Streamlined ACH processing and reporting

Financial institutions that transfer funds electronically through ACH (the Automated Clearing House) need robust processing and reporting capabilities to keep funds secure and compliant.

Best of breed ACH risk management

Faster ACH risk reviews

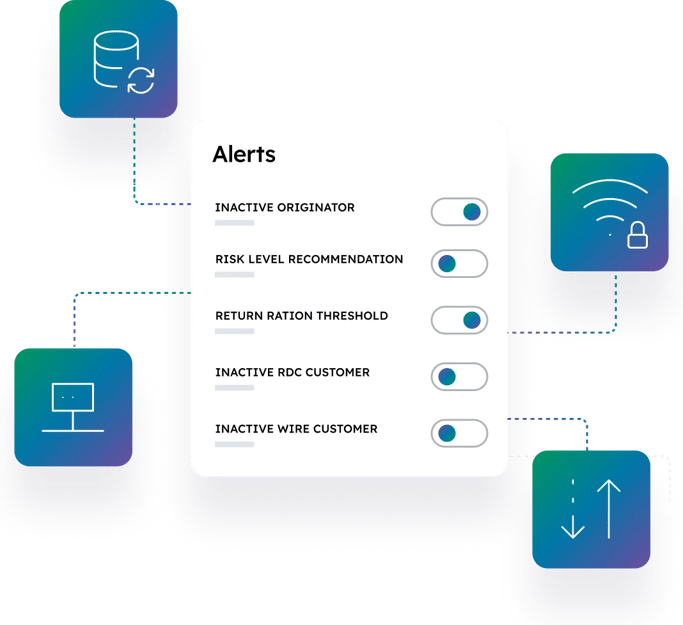

Our Centrix ACH Processing solution removes the manual effort from your ACH originators, RDC customers, or other risk reviews. It lets our innovative technology do the work to ensure compliance, mitigate ACH fraud risk, and manage ACH and other payment activity.

With Q2, you can track and better manage originated and inbound ACH activity with simple and intuitive reporting, worksheets, and a risk calculator.

Our risk calculator automatically assesses whether a transaction is legitimate, or if there are indications of an unauthorized transaction. With cybercrime an increasing financial industry concern, it’s never been more important to offer a secure solution.

Improve operations to focus on opportunities

With a more efficient approach to ACH risk management and reporting, Centrix ACH Processing helps your institution re-allocate time and resources to the most valuable activities.

Better originated

ACH validation

With Q2, all originated ACH network activity can be validated and approval withheld if issues such as exceeded limits or invalid National Automated Clearing House Association (NACHA) formats are found. Plus, our authorized account validation protects against man-in-the-middle and account takeover attacks.

Notices of Change

Notices of change (NOCs) received by an institution can be compared against transactions submitted by ACH originators, and items in violation of an NOC are stopped for approval.

ACH Calendaring

Your financial institution or originators can specify which days ACH files will be submitted, preventing the submission of unauthorized items on non-scheduled days.

Totals Entry

Ensure that submitted ACH files match the dollar amounts and item counts supplied by originators to prevent unauthorized file modifications.

Meet reporting requirements easily

Our activity reporting and risk worksheets allow you to more easily comply with reporting requirements set by regulators and internal stakeholders. Reports generated through our solutions support annual ACH risk assessments required by NACHA while saving compliance and audit teams valuable time.

Flexible report filters

Allow analysis of your entire institution, specific account holders (or groups of account holders), or transaction types. Plus, drill-down capability makes it quick and simple to research individual ACH transactions.

AI coaches your team in real time

Andi® is a virtual advisor for coaching and actionable insights. It monitors information and informs your staff when action is needed to make informed decisions and remain compliant.

Andi will guide staff through daily ACH processing, help balance files to ensure backoffice operations are seamless, and provide notifications for overrides and originators exceeding limits. Staff training can be measurably reduced, saving money on administration while ensuring employees are trained quickly.

Proven success

“The Centrix ACH Processing Risk Review process has saved considerable time during audits and during the review period. It saves time operationally, giving us a particularly useful view into all risk-exposure-related activity.”

Senior Vice President, Digital Services, Mercantile Bank of Michigan

ACH is accelerating around the clock

Same Day ACH and the introduction of Late Night ACH in 2022 are accelerating delivery of ACH payments. Here's a case in point: an average of nearly 10 million ACH payments per day were delivered in these new files on Monday through Thursday in the first seven weeks of service and during that time, Friday night ACH payments averaged more than 50 million.

Frequently Asked Questions

What is an ACH risk assessment?

An ACH risk assessment is a process in which financial institutions that handle ACH payments seek to identify, analyze, and mitigate potential risks associated with ACH transactions, including fraud, operational issues, and compliance violations.

What is ACH compliance reporting?

Financial institutions perform ACH compliance reporting to confirm they adhere to the rules and guidelines set by NACHA for electronic payments.

Those guidelines cover various aspects of ACH transactions, such as transaction timing and transaction authorizations, and they are designed to provide secure and efficient payment processing.

What types of fraud does ACH validation protect against?

ACH validation ensures financial institutions have protection against common types of fraud, including man-in-the-middle attacks, account takeovers, and duplicate submissions.

Can community banks and credit unions use Centrix ACH Processing, or is it only for large institutions?

This software is built to be scalable and adaptable for financial institutions of all sizes. It’s just as powerful for smaller institutions as it is for large-scale banks and credit unions.