Hosting architected for superior security and performance

Distributed cloud architecture for digital banking security and performance

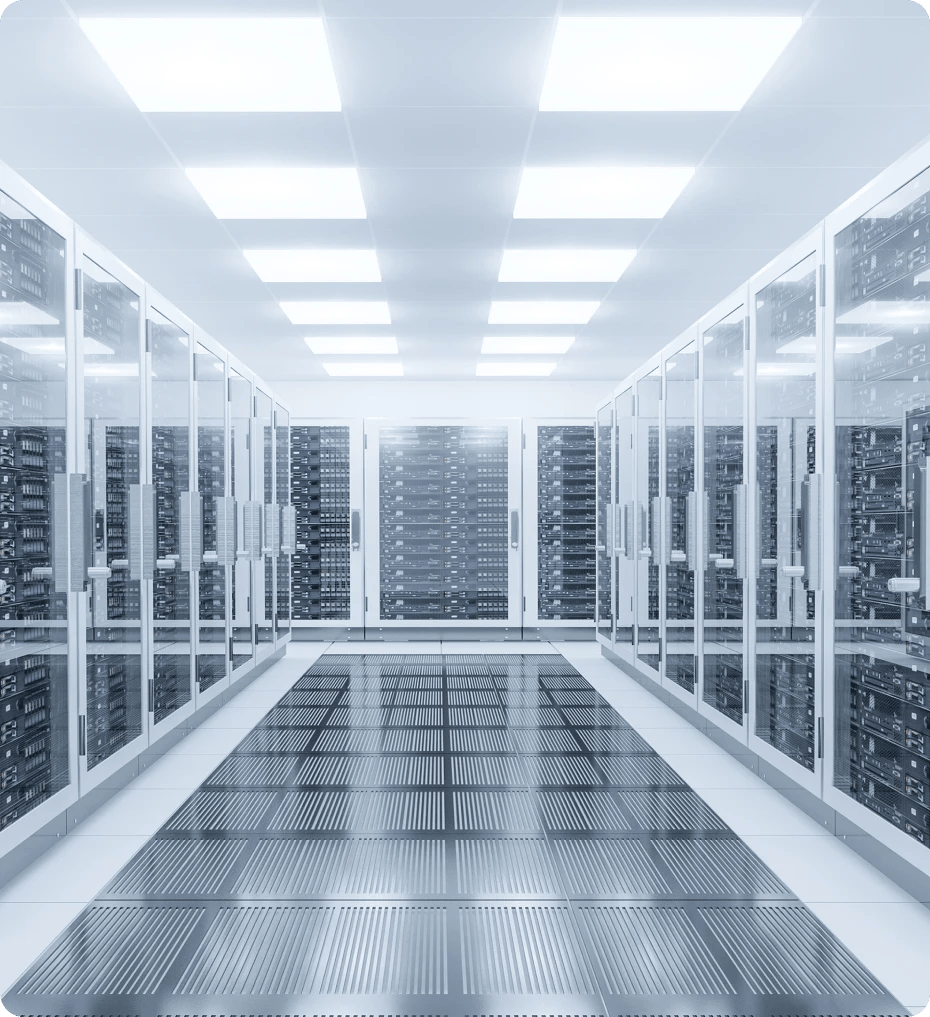

Q2’s differentiated architecture of public cloud hosting and active-active private data centers provides the best of all worlds for financial institutions: agility, uptime, and security unparalleled in the industry.

Fast, secure hosting

Our distributed cloud hosting approach gives you the speed and innovation of public cloud with the security and resiliency of private cloud. With the Q2 platform, you can improve average latency and recovery times while aligning with PCI DSS, SOC2, and FFIEC for compliance.

Public cloud hosting for agility and availability

Our distributed cloud architecture takes full advantage of public cloud providers Microsoft Azure and Amazon Web Services (AWS) to maintain the agile environment necessary for rapid software delivery, technical innovation, and redundancy with the highest reliability.

Private data centers for security and reliability

Private active-active data centers provide Tier IV security—the highest level of security in the industry. Fully automated, these data centers deliver incredibly resilient disaster recovery for your most critical workloads.

Built on decades of experience

After 20+ years of building innovative hosting environments and technology options, Q2’s distributed cloud hosting computing solution is designed with industry-leading technology and partner services.

Our distributed cloud architecture is a combination of public and private cloud hosting strategies developed for our customers’ growing digital banking needs.

An architecture that grows with your financial institution

Q2’s distributed system is built with scalability and flexibility in mind, giving financial institutions the ability to respond quickly to sudden transaction spikes and onboard new fintech integrations without downtime. Our proven growth model makes us the first choice of financial institutions of every size.

Superior security, uptime, and availability

The Q2 distributed cloud computing architecture achieves superior, faster scalability and extensibility compared to other digital banking providers.

We don't just talk about our ability to scale, we've demonstrated it through performance, including during critical events like the high-volume, pandemic-era U.S. Paycheck Protection Program. With industry-leading availability, you can count on Q2 to be there when you need us most.

Continuous security testing

Q2 conducts internal and external testing, penetration tests, and vulnerability testing to fortify security beyond what’s available in the public cloud.

24/7/365 monitoring

We actively monitor all infrastructure components via the Global Integrated Operations Center (IOC) to ensure optimized visibility and security.

Constant improvement for even-better performance

Take advantage of continuous innovation and delivery with Q2. Our distributed cloud services allow us to provide critical software updates seamlessly, for better performance, shorter time to market, and faster updates. This increases your ability to serve account holders with faster access to the features they need.

Admin teams will appreciate the Q2 architecture

No-hassle upgrades free up admin teams for more critical projects. Delivery of important back-end upgrades happens completely behind the scenes, allowing your internal system administrators to focus on user-facing upgrades that directly serve account holders.

An architecture to stay ahead of the competition

Your financial institution will have the technology in place to compete with bigger banks and credit unions while reducing operational and maintenance costs. Whether you are a small institution or a larger one, our architecture will protect you.

Compliance and regulatory readiness

One of the most important issues for financial institutions considering the cloud is compliance. Q2’s cloud architecture is fully compliant with PCI DSS, SOC 2, FFIEC, GDPR, and other standards. Features like automated reporting and auditing support help reduce risk exposure for financial institutions.

Dedicated commitment

- +$350M 10-year hosting investment growth

-

0.4 hours

Annual downtime

(2 mins, 11 secs/month)

Proven Success

99.97%

Availability

-98%

External attacks

“The acquisitions we’ve done show the real value of the platform. In our last acquisition, we converted 15,000 online banking users and 70 percent of those had logged in within the first two weeks. We had people signing up in droves for mobile remote deposits, P2P payments, and e-statements. You could just tell from the level of activity and how everything ballooned in the first two weeks that they were engaged. Because everything was easy for them to find and easy to use.”

SVP of Digital Channels

Learn more about the Q2 platform

-

Q2 Security

Q2 provides multilayer security with the latest fraud detection innovation.

-

Q2 Extensibility

Easily build the customizations your FI wants.