Streamline your ACH reporting and compliance

Best of breed ACH risk management

Faster ACH risk reviews

Our CentrixPIQS™ solution removes the manual effort from your ACH originators, RDC customers, or other risk reviews and lets innovative technology work to ensure compliance, mitigate ACH fraud risk, and manage ACH and other payment activity. Your financial institution (FI) can track and better manage originated and inbound ACH activity with simple and intuitive reporting, worksheets, and a risk calculator.

Improve operations to focus on opportunities

With a more efficient approach to ACH risk management and reporting, CentrixPIQS™ helps your FI re-allocate time and resources to more valuable areas.

Better originated

ACH validation

All originated ACH activity can be validated and stopped for approval if issues such as exceeded limits or invalid NACHA formats are found. Plus, Authorized Account Validation protects against man-in-the-middle and account takeover attacks.

Notices of Change (NOC)

NOCs received by an FI can be compared against transactions submitted by ACH originators, and items in violation of the NOC are stopped for approval.

ACH Calendaring

Your FI or originators can specify which days ACH files will be submitted, preventing the submission of unauthorized items on non-scheduled days.

Totals Entry

Ensure that submitted ACH files match the dollar amounts and item counts supplied by originators to prevent unauthorized file modifications.

Meet reporting requirements easily

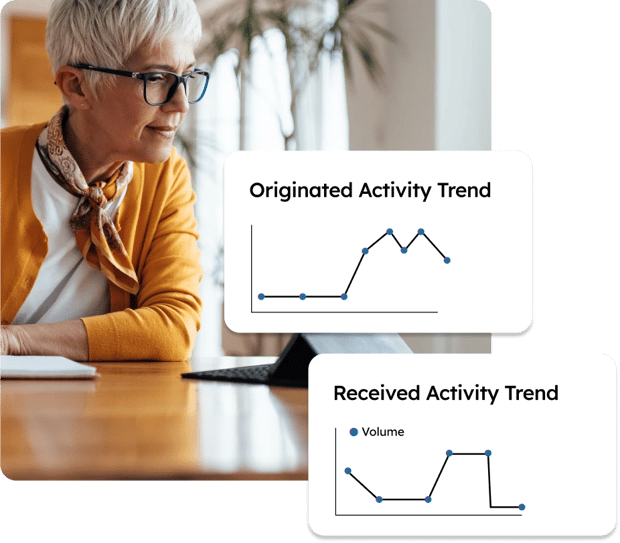

Activity Reporting and Risk Worksheets allow your FI to easily comply with reporting requirements set forth by regulators, as well as internal stakeholders.

Flexible report filters

Allow analysis of an entire FI, specific account holders (or groups of account holders), or specific transaction types—and drill-down capability makes it quick and simple to research individual ACH transactions.

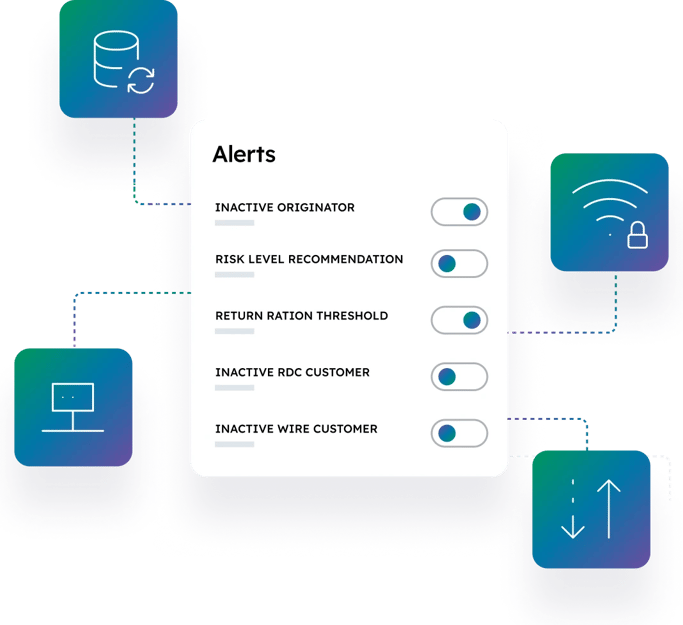

AI coaches your team in real time

Andi® is a virtual advisor for coaching and actionable insights, and monitors data and informs your staff when action is needed to make informed decisions and remain compliant. Andi will guide staff through daily ACH processing, help when balancing files to ensure backoffice operations are seamless, and provide notifications for overrides and originators exceeding limits.

Proven success

“The PIQS Risk Review process has saved considerable time during audits and during the review period. It saves time operationally, giving us a particularly useful view into all risk-exposure-related activity.”

Senior Vice President, Digital Services, Mercantile Bank of Michigan

ACH is accelerating around the clock

Same Day ACH and the introduction of Late Night ACH in 2022 are accelerating delivery of ACH payments. Here's a case in point: an average of nearly 10 million ACH payments per day were delivered in these new files on Monday through Thursday in the first seven weeks of service and during that time, Friday night ACH payments averaged more than 50 million.

What is an ACH risk assessment?

An ACH risk assessment is a process in which financial institutions that handle ACH payments seek to identify, analyze, and mitigate potential risks with ACH transactions, including fraud, operational issues, and compliance violations.

What is ACH compliance reporting?

Financial institutions perform ACH compliance reporting to confirm they are adhering to the rules and guidelines set by the National Automated Clearing House Association (NACHA) for electronic payments. Those guidelines cover various aspects of ACH transactions, such as transaction timing and transaction authorizations, and are designed to ensure secure and efficient payment processing.