Dynamic personal experiences for every account holder

Build experiences for the moments that matter

Consumer

Put account holders into audience segments based on their unique needs, then curate an experience with targeted financial products to meet those needs.

Business

Group businesses by their vertical, complexity, and specific financial needs—and deliver a tailored UI that features the functionality they need.

Personal experiences create lifelong, profitable relationships.

Get back to personalized service, digitally

Boost revenue with timely product placement aligned to customer moments, maintaining engagement by anticipating future instances.

Differentiate beyond logos and colors

Deliver personalized experiences that showcase your brand and resonate with account holders by deeply integrating with their financial lives.

Configuration that’s easy to manage

Our tools need no coding for setup, deploying, or managing.

Every piece of the personalization puzzle in one platform

AUDIENCE BUILDER

Segment account holders easily

Audience Builder transforms transaction and behavioral data into traits, enabling you to easily create targeted audience segments for tailored experiences.

EXPERIENCE BUILDER

Create custom experiences effortlessly

Maximize efficiency with Experience Builder's "drag and drop" functionality, enabling quick composition and configuration of audience-specific dashboards without starting from scratch.

COMPOSABLE DASHBOARD

Empower users with dynamic dashboards

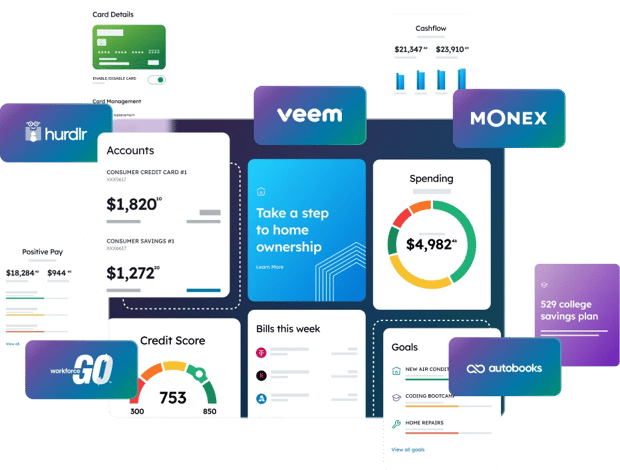

Craft personalized experiences easily with our Content Blocks—flexible, movable tiles for designing intuitive and visually engaging user interfaces.

Power your experience

To fuel these personalized experiences, we offer a substantial library of content blocks powered by 1,000+ third-party integrations and our fintech partner ecosystem.

-

The richest baseline feature yet

Our digital banking platform comes with a robust set of baseline functionality, with 1,000+ integrations to third-party systems like bill pay, check and statement imaging, remote deposit capture, and more—and plenty of products we’ve built in house to boot. No additional integrations or configuration required.

-

Robust fintech ecosystem

Through our fintech ecosystem, we provide all the building blocks you’ll need to power highly customized experiences and meet even more account holder needs beyond traditional banking. And every fintech partner’s product comes with a Content Block that can be added to your dashboard.

Different devices, same experience

Unified Digital Banking Platform

Q2 pioneered a single platform with componentized architecture, delivering versatile digital banking solutions tailored to diverse needs—from consumer to small business and commercial enterprises.