The freedom to innovate your way

Build, partner, and launch with ease

Financial institutions have always been at the mercy of their vendors to deliver new capabilities and do what they want with their technology. With Q2 Innovation Studio, you control your own digital destiny.

Build your own solutions

Bring more personalization to your digital banking with robust developer tools and documentation—with your own team, or our certified development partners.

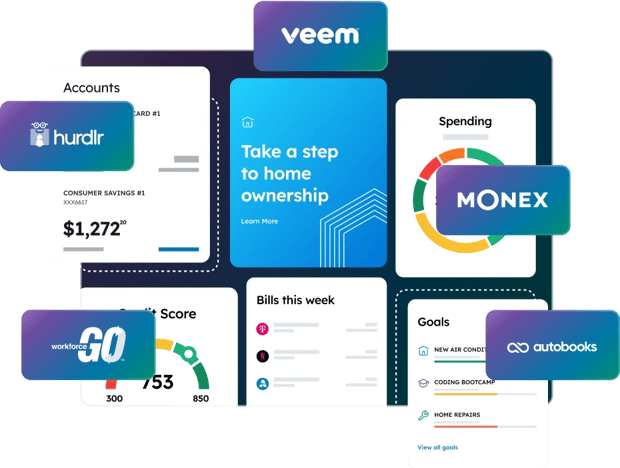

Partner with fintechs

Go beyond traditional banking by choosing pre-built integrations with 150+ fintech solutions that expand your offerings into banking-adjacent categories.

Differentiate your FI

Add valuable services that help you win and serve key account holder segments, like accounting and payroll for SMBs or financial wellness tools for younger consumer generations.

Earn non-interest income

Create deep engagement and lifetime loyalty. Drive increased products per household. Earn non-interest income when account holders use partner solutions.

Q2 Innovation Studio

Delivering new technology in banking is often too slow and expensive to keep up with today’s pace of change. Q2 has re-invented the innovation paradigm by enabling our customers to control how they build and partner. By opening up the Q2 platform via Innovation Studio, you can innovate at the pace your business needs.

Partner and integrate with ease

Choose from a wide and varied range of superior fintech solutions and quickly launch them to meet account holders’ specific needs and return to the center of their financial journey.

No hassle fintech integrations

Fintechs can use the SDK to quickly integrate their products to the Q2 platform, and offer them in Innovation Studio for financial institutions to simply activate.

Deposit Growth

- Finit Refer

- ModernFi

- Plinqit

- Pulsate

- TruStage

- ZSuite

SMB

- Autobooks

- Homebase

- Hurdlr

- Monit

- upSWOT

- WorkforceGo

Payments

- Alacriti

- Allied

- CXI

- Neural

- PayRecs

- Veem

Fraud/Security

- BioCatch

- Carefull

- DefenseStorm

- Entersekt

- HID Global

- ThreatMark

Financial Wellness

- Array

- Experian

- Plinqit

- SavvyMoney

- Trustworthy

- Zogo

Digital Engagement

- Agent IQ

- Finotta

- Glia

- Larky

- Personetics

- Posh

A tested, valuable ecosystem

Since the Innovation Studio launch in 2020- 300+ FIs use Innovation Studio

- 50+ Fintech partners are available in Innovation Studio

Reduce time and cost to deploy by 70%+

We work with our partners to build a single integration to digital banking. We then perform code reviews, test the app deployment, and complete an integration review of every app—all making it faster for you to deploy new fintech solutions.

Build and extend the platform however you see fit

Build on your own using our award-winning SDK to meet customization needs and build bespoke workflows, integrations, and branding, or partner with Q2-trained and certified third-party developers with deep knowledge of the Q2 SDK that work on your schedule.

A proven SDK

The Q2 SDK and our open platform allow easy customization as needed- 100+ FI customers

- 1000+ External developers

What FIs are saying:

-

"There are so many FinTech partners out there who have incredible products or services for our members, and Q2’s Innovation Studio has allowed us to have more options, bring things faster and more cost-effective.”

Joli Hensley

Manager of Digital Channels -

“Our previous provider limited what we could do with outside fintechs. With Q2, it’s easy to integrate with third parties, which allows us to quickly bring new tools and services to our customers.”

Mike BowenRead story

Senior Vice President and CIO