Synovus Banks on Q2 to Deliver Innovative Digital Banking Services Faster

14 Jul, 2021

Q2 helps Synovus, a leading Southeast-based commercial bank, transform its advisory experience to make it easier for clients to do business with them

AUSTIN, TX (July 14, 2021)—Q2 Holdings, Inc. (NYSE:QTWO), a leading provider of digital transformation solutions for banking and lending, today announced Synovus, a leading commercial banking services company based in Columbus, Georgia, partners with Q2 to quickly evolve and deliver digital solutions to make it easier for their clients do business with them. With the Q2 digital banking platform, Synovus is transforming its entire client advisory process from a face-to-face engagement to a virtual environment. In addition, Q2 is also helping Synovus leverage data analytics to better serve the needs of their clients while also empowering their commercial banking team to deliver that right information at the right time to the right clients.

Synovus provides commercial and retail banking, investment, and mortgage services throughout Georgia, Alabama, South Carolina, Florida, and Tennessee. As the banking industry has evolved, Synovus is quickly responding by delivering digital-first experiences to its clients. As a result, Synovus conducted an extensive search for the right digital partner. They determined Q2’s comprehensive and customer-focused digital banking solutions would best meet their requirements, beginning with providing mobile banking services for their commercial clients.

“We didn't want to be at par. We wanted to have a partner that was customizable, would grow with us, and who was thinking about the future. That’s what Q2 offered and why they won our business,” said Katherine Weislogel, executive director of Treasury & Payment Solutions, Synovus. “We were looking for that competitive edge solution, and we needed a partner that is going to do that with us. And we needed a portal that was going to allow us to be able to bring in other fintech partners into that competitive edge environment. And the partnership with Q2 allows that.”

Q2 has helped Synovus integrate two platforms together into one state-of-the-art digital platform so they can move faster for integrations with their internal and external partners. The migration to the Q2 digital banking platform and consolidation of their two platforms has enabled Synovus to accelerate their innovation roadmap. In addition, the Q2 team worked closely with the Synovus team to ensure seamless migrations. Prior to Q2, Synovus only offered mobile solutions on one of their two platforms and in one of their five states. Synovus recognized the need to get mobile in the hands of all its clients.

In addition to consolidating multiple platforms, Q2 has helped Synovus integrate other solutions into its digital banking platform. As the industry continues to evolve, the Q2 Innovation Studio enables Synovus to partner with fintech companies to meet their client needs. Partners can build additional functionality directly into the Synovus digital banking platform.

“Serving business customers digitally is the new strategic imperative for growing banks and credit unions,” said Will Furrer, chief strategy officer, Q2. “One-size-fits-all solutions are going the way of the dinosaur. This means today’s digital leaders are deploying intuitive, flexible, and agile business banking solutions so that they can serve small family businesses, SMBs, and even large corporate accounts with a single solution. At Q2, it’s our collaborative relationship with customers like Synovus that inform and inspire our strategy for digitally transforming all aspects of business banking.”

Since implementing Q2’s digital banking platform, Synovus has provided a modern, digital-first commercial platform to its customers. As a result, they can now deliver faster integrations, digital advisory services, and better innovation, which has strengthened their relationships with clients and provided a more seamless customer experience.

To learn more about Synovus’ digital transformation story:

About Synovus Financial Corporation

Synovus Bank, a Georgia-chartered, FDIC-insured bank, provides commercial and retail banking, investment, and mortgage services together with its affiliates through 289 branches in Georgia, Alabama, South Carolina, Florida, and Tennessee. Synovus Bank has been recognized as one of the country’s “Most Reputable Banks” by American Banker and the Reputation Institute. Synovus Bank is on the web at synovus.com, and on Twitter, Facebook, LinkedIn, and Instagram. Equal Housing Lender.

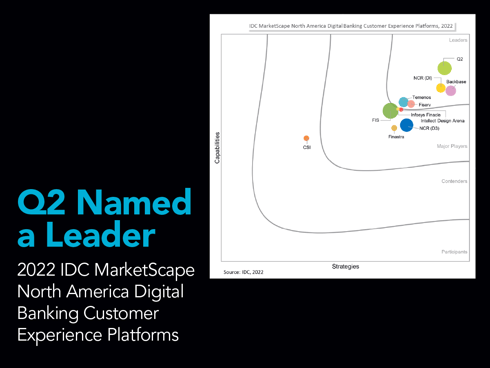

About Q2 Holdings, Inc.

Q2 is a financial experience company dedicated to providing digital banking and lending solutions to banks, credit unions, alternative finance, and fintech companies in the U.S. and internationally. With comprehensive end-to-end solution sets, Q2 enables its partners to provide cohesive, secure, data-driven experiences to every account holder – from consumer to small business and corporate. Headquartered in Austin, Texas, Q2 has offices worldwide and is publicly traded on the NYSE under the stock symbol QTWO. To learn more, please visit Q2.com.

MEDIA CONTACT

Jean Kondo

Q2 Holdings, Inc.

+1 510-823-4728

jean.kondo@Q2.com

.png?height=368&name=4Front_Blog_1200x900%20(1).png)

.png?height=368&name=TopWorkplaces_2024_Newsroom%20Blog_1200x900%20(1).png)

.png?height=368&name=Datos%20Cash%20Management%20Matrix_Newsroom%20(1).png)

%20(1).png?height=368&name=MicrosoftTeams-image%20(14)%20(1).png)

.jpg?height=368&name=Newsroom_1200x900-100%20(1).jpg)

.png?height=368&name=MicrosoftTeams-image%20(82).png)

.png?height=368&name=MicrosoftTeams-image%20(79).png)

%5B29%5D.jpg?height=368&name=2023-Philanthropy-Fund-PR-1200x900%20(1)%5B29%5D.jpg)

.jpg?height=368&name=AiteCashManagementWP_PR-Blog%20(1).jpg)

.png?height=368&name=MicrosoftTeams-image%20(74).png)

.png?height=368&name=MicrosoftTeams-image%20(73).png)

.png?height=368&name=MicrosoftTeams-image%20(71).png)

.png?height=368&name=MicrosoftTeams-image%20(66).png)

.png?height=368&name=MicrosoftTeams-image%20(64).png)

-1.png?height=368&name=MicrosoftTeams-image%20(14)-1.png)

.png?height=368&name=MicrosoftTeams-image%20(60).png)

.png?height=368&name=MicrosoftTeams-image%20(58).png)

-2.png?height=368&name=MicrosoftTeams-image%20(56)-2.png)

.png?height=368&name=MicrosoftTeams-image%20(57).png)

.png?height=368&name=MicrosoftTeams-image%20(52).png)

.png?height=368&name=MicrosoftTeams-image%20(48).png)

.png?height=368&name=MicrosoftTeams-image%20(46).png)

.png?height=368&name=MicrosoftTeams-image%20(43).png)

.png?height=368&name=MicrosoftTeams-image%20(38).png)

.png?height=368&name=MicrosoftTeams-image%20(11).png)

.png?height=368&name=MicrosoftTeams-image%20(30).png)

-1.png?height=368&name=MicrosoftTeams-image%20(28)-1.png)

.png?height=368&name=MicrosoftTeams-image%20(27).png)

.png?height=368&name=MicrosoftTeams-image%20(10).png)

.png?height=368&name=MicrosoftTeams-image%20(9).png)

.jpg?height=368&name=Newsroom-1200x900-2-100%20(1).jpg)

.png?height=368&name=InnovationStudio_FintechAdoption_Newsroom%201200x900%20(2).png)

.png?height=368&name=MicrosoftTeams-image%20(8).png)

.png?height=368&name=MicrosoftTeams-image%20(7).png)

.png?height=368&name=MicrosoftTeams-image%20(26).png)

.png?height=368&name=MicrosoftTeams-image%20(6).png)

.png?height=368&name=MicrosoftTeams-image%20(25).png)

.png?height=368&name=MicrosoftTeams-image%20(3).png)