Q2 Makes Consumer Banking More Personal with Q2 Engage

15 May, 2024

Q2 delivers a comprehensive portfolio of digital solutions to empower banks and credit unions to transform the consumer banking journey with dynamic personal experiences

AUSTIN, TX (May 15, 2024)—Q2 Holdings, Inc. (NYSE:QTWO), a leading provider of digital transformation solutions for financial services, today announced the launch of Q2 Engage, a suite of consumer banking solutions designed to help financial institutions acquire and build life-long relationships with account holders. Q2 Engage enables banks and credit unions to innovate faster and provide personalized experiences to strengthen their relationships with their account holders.

According to the 2024 Retail Banking Trends Report, 83 percent of respondents identified improving the digital experience for consumers as one of their key strategic priorities in 2024. As digital channel use increases, financial institutions must offer dynamic and personal experiences to their account holders, especially as competition continues to increase.

Q2 Engage brings together Q2’s existing and new consumer banking products and capabilities to help financial institutions curate personal experiences across the consumer journey. With Q2 Engage, financial institutions can build curated digital experiences that are aligned with the moments that matter in a consumer’s financial journey. These experiences create deeper engagements with consumers to help grow relationships that align with the bank or credit union’s strategic goals, such as growing deposits or promoting new products.

“Each member we serve is unique and expects personal digital banking experiences that meet them where they are in their life journey,” said Bruce Brumfield, president and CEO, at Founders Federal Credit Union. “Our partnership with Q2 over the years has helped us meet our members’ individual needs, while helping us stay competitive in the market. Q2 Engage will enable us to more deeply serve our members and grow our relationships with them and the community.”

The Q2 Digital Banking Platform and Q2 Engage solutions support a strategic framework to continually Know, Serve, and Grow consumer relationships. Here’s how it works:

Know: Use data and AI to understand needs across account holder journeys.

- Make sense of consumer data through patent-protected application of AI by giving it context and meaning. By using machine learning to recommend products and deep learning to clean and categorize financial transactions, financial institutions can retrieve data, give it meaning, and better recommend specific experiences and products to their account holders.

- Enable financial institutions to access over 450 attributable traits to build targeted segments.

- Provide low-friction new account onboarding, which is critical to drive adoption and engagement with key products and services in the first 90 days.

Serve: Deliver dynamic personal experiences for the moments that matter.

- Create personalized dashboards that cater to the needs of account holders.

- Deliver curated experiences to account holders that adapt based on new data, like parents saving for education, gig workers managing money, and students with micro-businesses.

- Use account holder data to build targeted campaigns that are unique to each account holder and drive the financial institution’s strategy, for example payroll deposit switching promotions or first-time home buyer incentives.

Grow: Deepen relationships with personal engagement beyond traditional banking.

- Offer capabilities beyond traditional banking through Q2 Innovation Studio’s fintech partner ecosystem.

- Deliver differentiated experiences beyond traditional banking that account holders need, such as financial wellness, payments, loyalty rewards, and investments.

- Build custom products and offerings using Q2’s open digital banking platform.

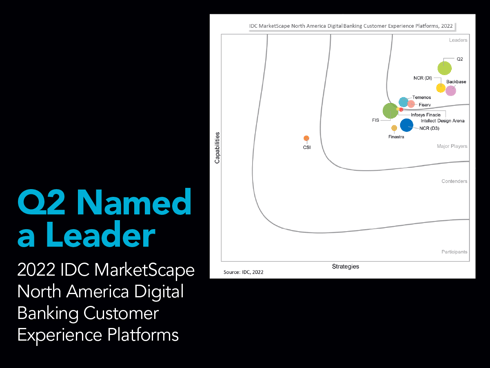

“Personalization, not just innovation, is the key to laying the foundation for becoming your customer’s primary financial institution. It starts with having the right digital tools and the ability to offer outstanding engagements,” said Marc DeCastro, research director, IDC Financial Insights. “Solutions that can create highly personalized, engaging experiences can help financial institutions better know, serve, and grow their customer relationships.”

Q2 Engage drives the Know, Serve, and Grow framework with our consumer banking solutions, including the following products:

- Composable Dashboard – A new digital banking experience that allows financial institutions to guide the account holder’s journey using a modern user interface (UI) that is configurable by financial institutions in a no-code way.

- Audience Builder – A new feature of Q2 SMART, Q2’s targeted marketing platform, that allows financial institutions to create segmented account holder audiences based on data-led traits.

- Experience Builder – Formerly Q2 Config, Experience Builder allows financial institutions to build composable experiences using a powerful no-code development environment.

- Getting Started – An online banking extension that guides the account holder through onboarding tasks that are most valuable to the financial institution and the account holder.

- Add Account – An online banking extension that gives account holders the power to quickly and easily add new accounts without being redirected outside of their digital banking experience.

- Task Manager – An online banking extension that allows financial institutions to manage and deploy tasks to account holders, such as prompts to transfer funds, registration for financial wellness, and reminders to fund a goal.

“Q2 Engage enables financial institutions to deliver the experiences their customers expect, while anticipating their needs and providing products and services that delight at every crucial life stage,” said Dallas Wells, SVP, product strategy at Q2. “The ability for financial institutions to know, serve and grow their customer relationships will help set them apart and build lifelong relationships.”

To learn more about Q2 Engage:

Website and Video: Q2 Engage Overview

Financial Brand Forum: Come visit us at Booth #B531, May 20-22 in Las Vegas, NV, during the Financial Brand Forum.

Demo Session at Financial Brand Forum: “Create Dynamic Experiences That Are Uniquely Yours”- Wednesday, May 22 at 9:30 a.m.

About Q2 Holdings

Q2 is a leading provider of digital transformation solutions for financial services, serving banks, credit unions, alternative finance companies, and fintechs in the U.S. and internationally. Q2 enables its financial institutions and fintech customers to provide comprehensive, data-driven digital engagement solutions for consumers, small businesses and corporate clients. Headquartered in Austin, Texas, Q2 has offices worldwide and is publicly traded on the NYSE under the stock symbol QTWO. To learn more, please visit Q2.com. Follow us on LinkedIn and X to stay up to date.

Media Contact

Maria Gari

Q2 Holdings, Inc.

315-657-0041

.png?height=368&name=Newsroom_1200x900%20(1).png)

.png?height=368&name=4Front_Blog_1200x900%20(1).png)

.png?height=368&name=TopWorkplaces_2024_Newsroom%20Blog_1200x900%20(1).png)

.png?height=368&name=Datos%20Cash%20Management%20Matrix_Newsroom%20(1).png)

%20(1).png?height=368&name=MicrosoftTeams-image%20(14)%20(1).png)

.jpg?height=368&name=Newsroom_1200x900-100%20(1).jpg)

.png?height=368&name=MicrosoftTeams-image%20(82).png)

.png?height=368&name=MicrosoftTeams-image%20(79).png)

%5B29%5D.jpg?height=368&name=2023-Philanthropy-Fund-PR-1200x900%20(1)%5B29%5D.jpg)

.jpg?height=368&name=AiteCashManagementWP_PR-Blog%20(1).jpg)

.png?height=368&name=MicrosoftTeams-image%20(74).png)

.png?height=368&name=MicrosoftTeams-image%20(73).png)

.png?height=368&name=MicrosoftTeams-image%20(71).png)

.png?height=368&name=MicrosoftTeams-image%20(66).png)

.png?height=368&name=MicrosoftTeams-image%20(64).png)

-1.png?height=368&name=MicrosoftTeams-image%20(14)-1.png)

.png?height=368&name=MicrosoftTeams-image%20(60).png)

.png?height=368&name=MicrosoftTeams-image%20(58).png)

-2.png?height=368&name=MicrosoftTeams-image%20(56)-2.png)

.png?height=368&name=MicrosoftTeams-image%20(57).png)

.png?height=368&name=MicrosoftTeams-image%20(52).png)

.png?height=368&name=MicrosoftTeams-image%20(48).png)

.png?height=368&name=MicrosoftTeams-image%20(46).png)

.png?height=368&name=MicrosoftTeams-image%20(43).png)

.png?height=368&name=MicrosoftTeams-image%20(38).png)

.png?height=368&name=MicrosoftTeams-image%20(11).png)

.png?height=368&name=MicrosoftTeams-image%20(30).png)

-1.png?height=368&name=MicrosoftTeams-image%20(28)-1.png)

.png?height=368&name=MicrosoftTeams-image%20(27).png)

.png?height=368&name=MicrosoftTeams-image%20(10).png)

.png?height=368&name=MicrosoftTeams-image%20(9).png)

.jpg?height=368&name=Newsroom-1200x900-2-100%20(1).jpg)

.png?height=368&name=InnovationStudio_FintechAdoption_Newsroom%201200x900%20(2).png)

.png?height=368&name=MicrosoftTeams-image%20(8).png)

.png?height=368&name=MicrosoftTeams-image%20(7).png)

.png?height=368&name=MicrosoftTeams-image%20(26).png)

.png?height=368&name=MicrosoftTeams-image%20(6).png)

.png?height=368&name=MicrosoftTeams-image%20(25).png)

.png?height=368&name=MicrosoftTeams-image%20(3).png)