Q2 Announces Premium Treasury Pricing Solution to Help Financial Institutions Grow Deposits, Increase Fee Income and Expand Client Relationships

13 Apr, 2023

The unified treasury pricing and relationship profitability solution designed for treasury officers delivers a seamless experience across business units

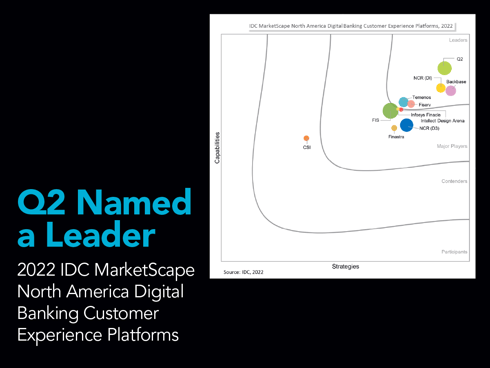

AUSTIN, TX (April 13, 2023)—Q2 Holdings, Inc. (NYSE:QTWO), a leading provider of digital transformation solutions for banking and lending, today announced Q2 Premium Treasury Pricing, a unified relationship pricing and profitability module of Q2 PrecisionLender to help financial institutions win the entire banking relationship with their clients. The solution replaces conventional pro forma tools to deliver a comprehensive approach to relationship pricing and deal structuring for relationship managers and treasury officers within Q2 PrecisionLender.

“In today’s market, financial institutions of all sizes need to generate more fee income in order to reduce their reliance on net interest income, but historically, banks and credit unions have struggled with the collaboration between business units needed to optimize the deal structures for commercial customers,” said Dallas Wells, SVP of Product Management, Q2. “Q2’s Premium Treasury Pricing solution helps drive deposits and fee income by bringing treasury and deposit teams into the conversation when it matters most – in the beginning.”

With a lack of guidance around pricing methodology and a minimal understanding of cross-sell potential within customer relationships, many financial institutions undervalue treasury services and, in turn, fail to maximize revenue opportunities with customers. Q2 Premium Treasury Pricing helps position financial institutions to win the entire commercial banking relationship by introducing a collaborative approach to deal structuring that ultimately drives primacy, profitability and efficiency.

“Q2 PrecisionLender continues to help us on our journey to make more informed decisions with our customers,” said Andy Max, Senior Director of Data Enablement for FNBO. “Including Treasury Services in their pricing offering paired with a robust Treasury roadmap is something our teams are very excited about.”

Q2 PrecisionLender, including Q2 Premium Treasury Pricing, is a part of Q2 Catalyst, a suite of best-in-class commercial banking solutions, and supports Q2’s strategic approach to innovation. The solution will empower deal team members with the technology needed to win and grow client relationships.

Learn more about Q2 PrecisionLender and Q2 Premium Treasury Pricing.

Q2 Catalyst Website: https://www.q2.com/commercial

Nacha 2023 Smarter Faster Payments Annual Conference: Visit us at Booth #437, Las Vegas, NV, April 16 – 19. Learn more about the event here.

Q2 Sessions at Nacha:

- “On Track, On Time, and Onboard: Improve Your Business Onboarding With Digital” – Sunday, April 16 from 3:10 – 4:00 p.m. PST

- Demo Presentation: Modernizing B2B Payments with the Instant Payment Rails – Monday, April 17 from 9:20 – 9:50 a.m. PST

- “An Unbeatable Pair: FIs and Fintechs Play a Winning Hand with Consumers” – Monday, April 17 from 4:40 – 5:30 p.m. PST

- “Big Opportunities in Micro and Small Business Banking” – Monday, April 17 from 2:50 – 3:40 p.m. PST

.png?height=368&name=4Front_Blog_1200x900%20(1).png)

.png?height=368&name=TopWorkplaces_2024_Newsroom%20Blog_1200x900%20(1).png)

.png?height=368&name=Datos%20Cash%20Management%20Matrix_Newsroom%20(1).png)

%20(1).png?height=368&name=MicrosoftTeams-image%20(14)%20(1).png)

.jpg?height=368&name=Newsroom_1200x900-100%20(1).jpg)

.png?height=368&name=MicrosoftTeams-image%20(82).png)

.png?height=368&name=MicrosoftTeams-image%20(79).png)

%5B29%5D.jpg?height=368&name=2023-Philanthropy-Fund-PR-1200x900%20(1)%5B29%5D.jpg)

.jpg?height=368&name=AiteCashManagementWP_PR-Blog%20(1).jpg)

.png?height=368&name=MicrosoftTeams-image%20(74).png)

.png?height=368&name=MicrosoftTeams-image%20(73).png)

.png?height=368&name=MicrosoftTeams-image%20(71).png)

.png?height=368&name=MicrosoftTeams-image%20(66).png)

.png?height=368&name=MicrosoftTeams-image%20(64).png)

-1.png?height=368&name=MicrosoftTeams-image%20(14)-1.png)

.png?height=368&name=MicrosoftTeams-image%20(60).png)

.png?height=368&name=MicrosoftTeams-image%20(58).png)

-2.png?height=368&name=MicrosoftTeams-image%20(56)-2.png)

.png?height=368&name=MicrosoftTeams-image%20(57).png)

.png?height=368&name=MicrosoftTeams-image%20(52).png)

.png?height=368&name=MicrosoftTeams-image%20(48).png)

.png?height=368&name=MicrosoftTeams-image%20(46).png)

.png?height=368&name=MicrosoftTeams-image%20(43).png)

.png?height=368&name=MicrosoftTeams-image%20(38).png)

.png?height=368&name=MicrosoftTeams-image%20(11).png)

.png?height=368&name=MicrosoftTeams-image%20(30).png)

-1.png?height=368&name=MicrosoftTeams-image%20(28)-1.png)

.png?height=368&name=MicrosoftTeams-image%20(27).png)

.png?height=368&name=MicrosoftTeams-image%20(10).png)

.png?height=368&name=MicrosoftTeams-image%20(9).png)

.jpg?height=368&name=Newsroom-1200x900-2-100%20(1).jpg)

.png?height=368&name=InnovationStudio_FintechAdoption_Newsroom%201200x900%20(2).png)

.png?height=368&name=MicrosoftTeams-image%20(8).png)

.png?height=368&name=MicrosoftTeams-image%20(7).png)

.png?height=368&name=MicrosoftTeams-image%20(26).png)

.png?height=368&name=MicrosoftTeams-image%20(6).png)

.png?height=368&name=MicrosoftTeams-image%20(25).png)

.png?height=368&name=MicrosoftTeams-image%20(3).png)