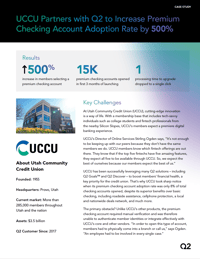

UCCU Boosts Premium Checking Account Adoption by 500% with Q2

UCCU automated identity verification and boosted premium checking account adoption in just three months with Q2 Innovation Studio's robust SDK

- 500% increase in premium checking account adoption

- 15,000 new accounts opened within first three months

- 1 click processing time reduced to a single click

"Utilizing Q2 Innovation Studio and building our own API exchanges unlocked almost unlimited potential. We can accomplish what we need internally—and let members accomplish what they want for themselves."

About Utah Community Credit Union

- Headquarters

- Provo, Utah

- Assets Under Management

- $3.5 billion

- Solutions

- Q2 Digital Banking Platform, Q2 Innovation Studio

Challenge

Meeting member expectations in a tech-savvy market

Utah Community Credit Union (UCCU) serves more than 285,000 members nationwide, many of whom are students and fintech professionals near Silicon Slopes. These members expect a seamless digital banking experience that rivals top fintech providers.

But one product was underperforming: UCCU’s premium checking account. Despite offering benefits like cellphone protection, roadside assistance, and a nationwide deals network, adoption was stuck at just 8%. The reason? Manual verification. Every account required branch visits or staff intervention.

Solution

Streamlining with Q2 Innovation Studio

Using Q2 Innovation Studio, UCCU’s team custom-built an automated solution that eliminated manual checks and enabled members to upgrade to Elevated Checking with a single click.

The solution integrated five disparate vendors, synced seamlessly with the core, and gave members a simple, self-service enrollment process.

Results

The impact exceeded expectations:

-

500% increase in premium checking adoption

-

15,000 new accounts opened within the first three months

-

Processing time reduced from in-branch enrollment to a single click

Read the UCCU Case Study

Download NowCustomer Stories

Browse All-

200 new digital banking enrollments each month

-

20% of digital users engaged with SavvyMoney in less than 6 months

-

30% growth in deposit volume for ClickSWITCH accounts

-

Generated $1 million in new home equity loans and credit cards

-

*Processed $372M* in PPP loans and doubled the client base

-

Led strategy through partner integration

-

Increased international bank transfers

-

Tripled innovation speed

-

Implemented new digital system in 4 days

-

Reduced time to market to 4 weeks