestrated decisioning to block suspicious activity in the moment, protecting both your institution and your account holders.

Protected customers

Safeguard both retail and commercial clients. From protecting digital banking sessions and preventing account takeover to stopping check and ACH fraud with Positive Pay, Q2 delivers proactive protection that builds trust while minimizing friction.

Positive Pay

Faster resolution

Resolve fraud events quickly and confidently. With case management, dispute tracking, and automated workflows, your team can triage issues faster, reduce losses, and return focus to customer service.

Dispute Tracking

Simplified operations & compliance

Reduce complexity while staying compliant. Q2 streamlines fraud management with integrated reporting, risk reviews, and automated controls, helping you meet regulatory requirements and operate more efficiently.

ACH Management & Compliance

Making Fraud Intelligence a reality

Here's some additional content to guide you on your Fraud Intelligence journey.