Keep up with keeping account holders safe

Putting multilayer risk and fraud management in place is challenging, especially if you’re not staying on top of the latest best-practice methods. Without this edge, expect trouble.

Security is a 24x7x365 job

A digital banking platform provider has to maintain a continuous focus on global research, top-tier partnerships, and security-by-design. Q2, with a Level 4 NIST maturity rating, does all those and more.

Zero trust

We apply a zero-trust framework to continuously authenticate and authorize access to systems and our network.

Data-driven security

Q2’s innovative tools combine behavioral data and machine learning to detect anomalies and trigger real-time alerts.

Automated risk management

Prevent ACH and check fraud with positive pay backed by Andi®, a virtual advisor for coaching and actionable insights to make your staff and account holders more secure.

Robust access control

Your options are extensive. Password policy management, password encryption, out of band MFA (Multifactor Authentication), and entitlement control.

Bank on Q2’s best-of-breed security

- $1B Check and ACH fraud prevented in 2023

- >$1.5B In fraud transactions stopped by Q2 Sentinel in 2021-2022

- 99.1% Uptime with hybrid cloud hosting architecture

Lessen risk, prevent fraud

- CentrixDTS

- Centrix ETMS

- CentrixPIQS

Automated dispute management

Allows more effective, more efficient case management. A single screen shows all activity associated with a dispute—including case notes, attachments, letters, and adjustment transactions— with automated alerting.

ACH and check positive pay with high fraud prevention

Secure commercial clients with automated, full-featured transaction management for ACH and check positive pay. ETMS can coexist with an FI’s legacy technology or easily integrate into the Q2 digital banking platform.

Risk mitigation and compliance made easy

Remove the manual effort from your ACH originators, RDC customers, or other risk reviews and let innovative technology work to ensure compliance, mitigate risk, and manage ACH and other payment activity.

Behavioral analytics and fraud prevention

With Q2 Sentinel, apply machine learning, endpoint interrogation, and other security technology to monitor user behavior on our digital banking platform and to prevent fraudulent activity from negatively affecting our FIs.

Step-up Authentication

With Q2 Patrol™, monitor login and behavior patterns and prompt users to complete step-up authentication before accessing high-risk events when anomalous activity is detected. Access details are continuously tracked and anomalies found in use patterns trigger further authentication.

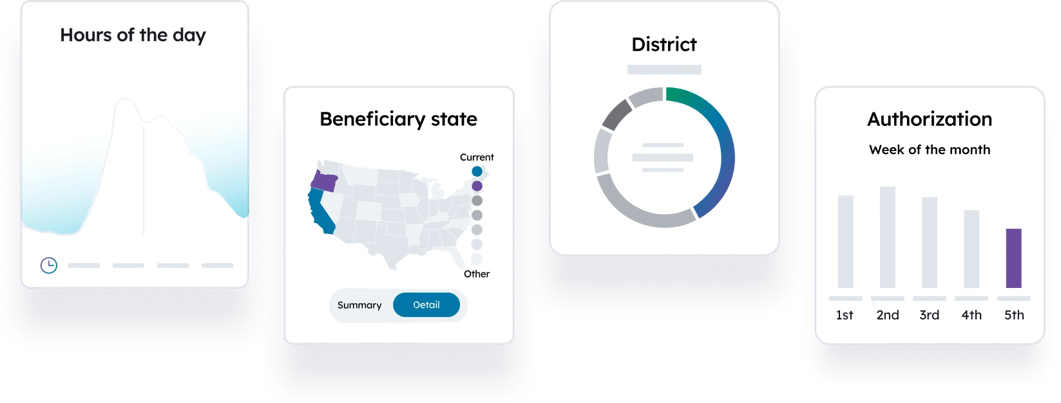

Security Event Dashboard

Access to even-deeper security data

Q2 Security Insights is offered to FI security personnel for deeper visibility into the full set of network traffic that Q2 manages for continuous validation purposes and access to real-time updates from Q2’s threat feeds to protect non-Q2 hosted assets.

Transaction risk management

Obtain comprehensive transaction risk management using Q2 Centrix solutions.

Proven success

-

“Offering a secure online experience for our customers was the number one reason Q2 was attractive.”

Greg Binns

President -

“We’ve had the Q2 Sentinel program for a number of years, and it has helped protect our customers. We had one $600,000 loss we were able to avoid because of Sentinel.”

Scott Jennings

Senior VP and COO

Resources

Learn more about Q2’s best-practice technology

-

The Q2 Platform

Best-in-breed security plus fast, easy account opening and onboarding; personalized, tailored banking; data-driven marketing; and much more.

-

The Q2 Security Framework

Our quick-read ebook will give you more insight on how we tackle today's security concerns.