Consumer Banking Card Management

According to a report by McKinsey & Company, nearly 20% of consumers who use digital wallets leave their physical debit and credit cards at home.

The growing popularity of digital payments means financial institutions must keep them secure. Q2’s digital banking platform includes the digital card management services necessary to give account holders peace of mind with every card transaction.

Online features to manage spending and fraud

Personalized controls

Provide tools to control how, when, and where cards are used, with limits and alerts by:

- Amount

- Time

- Location

- Merchant or transaction type

- Other personalized parameters

No additional authentication is required, all controls are accessible on the digital banking homepage—across devices.

Cardholders get access to real-time alerts and notifications when limits are exceeded. Through these proactive controls, Q2 card management solutions help financial institutions reduce card fraud while building trust.

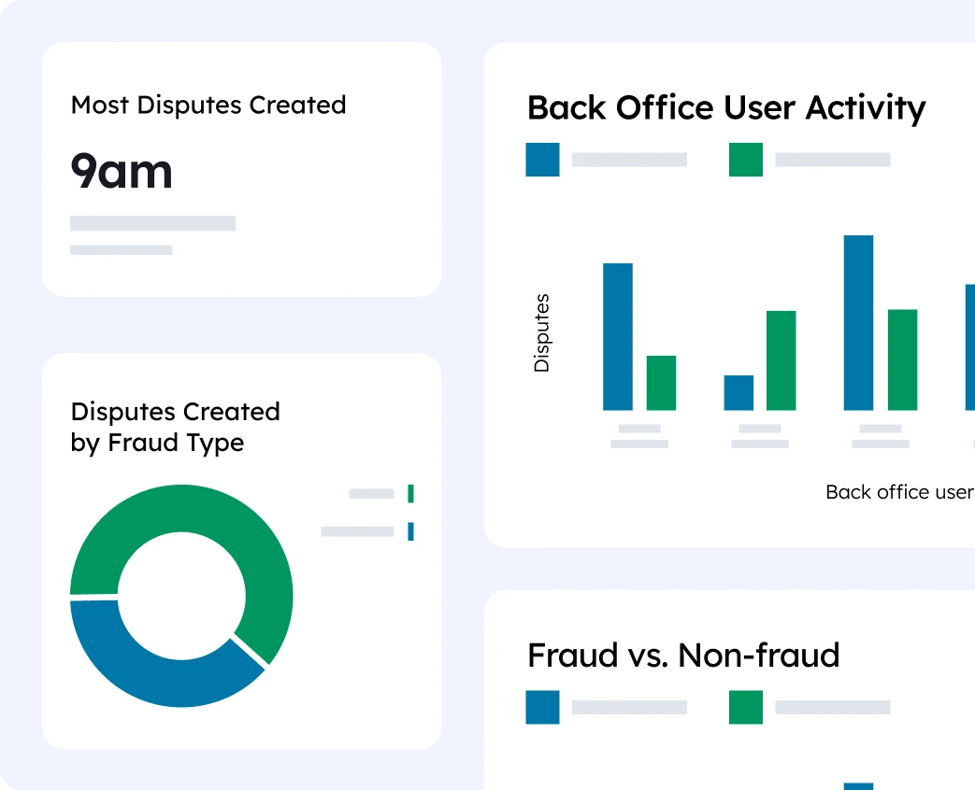

Better dispute management

Q2’S CentrixDTS™ simplifies dispute management for you and your cardholders. It speeds fraud response, ensures Reg E compliance, and quickly uncovers the impact of card breaches. It also streamlines back-office workloads and reduces operational costs.

Online card replacement and provisioning

When people can report and deactivate lost or stolen cards online, and order new ones, you save them time and worry. Plus, with Q2, you can easily issue and fund digital cards, even provision for digital wallets.

For financial institutions, when lost or stolen cards are quickly deactivated, you minimize losses.

Why it matters

- 78% of all U.S. households subscribe to one or more streaming services.

- $10 Americans pay an average of $10 monthly for on-demand music streaming services (Spotify dominates).

- $9.3B+ Video game streaming is a $9.3B per year industry, and it’s growing rapidly.

*Based on a survey of 1,005 American consumers commissioned by Forbes Home and conducted by market research company Prolific.

Other convenient self-service features to manage evolving needs

-

Consolidated card services view

Cardholders can see, select, and initiate services for all cards issued by your institution in a single view.

-

Online travel notifications

Prevent fraud and avoid unnecessary declines with easy notification of travel for any or all cards.

-

Credit line and ATM limit requests

With features to request credit line extensions and cash availability adjustments, cardholders can manage changing spending needs online, reducing call center volume and improving operational efficiency for financial institutions.

Resources

Additional Products

-

Consumer Banking

Transform banking as usual.

-

Personal Financial Management

Pave the way to financial freedom.

-

Digital Onboarding

Build relationships from Day 1.