Elevate your lending experience

Offer borrowers a seamless experience and streamline lending operations on a unified platform. Get everything you need to serve modern borrowers efficiently and stay ahead in the lending industry.

Andi Copilot Platform

Streamline processes

Optimize processes for increased loan efficiency, disrupting the payments industry with automated workflows for speed and accuracy.

Simplify credit access

Make credit a quick and easy option for consumers – and even SMBs - buying various items, including larger-ticket items.

Change as you grow

Expand effortlessly by incorporating new lending types as your business evolves.

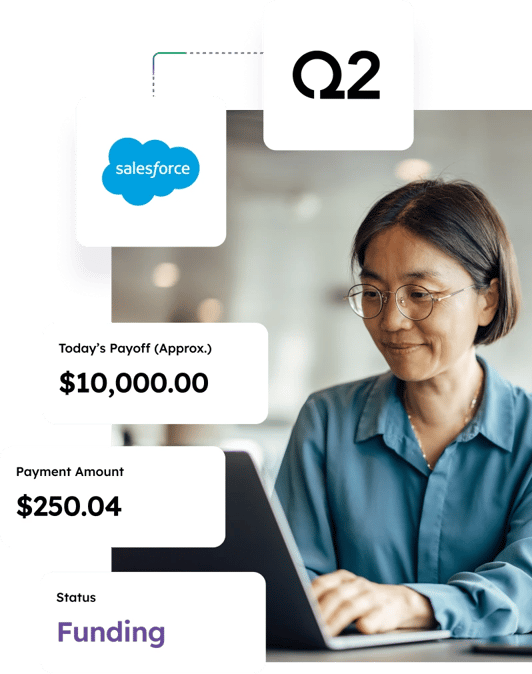

Get the benefits of Salesforce

The Q2 Lending platform utilizes the robust security features and controls, as well as the extensive app and partner ecosystems of the Salesforce Platform.

Andi knows banking.

At Q2, we’ve long believed AI has the potential to transform banking. And there are lots of new technologies and language models emerging in the market. But for new AI tools to really support bankers, they need a knowledge model in order to understand the complex, regulated banking industry. The Andi copilot platform comes equipped with a deep understanding of how banking and bankers work, so it can provide real recommendations that are immediately actionable.

Today, Andi’s knowledgable model is powered by:

- $1.1T in active loan balances

- ~200 banking skills

- 10K bankers

- 100+ banks

What does Andi do?

- Provides contextual, in-the-moment deal coaching that drives profitability

- Uses specific pricing and policy information to align bank strategy to front-line bankers

- Simplifies banker workflows and accelerates new banker onboarding, training, and education

More capable and accessible than ever before

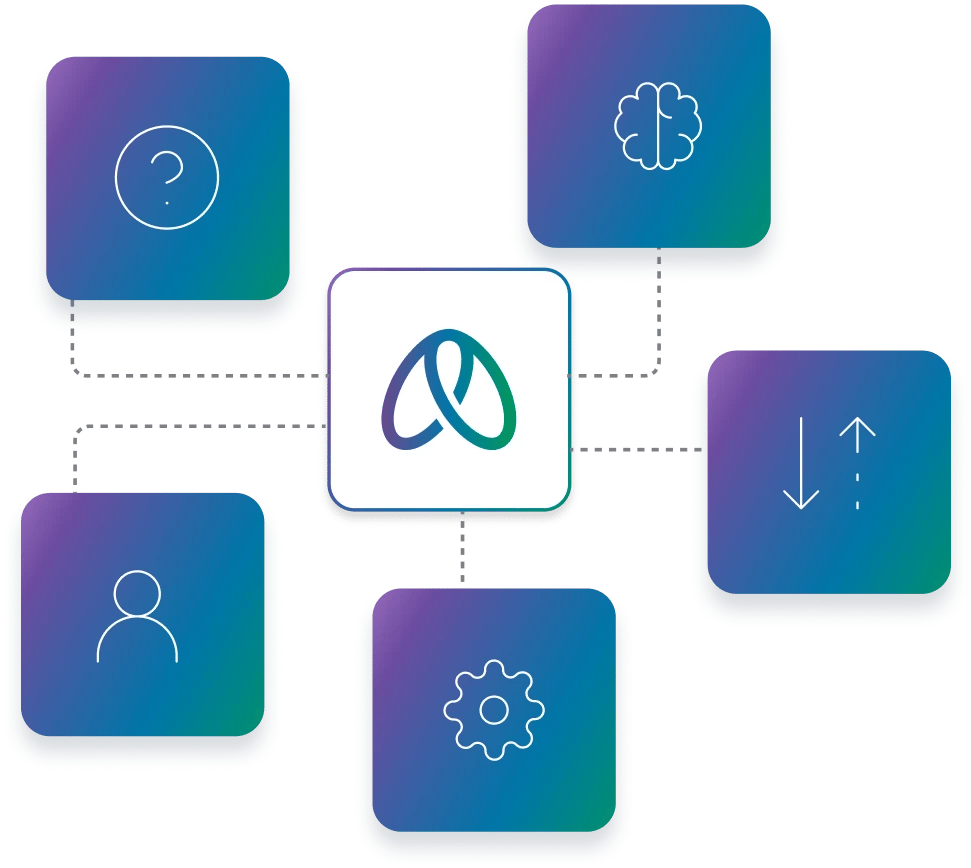

Andi is the only live, proven copilot for bankers that brings together:

-

Bank-ready knowledge model

Andi comes with a deep, data-driven understanding of banking. And you can easily expand its knowledge with your own resources.

-

Ever-expanding skills

Andi's Skills Builder lets anyone teach Andi new FI-specific information, skills, and workflows.

-

Data extraction

Our proprietary data extraction technology lets the Andi copilot platform interpret a wide range of data inputs, like hand-written forms.

-

Security & compliance

The data in the Andi copilot platform is non-attributable, de-identified, and encrypted with TLS 1.2 and 256-bit AES protocols.

Help us build the future of Andi.

Originally built to help commercial lenders, we’re making Andi available across other Q2 products and use cases like treasury and deposit pricing, dispute tracking, account reconciliation, and more.

And we’re currently in pilot to build the next generation of Andi, which will have universal access to third-party applications beyond the Q2 product family.

Resources

Learn more about Andi:

-

The First AI Copilot Platform Built for Bankers

Get a closer look at the conception and evolution of Andi to better understand its use cases and what sets it apart from other solutions entering the market.

-

Q2 Announces Andi Copilot Platform

For more information on Andi’s capabilities, our vision for the platform, and statements from leadership, check out Q2’s official announcement.

-

How Will AI Transform Banking?

Join Purposeful Banker host Alex Habet and two of Q2’s AI experts as they discuss the potential and pitfalls of AI in banking based on their experience building Andi.