Faster, more efficient dispute resolution

Simplified administration of dispute tracking

Your financial institution (FI) can save time and cost with more simplified administration of disputed electronic transactions with our easy-to-use case transaction management system that provides operational improvements through automation with compliance controls. Centrix Dispute Management System includes a workflow for any transaction that posts to a customer or member account.

Simplify administration of disputed debit card, ATM, ACH, and remittance transfers for the purpose of Reg E compliance

Credit Card (Reg Z), Check, Wire and Zelle disputes also can be handled.

Uncomplicated frontline processes

Better customer engagement with time savings will take place by receiving integrated customer data, providing online dispute forms and signature pad integration, and having a simpler way to research past disputes.

More orderly back-office administration

Full case and timeline management with automated posting of adjustment transactions, approval workflow, and letter production.

Effective and efficient case management

Achieve better dispute management through a single screen showing all activity associated with a dispute—including case notes, attachments, letters, and adjustment transactions—along with automated alerting.

Automated case management

Automation and features delivering efficiency help drive the entire case management process. Transaction adjustments, timeline management, approval workflow, letter production, and comprehensive reporting are easier and faster, thanks to Q2 Centrix innovation.

Alerts are sent to back-office staff when critical dates approach

Alerts are provided for provisional credit deadline and the dispute expiration date.

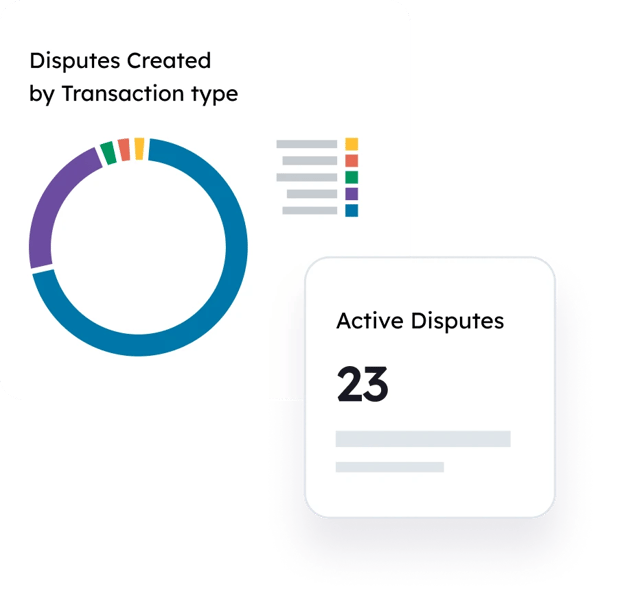

Improved management oversight

A data-driven dashboard aids management when digging deeper into a dispute history, high-volume alerts, and fraud analysis by breach. Compromised card files from Visa, MasterCard, and Discover are processed into CentrixDTS for analysis.

See important trends and activity in the Management Dashboard

The dashboard gives you a quick snapshot into the fraud trends, dispute activity, and other vital statistics over periods of time.

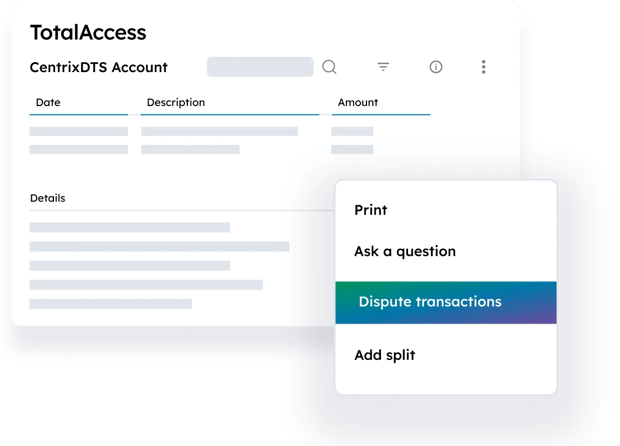

Quickly integrate with the Q2 digital banking platform

CentrixDTS can integrate with the Q2 platform which enables end users to initiate disputes (self-service disputing) and view the status of disputed transactions as your FI researches and processes a claim.

Proven success

-

“We were doing all our dispute resolution manually, and the volume was getting overwhelming. With Centrix Dispute Management System, a basic fraud case now takes maybe ten minutes. It’s so simple and very user-friendly–and I think we’re getting even faster as we get more familiar.”

Patty Davis

Director of Card Services -

“CentrixDTS has been a godsend. We didn’t realize how much benefit it would bring. It’s led to process efficiencies, workflow improvements, and better staff alignment.”

Nancy Harvey

SVP of Branch Operations and Treasury

Management Office

Resources

Additional products

-

ACH Processing & Reporting

Better meet compliance requirements.

-

Positive Pay

Put superior check and ACH fraud prevention to work.

-

Behavioral Analytics and Fraud Prevention

Prevent fraud before it happens.