Q2 Announces Q2 Fabric to Enable Financial Institutions to Launch Digital Brands

18 Oct, 2023

New integrated stack combines the power of Q2’s retail banking experience, a lightweight modern core, and a pre-integrated fintech ecosystem to deliver personalized digital products

AUSTIN, TX. (October 18, 2023) –Q2 Holdings, Inc. (NYSE: QTWO), a leading provider of digital transformation solutions for banking and lending, today announced the launch of Q2 Fabric, a full stack solution that weaves together a best-in-class retail banking experience, a lightweight modern core, and a robust, pre-integrated fintech ecosystem. Q2 Fabric enables banks and credit unions to launch a differentiated digital brand to grow consumer deposits, increase profitability and accelerate innovation.

Q2 Fabric combines Q2’s industry-leading digital banking platform, Helix’s lightweight cloud-based core, and Q2’s Innovation Studio with more than 130 fintech partners. Q2 Fabric enables financial institutions to accelerate the delivery of personalized digital products, such as high-yield savings accounts and demand deposit accounts with debit card, and differentiate them with the partner fintech functionality that best fits their users’ needs.

“With Q2 Fabric, financial institutions no longer need to rip and replace their legacy core systems to deliver personalized digital products,” said Ahon Sarkar, general manager, Helix by Q2. “Q2 Fabric runs alongside existing core capabilities to fuel the innovative digital-first banking experiences necessary to drive deposit growth and improve profitability.”

“For over 19 years, Q2 has worked diligently to innovate and create digital banking products that address the needs of financial institutions,” said Dallas Wells, senior vice president of Product Management, Q2. “As the market has shifted and financial institutions face a wide range of new challenges, we see an opportunity to help banks and credit unions rise to the occasion. Q2 Fabric brings together three of our best assets to deliver a new, differentiated offering in the market.”

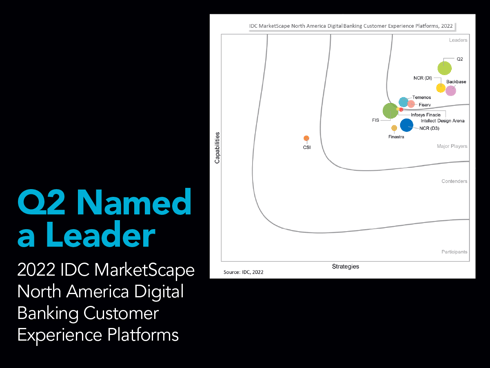

“Banks and credit unions must fully embrace the shift in our digital-first world while assessing the evolving competitive landscape, both within financial services and even from other industries,” says Marc DeCastro, research director, IDC Financial Insights. “Solutions that can leverage partner ecosystems to meet the customer’s financial needs and expectations will allow an institution to target new markets and prospects in a more efficient manner without the need for large scale transformative disruptions.”

Today, banks and credit unions are faced with four significant challenges: the race for deposits, rising digital expectations, profitability pressure, and limited distribution channels. Q2 Fabric helps financial institutions grow deposits, increase profitability and accelerate innovation by offering the following products:

- Savings – high-yield savings accounts and goal-based savings

- Checking – no-fee checking accounts and data-driven personalization

- Debit cards – physical, virtual, and tokenized cards and account-level security controls

The retail digital banking experience can be further enhanced with targeted fintech solution bundles through Q2’s Innovation Studio fintech partner ecosystem. With these carefully curated collections of fintech offerings, banks and credit unions can extend their engagement with targeted, high-value niche groups. Examples include the following:

- Financial literacy for kids (goals, education, investing)

- Gen Z starter kit (goals, credit building, charitable giving)

- Solutions for Seniors (ID protection, insurance, estate/trust services)

- Save now, buy later (goal-based savings with rewards partners)

- Financial health (debt repayment, credit score, identity protection, insurance)

- Immigrant/migrant worker/underbanked toolkit (cross-border payments, credit builder)

- Savings and investment hub (wealth management)

To learn more about Q2 Fabric and how it can help your financial institution, please visit: https://info.q2.com/fabric

About Q2 Holdings, Inc.

Q2 is a leading provider of digital banking and lending solutions to banks, credit unions, alternative finance companies, and fintechs in the U.S. and internationally. Q2’s comprehensive solution set allows its customers to better onboard, grow and serve their consumer, small business and corporate clients. Headquartered in Austin, Texas, Q2 has offices throughout the world and is publicly traded on the NYSE under the stock symbol QTWO. To learn more, please visit Q2.com. Follow us on LinkedIn and X (Formerly Twitter) to stay up-to-date.

Media Contact

Maria Gari

315-657-0041

Investor Contact

Josh Yankovich

Q2 Holdings, Inc.

O: 512-682-4463

josh.yankovich@Q2.com

.png?height=368&name=Newsroom_1200x900%20(1).png)

.png?height=368&name=4Front_Blog_1200x900%20(1).png)

.png?height=368&name=TopWorkplaces_2024_Newsroom%20Blog_1200x900%20(1).png)

.png?height=368&name=Datos%20Cash%20Management%20Matrix_Newsroom%20(1).png)

%20(1).png?height=368&name=MicrosoftTeams-image%20(14)%20(1).png)

.jpg?height=368&name=Newsroom_1200x900-100%20(1).jpg)

.png?height=368&name=MicrosoftTeams-image%20(82).png)

.png?height=368&name=MicrosoftTeams-image%20(79).png)

%5B29%5D.jpg?height=368&name=2023-Philanthropy-Fund-PR-1200x900%20(1)%5B29%5D.jpg)

.jpg?height=368&name=AiteCashManagementWP_PR-Blog%20(1).jpg)

.png?height=368&name=MicrosoftTeams-image%20(74).png)

.png?height=368&name=MicrosoftTeams-image%20(73).png)

.png?height=368&name=MicrosoftTeams-image%20(71).png)

.png?height=368&name=MicrosoftTeams-image%20(66).png)

.png?height=368&name=MicrosoftTeams-image%20(64).png)

-1.png?height=368&name=MicrosoftTeams-image%20(14)-1.png)

.png?height=368&name=MicrosoftTeams-image%20(60).png)

.png?height=368&name=MicrosoftTeams-image%20(58).png)

-2.png?height=368&name=MicrosoftTeams-image%20(56)-2.png)

.png?height=368&name=MicrosoftTeams-image%20(57).png)

.png?height=368&name=MicrosoftTeams-image%20(52).png)

.png?height=368&name=MicrosoftTeams-image%20(48).png)

.png?height=368&name=MicrosoftTeams-image%20(46).png)

.png?height=368&name=MicrosoftTeams-image%20(43).png)

.png?height=368&name=MicrosoftTeams-image%20(38).png)

.png?height=368&name=MicrosoftTeams-image%20(11).png)

.png?height=368&name=MicrosoftTeams-image%20(30).png)

-1.png?height=368&name=MicrosoftTeams-image%20(28)-1.png)

.png?height=368&name=MicrosoftTeams-image%20(27).png)

.png?height=368&name=MicrosoftTeams-image%20(10).png)

.png?height=368&name=MicrosoftTeams-image%20(9).png)

.jpg?height=368&name=Newsroom-1200x900-2-100%20(1).jpg)

.png?height=368&name=InnovationStudio_FintechAdoption_Newsroom%201200x900%20(2).png)

.png?height=368&name=MicrosoftTeams-image%20(8).png)

.png?height=368&name=MicrosoftTeams-image%20(7).png)

.png?height=368&name=MicrosoftTeams-image%20(26).png)

.png?height=368&name=MicrosoftTeams-image%20(6).png)

.png?height=368&name=MicrosoftTeams-image%20(25).png)

.png?height=368&name=MicrosoftTeams-image%20(3).png)