Commercial Instant Payments Management

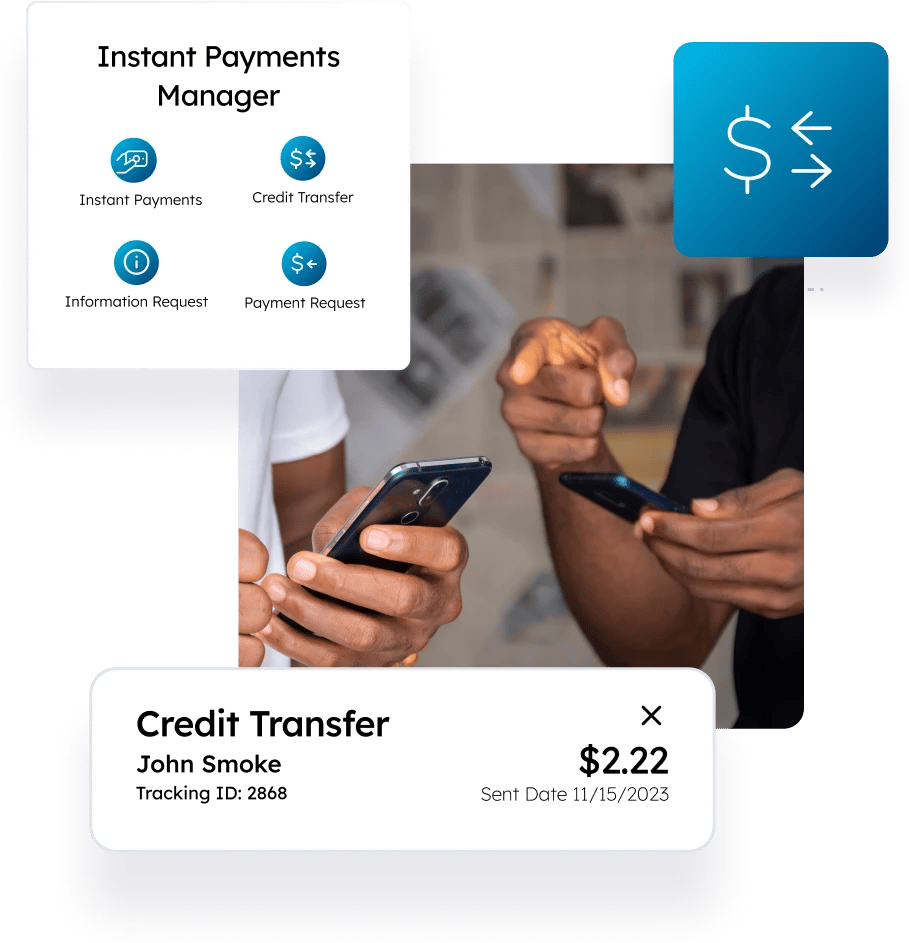

RTP® and FedNow™ give businesses of all sizes an opportunity to better control their finances. With Q2 Instant Payments Manager, FIs can make these new rails easily accessible for their account holders, right from the Q2 Digital Banking Platform™.

Real-time sending and receiving of payments

Enable commercial and small business customers to make fast, safe, immediate B2B payments through the instant payments rails from their Q2 Digital Banking Platform.

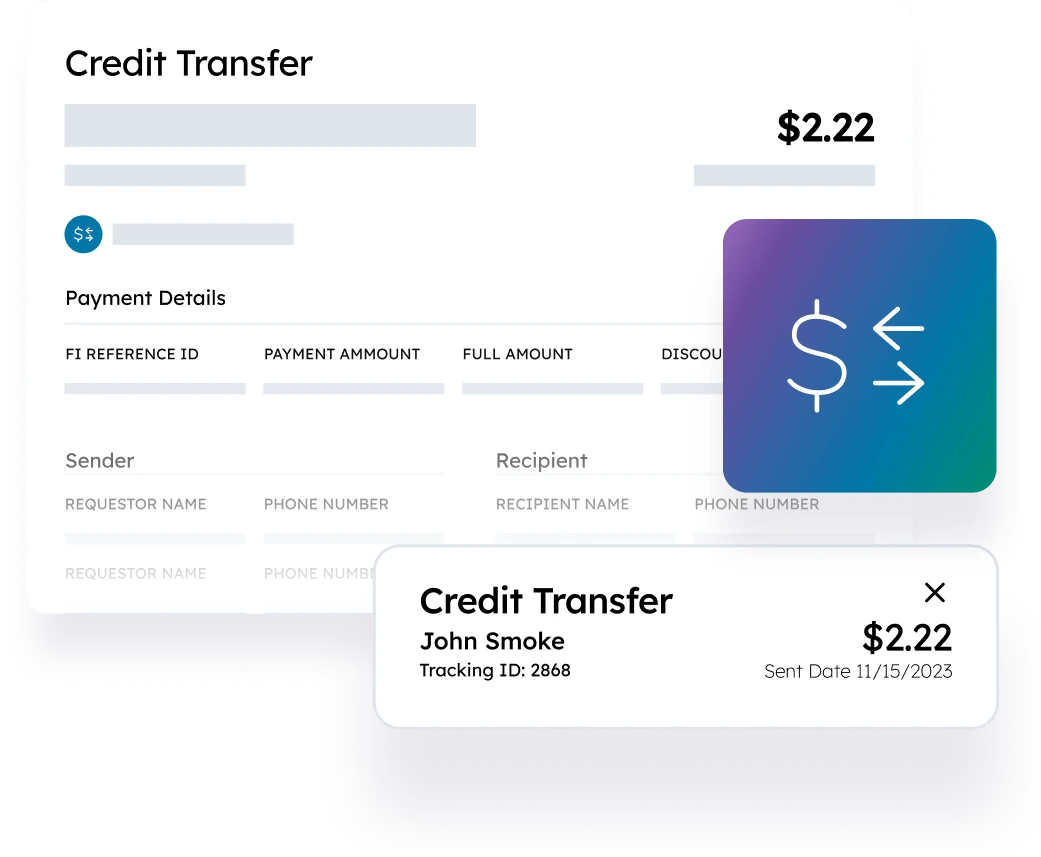

Rich data messaging—a game-changer for B2B bookkeeping

The rich messaging capabilities in instant payments create a powerful opportunity for businesses to streamline their accounting processes, saving them time and money.

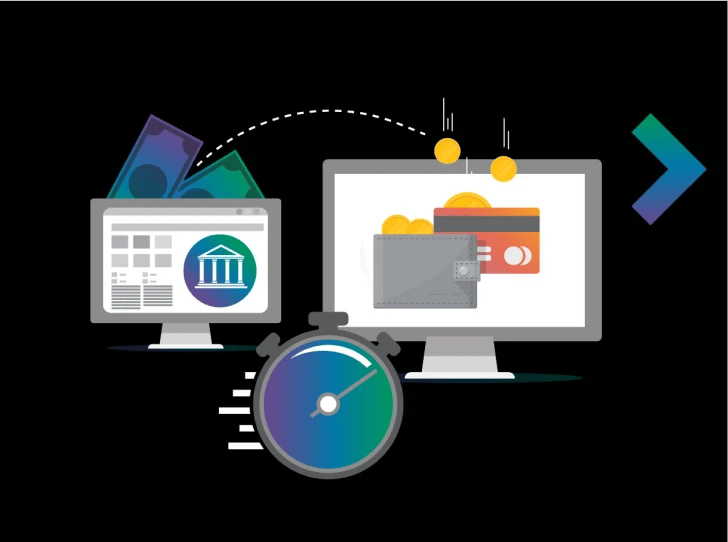

Instant payments change everything

New instant payments rails are here, and they're bringing new possibilities—and challenges—for consumer and business use cases alike. We're implementing instant payments solutions across our portfolio to meet the needs of FIs looking to take advantage of the even-faster payment needs of account holders.

Connected, capable, and compatible

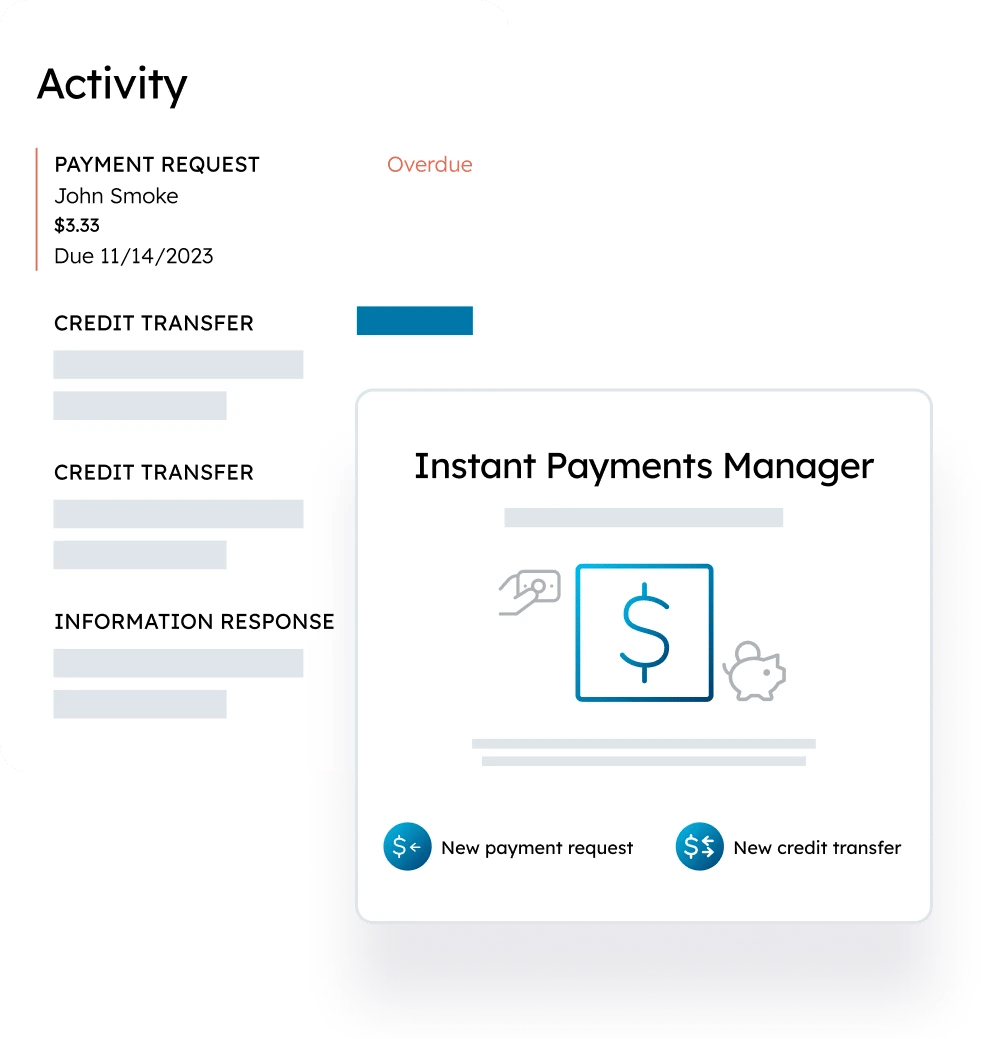

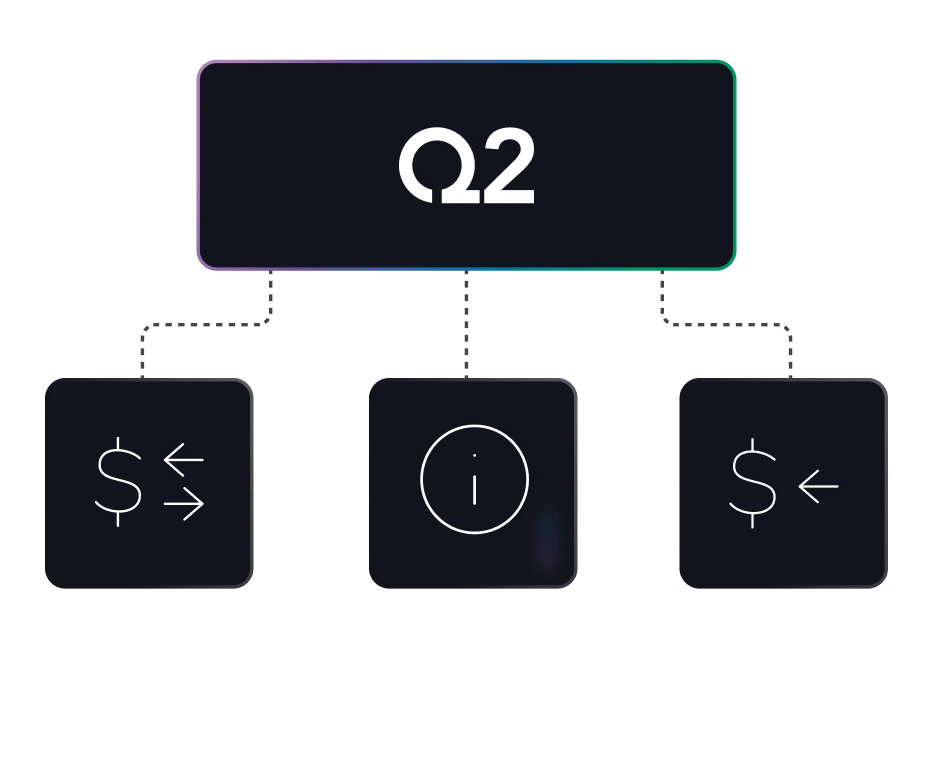

Q2 Instant Payments Manager opens up the possibilities of instant payments with support for the full message set, including credit transfer, request for payment, and request for information.

Key Benefits

-

Either network and any gateway

Works with both RTP and FedNow. Also works with any payments gateway.

-

Solve operational pain points

Rich data messaging capabilities streamline bookkeeping for business customers.

-

Better cash flow control

Businesses can pinpoint the exact moment they want money to leave their account.

In 2028

-

25%

of businesses expect to receive B2B transactions via instant payments

*2023 AFP Real-Time Payments Survey Report -

50%

of businesses expect to send payments via instant payments

2023 AFP Real-Time Payments Survey Report

Businesses see benefits of instant payments

- 1% say lower cost of transactions

- 20% say transparency