Elevate your

lending experience

Offer borrowers a seamless experience and streamline lending operations on a unified platform. Get everything you need to serve modern borrowers efficiently and stay ahead in the lending industry.

See what’s possible with digital lending

Streamline processes

Optimize processes for increased loan efficiency, disrupting the payments industry with automated workflows for speed and accuracy.

Simplify credit access

Make credit a quick and easy option for consumers – and even SMBs - buying various items, including larger-ticket items.

Change as you grow

Expand effortlessly by incorporating new lending types as your business evolves.

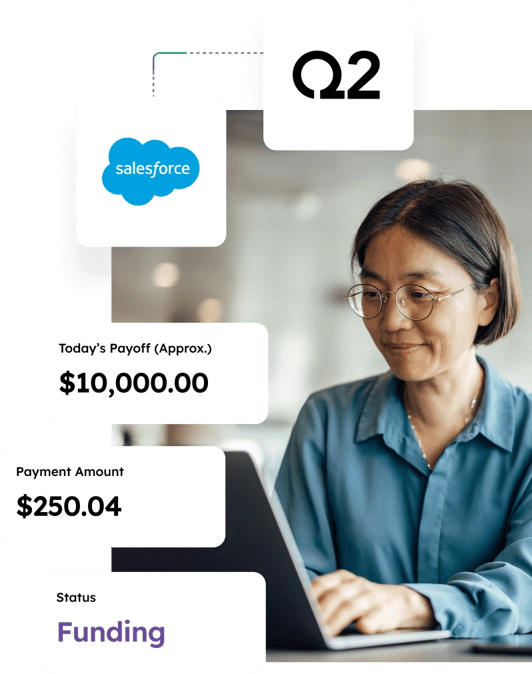

Get the benefits of Salesforce

The Q2 Digital Lending platform utilizes the robust security features and controls, as well as the extensive app and partner ecosystems of the Salesforce Platform.

Loan origination

Accelerate funding and enable a self-service experience with our versatile solution. It’s ideal for alternative finance, fintech, and more. Q2 Origination meets consumer, small business, marketplace lending, and equipment leasing needs.

Loan servicing

Automate loan operations with the Q2 Servicing platform for billing, payments, accounting, and more. It’s designed for efficiency, portfolio management, and rapid product launches. Meanwhile, Q2 Collections enhances customer communications and collector activities with real-time tracking and workload optimization.

Lending expertise on a global scale

Lending institutions worldwide use Q2's Digital Lending solutions to give customers a superior consumer and SMB lending experience.

- 1.63M applications created monthly

- 70K external, self-service customers monthly

- 8K internal users monthly