User data is a powerful tool for building relationships and revenue

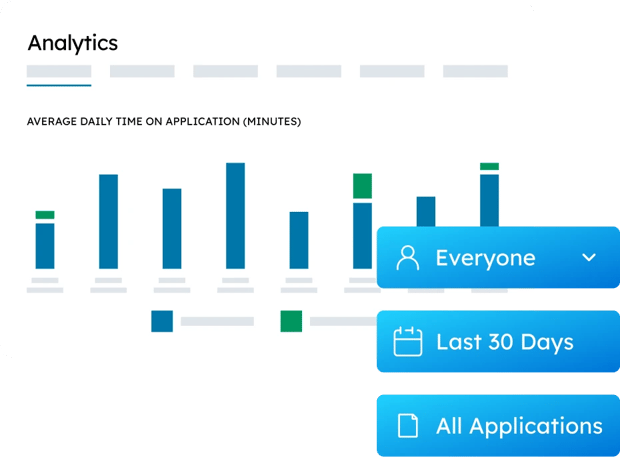

Data-driven decisions are informed decisions. Q2 Discover allows you to take action on data insights to provide a rich account holder experience with relevant banking suggestions.

Better understand your customer and tailor your messages

Q2 Discover enables you to track and analyze a customer’s journey, along with their engagement level and other valuable behavioral patterns, allowing you to deliver highly targeted campaigns and in-app messaging.

Increase engagement and product adoption

A clear view of which account holders are and aren’t using products enables you to build more effective targeted marketing and drive the adoption of features/benefits.

Group account holders for strategic campaigns

Segment digital account holder populations for analysis, and use the resulting information to refine messaging strategies, site content, and design tactics.

Fine-tune your strategy

Gather insightful testing data to help identify the most effective strategies for app content and communication.

Empower customers to help themselves

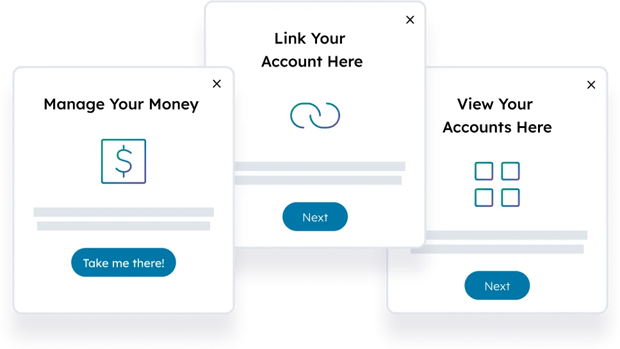

Account holders can easily find answers to their digital banking questions through an on-demand resource hub with guides and other aids to improve user education, accessibility, and engagement.

Help account holders become digital banking power-users

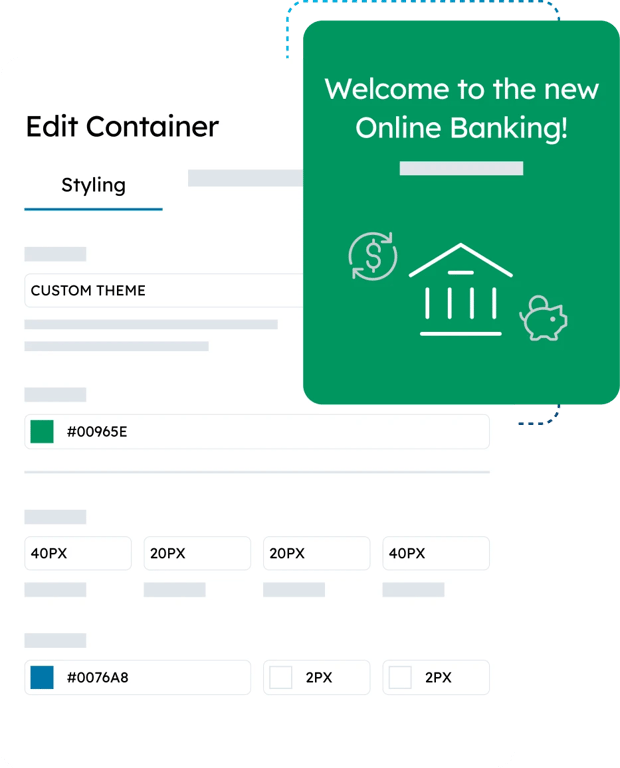

Deliver in-app and pop-up messages to account holders so they learn the powerful features within products and how to use them efficiently and effectively.

Reintroduce customers to the value of underused products

Monitor engagement within specific products and encourage users to re-engage with those they may have stopped using.

Keep customers engaged and informed

Easily communicate targeted information to account holders—from community outreach to event announcements and more.

Plus, there’s a Resource Center for easy to find, easy to understand information.

Your account holder can take advantage of an always-on point of reference that allows users to seek contextual help in their moment of need.

Proven success

-

“We launched our Net Promoter Score® through Q2 Discover instead of emailing the survey as we had in the past. We actually saw a 400% increase in responses from our customers, and that really demonstrates that we’re meeting customers where they want to be met—right in their digital banking space versus asking them to respond to an email.”

Brandy Allen

SVP and Director of Digital Channels

C&N Bank -

“We were doing about 170 Express Loans per month at about $300,000. It was not making a big impact. Once we started leveraging Q2 SMART and Q2 Discover (and integrated Qcash into the Q2 digital banking platform with Q2 Innovation Studio) we did about 1,700 loans at over $3 million in a single campaign. The response from our membership, once they got in and started using the product, was fantastic."

Pam Gilmore

SVP Digital and Debit Delivery

Founders FCU -

“Q2 SMART and Q2 Discover are differentiators for our bank. Because they help us identify what’s important to our clients and we can see how they’re engaging, we can send targeted messages to targeted audiences quickly. When I interact with my consumers, I want to send a message that’s meaningful to them.”

Lisa Fulton

Senior Vice President and Chief Operations Officer,

Lake City Bank -

“Members are happier and more satisfied. Using Q2 Discover in tandem with Q2 SMART, UNIFY more easily anticipates and enriches the member experience with each interaction. What used to take several days, we can now do with the snap of a finger.”

Jenny Wrobbel

Digital Operations Manager,

UNIFY Financial Credit Union

Resources

Additional products

-

Data-driven Marketing

Put data to work for better marketing outcomes.

-

Targeted Marketing

Use Q2 innovation to reach the right account holders with your offers.